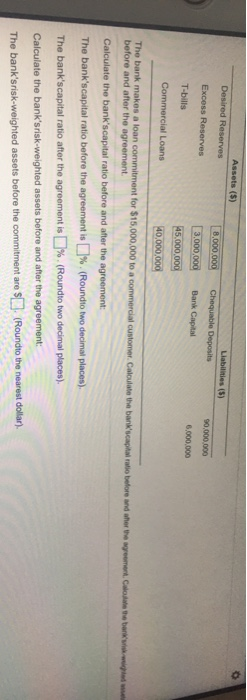

Assets (S) Liabities (S) Desired Reserves 8.000.000 Chequable Deposits 90.000.000 Excess Reserves 3.000.00d Bank Capital 6.000.000 T-bils 45.000.000 Commercial Loans 40.000.00d The bank makes a loan commitment for $15.000.000 to a commercial customer. Caloulate the bank'scaptal aio before and her the geement Calotebe before and after the agreement. Calculate the bank'scapital ratio before and after the agreement The bank'scapital ratio before the agreement is. (Roundio two decimal places). The bank'scapital ratio after the agreement is . (Roundto two decimal places). Calculate the bank'srisk-weighted assets before and after the agreement The bank'srisk-weighted assets before the commitment are S (Roundro the nearest dollar).

Assets (S) Liabities (S) Desired Reserves 8.000.000 Chequable Deposits 90.000.000 Excess Reserves 3.000.00d Bank Capital 6.000.000 T-bils 45.000.000 Commercial Loans 40.000.00d The bank makes a loan commitment for $15.000.000 to a commercial customer. Caloulate the bank'scaptal aio before and her the geement Calotebe before and after the agreement. Calculate the bank'scapital ratio before and after the agreement The bank'scapital ratio before the agreement is. (Roundio two decimal places). The bank'scapital ratio after the agreement is . (Roundto two decimal places). Calculate the bank'srisk-weighted assets before and after the agreement The bank'srisk-weighted assets before the commitment are S (Roundro the nearest dollar).

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 60APSA

Related questions

Question

Solve it early all subparts I definitely upvote solution if correctly now

Transcribed Image Text:Assets (S)

Liabities (S)

Desired Reserves

8.000.000

Chequable Deposits

90.000.000

Excess Reserves

3.000.00d

Bank Capital

6.000.000

T-bils

45.000.000

Commercial Loans

40.000.00d

The bank makes a loan commitment for $15.000.000 to a commercial customer. Caloulate the bank'scaptal aio before and her the geement Calotebe

before and after the agreement.

Calculate the bank'scapital ratio before and after the agreement

The bank'scapital ratio before the agreement is. (Roundio two decimal places).

The bank'scapital ratio after the agreement is . (Roundto two decimal places).

Calculate the bank'srisk-weighted assets before and after the agreement

The bank'srisk-weighted assets before the commitment are S (Roundro the nearest dollar).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning