Assets Cash FURTEN COMPANY Comparative Balance Sheets December 31 Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity Current Year Prior Year $ 88,500 $ 72,400 88,420 298,156 1,360 460,336 65,625 266,800 2,195 423,120 142,500 123,000 (44, 125) (53,500) $ 558,711 $ 68,141 72,000 140,141 185,250 60,000 173,320 $ 492,620 $ 137,175 72,750 209,925 d. Paid $52,125 cash to reduce the long-term notes payable. e. Issued 4,000 shares of common stock for $20 cash per share. f. Declared and paid cash dividends of $53,100. 165, 250 0 117,445 $ 558,711 $ 492,620 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $20,125 (details in b). b. Sold equipment costing $91,875, with accumulated depreciation of $45,125, for $26,625 cash. c. Purchased equipment costing $111,375 by paying $60,000 cash and signing a long-term notes payable for the balance. Required: 1. Prepare a complete statement of cash flows using the indirect method for the current year. Note: Amounts to be deducted should be indicated with a minus sign,

Assets Cash FURTEN COMPANY Comparative Balance Sheets December 31 Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity Current Year Prior Year $ 88,500 $ 72,400 88,420 298,156 1,360 460,336 65,625 266,800 2,195 423,120 142,500 123,000 (44, 125) (53,500) $ 558,711 $ 68,141 72,000 140,141 185,250 60,000 173,320 $ 492,620 $ 137,175 72,750 209,925 d. Paid $52,125 cash to reduce the long-term notes payable. e. Issued 4,000 shares of common stock for $20 cash per share. f. Declared and paid cash dividends of $53,100. 165, 250 0 117,445 $ 558,711 $ 492,620 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $20,125 (details in b). b. Sold equipment costing $91,875, with accumulated depreciation of $45,125, for $26,625 cash. c. Purchased equipment costing $111,375 by paying $60,000 cash and signing a long-term notes payable for the balance. Required: 1. Prepare a complete statement of cash flows using the indirect method for the current year. Note: Amounts to be deducted should be indicated with a minus sign,

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10SPA: RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem...

Related questions

Question

vd

subject-Accounting

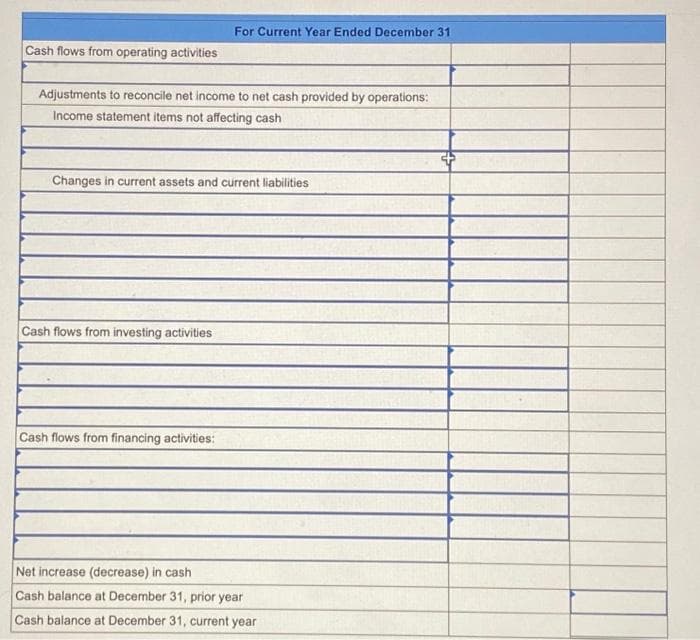

Transcribed Image Text:Cash flows from operating activities

Adjustments to reconcile net income to net cash provided by operations:

Income statement items not affecting cash

For Current Year Ended December 31

Changes in current assets and current liabilities

Cash flows from investing activities

Cash flows from financing activities:

Net increase (decrease) in cash

Cash balance at December 31, prior year

Cash balance at December 31, current year

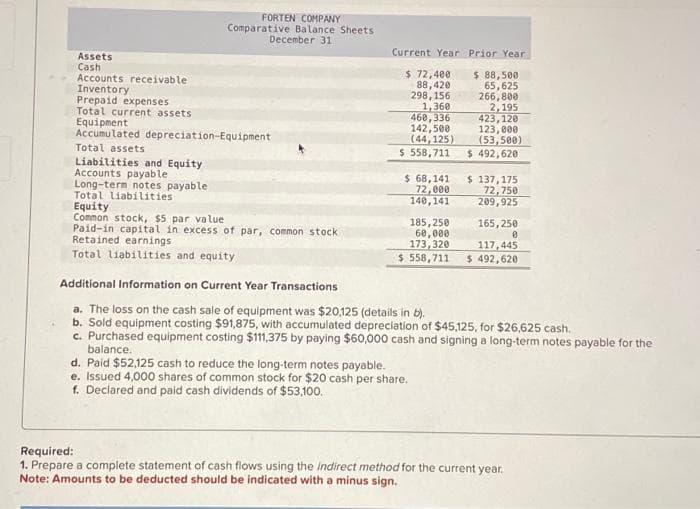

Transcribed Image Text:Assets

Cash

FORTEN COMPANY

Comparative Balance Sheets

December 31

Accounts receivable

Inventory

Prepaid expenses

Total current assets

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Long-term notes payable

Total liabilities.

Equity

Common stock, $5 par value

Paid-in capital in excess of par, common stock

Retained earnings

Total liabilities and equity

Current Year

$ 72,400

88,420

298,156

1,360

460,336

142,500

(44, 125)

$ 558,711

$ 68,141

72,000

140, 141

185,250

60,000

173,320

$ 558,711

Prior Year.

$ 88,500

65,625

266,800

2,195

d. Paid $52,125 cash to reduce the long-term notes payable.

e. Issued 4,000 shares of common stock for $20 cash per share.

f. Declared and paid cash dividends of $53,100.

423,120

123,000

(53,500)

$ 492,620

$ 137,175

72,750

209,925

165,250

0

117,445

$ 492,620

Additional Information on Current Year Transactions

a. The loss on the cash sale of equipment was $20,125 (details in b).

b. Sold equipment costing $91,875, with accumulated depreciation of $45,125, for $26,625 cash.

c. Purchased equipment costing $111,375 by paying $60,000 cash and signing a long-term notes payable for the

balance..

Required:

1. Prepare a complete statement of cash flows using the Indirect method for the current year.

Note: Amounts to be deducted should be indicated with a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning