Suppose the simplified consolidated

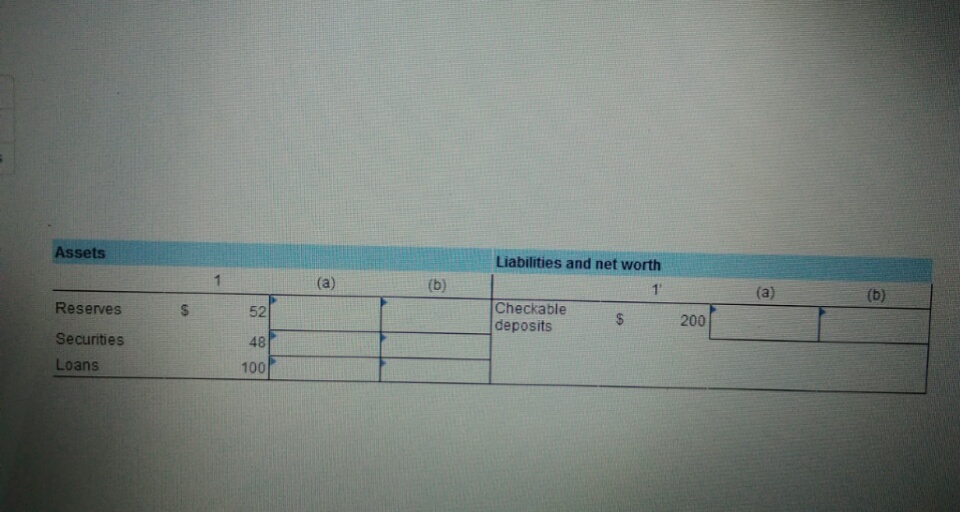

Refer to the balance sheet below. Enter your answers as whole numbers.

A) What is the amount of

What is the maximum amount the banking system might lend?

Show in columns 1(a) and 1'(a) how the consolidated balance sheet would look after this amount has been lent.

What is the size of the monetary multiplier?

B) Using the original figures, answer the questions in part A assuming the reserve ratio is 20%. What is the amount of excess reserves in this commercial banking system?

What is the maximum amount the banking system might lend?

Show in columns 1(b) and 1'(b) how the consolidated balance sheet would look after this amount has been lent. What is the monetary multiplier?

What is the resulting difference in the amount that the commercial banking system can lend when the

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 7 images