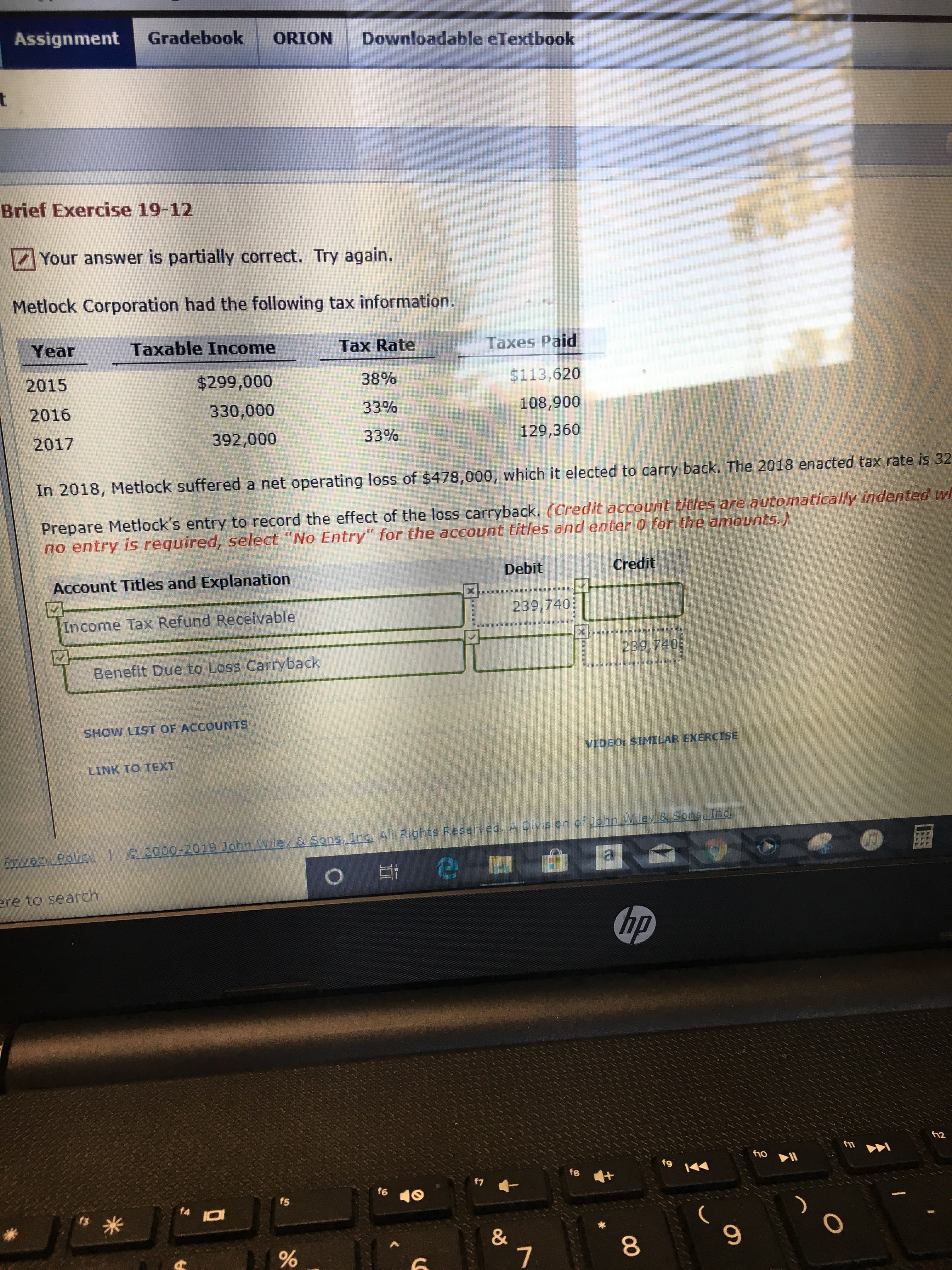

Assignment Gradebook Downloadable eTextbook ORION t Brief Exercise 19-12 Your answer is partially correct. Try again. Metlock Corporation had the following tax information. Taxable Income Year Taxes Paid Tax Rate $299,000 $113,620 2015 38% 108,900 33% 330,000 2016 129,360 33% 392,000 2017 In 2018, Metlock suffered a net operating loss of $478,000, which it elected to carry back. The 2018 enacted tax rate is 32 Prepare Metlock's entry to record the effect of the loss carryback. (Credit account titles are automatically indented w no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Credit Debit Account Titles and Explanation X 239,740 Income Tax Refund Receivable 239,7403 Benefit Due to Loss Carryback OF ACCOUNTS SHOW LIST VIDEO: SIMILAR EXERCISE LINK TO TEXT Rights Reserved. A Pivis cn of Johr Wle& Sons Inc e2000-2019 John Wiley & Sons Inc. A Privacy Polic e O t ere to search hp f12 f1o f9 7 f6 fs f4 I01 & 7 % 00

Assignment Gradebook Downloadable eTextbook ORION t Brief Exercise 19-12 Your answer is partially correct. Try again. Metlock Corporation had the following tax information. Taxable Income Year Taxes Paid Tax Rate $299,000 $113,620 2015 38% 108,900 33% 330,000 2016 129,360 33% 392,000 2017 In 2018, Metlock suffered a net operating loss of $478,000, which it elected to carry back. The 2018 enacted tax rate is 32 Prepare Metlock's entry to record the effect of the loss carryback. (Credit account titles are automatically indented w no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Credit Debit Account Titles and Explanation X 239,740 Income Tax Refund Receivable 239,7403 Benefit Due to Loss Carryback OF ACCOUNTS SHOW LIST VIDEO: SIMILAR EXERCISE LINK TO TEXT Rights Reserved. A Pivis cn of Johr Wle& Sons Inc e2000-2019 John Wiley & Sons Inc. A Privacy Polic e O t ere to search hp f12 f1o f9 7 f6 fs f4 I01 & 7 % 00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 4E: Single Temporary Difference: Multiple Rates At the end of 2019, Fulhage Company reported taxable...

Related questions

Question

100%

Transcribed Image Text:Assignment

Gradebook

Downloadable eTextbook

ORION

t

Brief Exercise 19-12

Your answer is partially correct. Try again.

Metlock Corporation had the following tax information.

Taxable Income

Year

Taxes Paid

Tax Rate

$299,000

$113,620

2015

38%

108,900

33%

330,000

2016

129,360

33%

392,000

2017

In 2018, Metlock suffered a net operating loss of $478,000, which it elected to carry back. The 2018 enacted tax rate is 32

Prepare Metlock's entry to record the effect of the loss carryback. (Credit account titles are automatically indented w

no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Credit

Debit

Account Titles and Explanation

X

239,740

Income Tax Refund Receivable

239,7403

Benefit Due to Loss Carryback

OF ACCOUNTS

SHOW LIST

VIDEO: SIMILAR EXERCISE

LINK TO TEXT

Rights Reserved. A Pivis cn of Johr Wle& Sons Inc

e2000-2019 John Wiley & Sons Inc. A

Privacy Polic

e

O t

ere to search

hp

f12

f1o

f9

7

f6

fs

f4

I01

&

7

%

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning