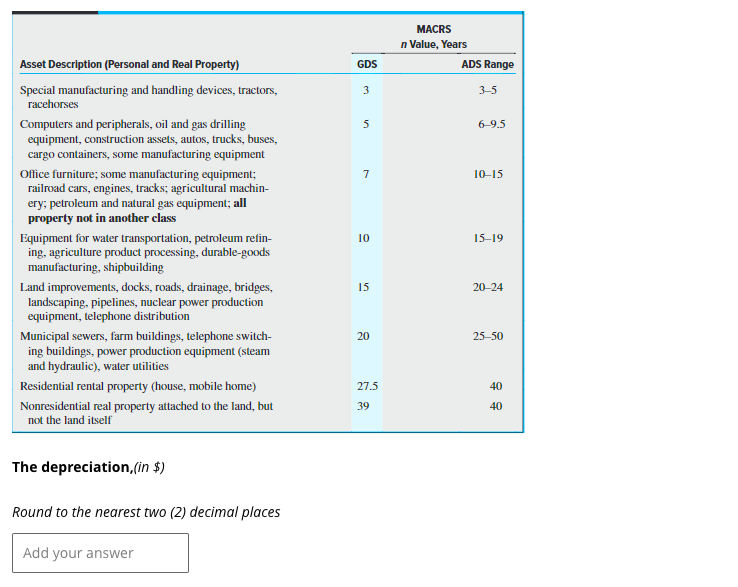

Asset Description (Personal and Real Property) Special manufacturing and handling devices, tractors, racehorses Computers and peripherals, oil and gas drilling equipment, construction assets, autos, trucks, buses, cargo containers, some manufacturing equipment Office furniture; some manufacturing equipment; railroad cars, engines, tracks; agricultural machin- GDS 3 5 7 MACRS n Value, Years ADS Range 3-5 6-9.5 10-15

Asset Description (Personal and Real Property) Special manufacturing and handling devices, tractors, racehorses Computers and peripherals, oil and gas drilling equipment, construction assets, autos, trucks, buses, cargo containers, some manufacturing equipment Office furniture; some manufacturing equipment; railroad cars, engines, tracks; agricultural machin- GDS 3 5 7 MACRS n Value, Years ADS Range 3-5 6-9.5 10-15

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 6MCQ: Which of the following is not true about the MACRS depreciation system: A salvage value must be...

Related questions

Question

6. Answer the given question. Do not round off answers while solving, instead just the final answer will be rounded off to two decimal places.

Transcribed Image Text:Asset Description (Personal and Real Property)

Special manufacturing and handling devices, tractors,

racehorses

Computers and peripherals, oil and gas drilling

equipment, construction assets, autos, trucks, buses,

cargo containers, some manufacturing equipment

Office furniture; some manufacturing equipment;

railroad cars, engines, tracks; agricultural machin-

ery; petroleum and natural gas equipment; all

property not in another class

Equipment for water transportation, petroleum refin-

ing, agriculture product processing, durable-goods

manufacturing, shipbuilding

Land improvements, docks, roads, drainage, bridges,

landscaping, pipelines, nuclear power production

equipment, telephone distribution

Municipal sewers, farm buildings, telephone switch-

ing buildings, power production equipment (steam

and hydraulic), water utilities

Residential rental property (house, mobile home)

Nonresidential real property attached to the land, but

not the land itself

The depreciation,(in $)

Round to the nearest two (2) decimal places

Add your answer

GDS

3

5

7

10

15

20

27.5

39

MACRS

n Value, Years

ADS Range

3-5

6-9.5

10-15

15-19

20-24

25-50

40

40

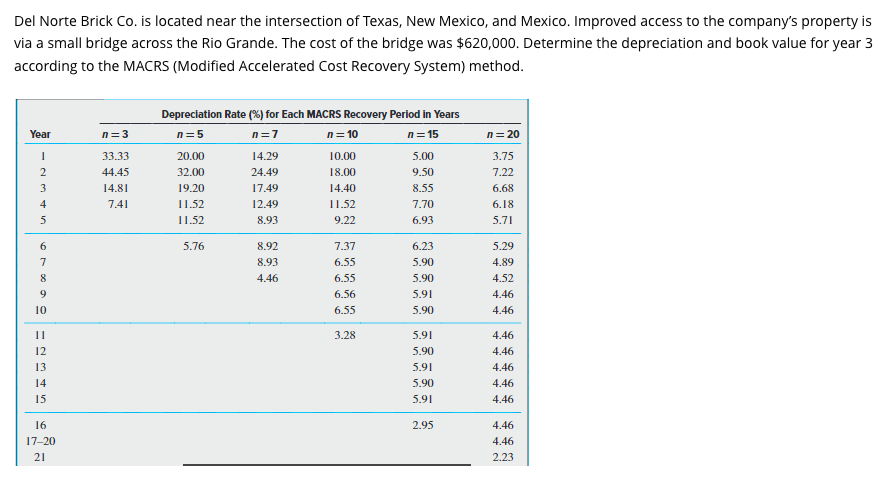

Transcribed Image Text:Del

Norte Brick Co. is located near the intersection of Texas, New Mexico, and Mexico. Improved access to the company's property is

via a small bridge across the Rio Grande. The cost of the bridge was $620,000. Determine the depreciation and book value for year 3

according to the MACRS (Modified Accelerated Cost Recovery System) method.

Year

12345

6

7

8

9

10

M2345

12

13

14

15

16

17-20

21

n=3

33.33

44.45

14.81

7.41

Depreciation Rate (%) for Each MACRS Recovery Period in Years

n=5

n=7

n=15

20.00

32.00

19.20

11.52

11.52

5.76

14.29

24.49

17.49

12.49

8.93

8.92

8.93

4.46

n=10

10.00

18.00

14.40

11.52

9.22

7.37

6.55

6.55

6.56

6.55

3.28

5.00

9.50

8.55

7.70

6.93

6.23

5.90

5.90

5.91

5.90

5.91

5.90

5.91

5.90

5.91

2.95

n = 20

3.75

7.22

6.68

6.18

5.71

5.29

4.89

4.52

4.46

4.46

4.46

4.46

4.46

4.46

4.46

4.46

4.46

2.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning