aser Delivery Services, Incorporated (LDS), was incorporated January 1. The following transactions occurred during the year: Received $35,000 cash from the company's founders in exchange for common stock. Purchased land for $10,000, signing a two-year note (ignore interest). Bought two used delivery trucks at the start of the year at a cost of $11,000 each; paid $3,000 cash and signed a note due in three years for $19,000 (ignore interest). Paid $1,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. Stockholder Jonah Lee paid $240,000 cash for a house for his personal use.

aser Delivery Services, Incorporated (LDS), was incorporated January 1. The following transactions occurred during the year: Received $35,000 cash from the company's founders in exchange for common stock. Purchased land for $10,000, signing a two-year note (ignore interest). Bought two used delivery trucks at the start of the year at a cost of $11,000 each; paid $3,000 cash and signed a note due in three years for $19,000 (ignore interest). Paid $1,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. Stockholder Jonah Lee paid $240,000 cash for a house for his personal use.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.17E: Profitability metrics The following selected data were taken from the financial statements of The...

Related questions

Topic Video

Question

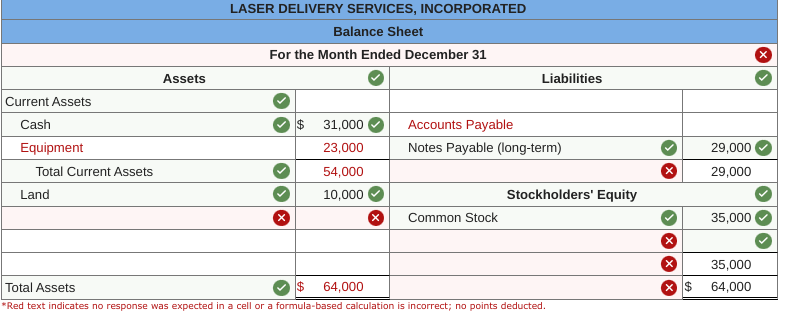

E2-12 (Algo) Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance Sheet [LO 2-2, LO 2-3, LO 2-4]

Skip to question

[The following information applies to the questions displayed below.]

Laser Delivery Services, Incorporated (LDS), was incorporated January 1. The following transactions occurred during the year:

- Received $35,000 cash from the company's founders in exchange for common stock.

- Purchased land for $10,000, signing a two-year note (ignore interest).

- Bought two used delivery trucks at the start of the year at a cost of $11,000 each; paid $3,000 cash and signed a note due in three years for $19,000 (ignore interest).

- Paid $1,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks.

- Stockholder Jonah Lee paid $240,000 cash for a house for his personal use.

E2-12 (Algo) Part 4

- Prepare a classified balance sheet for Laser Delivery Services at December 31. Include

Retained Earnings on the balance sheet even though the account has a zero balance.

Transcribed Image Text:LASER DELIVERY SERVICES, INCORPORATED

Balance Sheet

For the Month Ended December 31

Assets

Liabilities

Current Assets

Cash

$

31,000

Accounts Payable

Equipment

23,000

Notes Payable (long-term)

29,000

Total Current Assets

54,000

29,000

Land

10,000

Stockholders' Equity

Common Stock

35,000

35,000

Total Assets

$

64,000

64,000

*Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,