Assignment: Carefully read the instructions and write a program that reads the following information and prints a payroll statement.

Assignment: Carefully read the instructions and write a program that reads the following information and prints a payroll statement.

C++ Programming: From Problem Analysis to Program Design

8th Edition

ISBN:9781337102087

Author:D. S. Malik

Publisher:D. S. Malik

Chapter7: User-defined Simple Data Types, Namespaces, And The String Type

Section: Chapter Questions

Problem 7PE

Related questions

Question

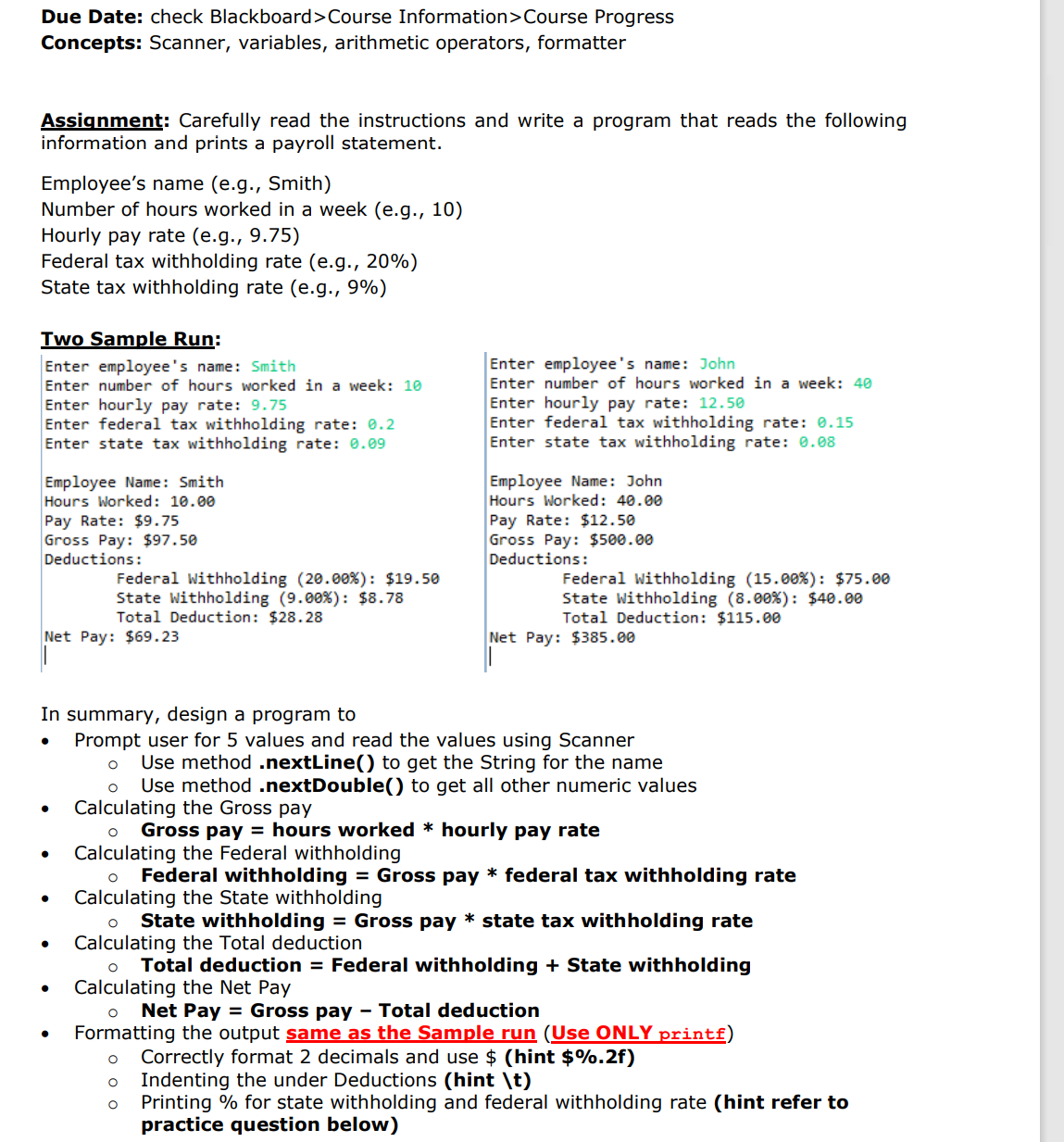

Transcribed Image Text:Due Date: check Blackboard>Course Information>Course Progress

Concepts: Scanner, variables, arithmetic operators, formatter

Assignment: Carefully read the instructions and write a program that reads the following

information and prints a payroll statement.

Employee's name (e.g., Smith)

Number of hours worked in a week (e.g., 10)

Hourly pay rate (e.g., 9.75)

Federal tax withholding rate (e.g., 20%)

State tax withholding rate (e.g., 9%)

Two Sample Run:

Enter employee's name: John

Enter number of hours worked in a week: 40

Enter employee's name: Smith

Enter number of hours worked in a week: 10

Enter hourly pay rate: 9.75

Enter federal tax withholding rate: 0.2

Enter state tax withholding rate: 0.09

Enter hourly pay rate: 12.50

Enter federal tax withholding rate: 0.15

Enter state tax withholding rate: 0.08

Employee Name: Smith

Hours Worked: 10.00

Pay Rate: $9.75

Gross Pay: $97.50

Deductions:

Employee Name: John

Hours Worked: 40.00

Pay Rate: $12.50

Gross Pay: $500.00

Deductions:

Federal Withholding (20.00%): $19.50

State Withholding (9.00%): $8.78

Total Deduction: $28.28

Federal Withholding (15.00%): $75.00

State Withholding (8.00%): $40.00

Total Deduction: $115.00

Net Pay: $69.23

Net Pay: $385.00

In summary, design a program to

Prompt user for 5 values and read the values using Scanner

Use method .nextLine() to get the String for the name

Use method .nextDouble() to get all other numeric values

Calculating the Gross

ay

Gross pay = hours worked * hourly pay rate

Calculating the Federal withholding

Federal withholding = Gross pay * federal tax withholding rate

Calculating the State withholding

State withholding = Gross pay * state tax withholding rate

Calculating the Total deduction

Total deduction = Federal withholding + State withholding

Calculating the Net Pay

Net Pay = Gross pay - Total deduction

Formatting the output same as the Sample run (Use ONLY printf)

Correctly format 2 decimals and use $ (hint $%.2f)

Indenting the under Deductions (hint \t)

Printing % for state withholding and federal withholding rate (hint refer to

practice question below)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr