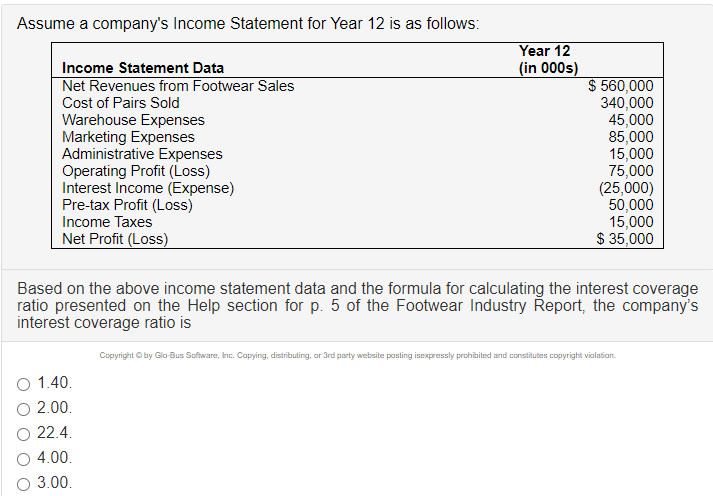

Assume a company's Income Statement for Year 12 is as follows: Year 12 (in 000s) Income Statement Data Net Revenues from Footwear Sales Cost of Pairs Sold $ 560,000 340,000 45,000 Warehouse Expenses Marketing Expenses Administrative Expenses Operating Profit (Loss) Interest Income (Expense) Pre-tax Profit (Loss) 85,000 15,000 75,000 (25,000) 50,000 15,000 $ 35,000 Income Taxes Net Profit (Loss) Based on the above income statement data and the formula for calculating the interest coverage ratio presented on the Help section for p. 5 of the Footwear Industry Řeport, the company's interest coverage ratio is Copyright O by Glo-Bus Software, Inc. Copying, distributing, ar 3rd party website posting isexpressly prohibited and constitutes copyright vialation. O 1.40. O 2.00. O 22.4. 4.00. O 3.00.

Assume a company's Income Statement for Year 12 is as follows: Year 12 (in 000s) Income Statement Data Net Revenues from Footwear Sales Cost of Pairs Sold $ 560,000 340,000 45,000 Warehouse Expenses Marketing Expenses Administrative Expenses Operating Profit (Loss) Interest Income (Expense) Pre-tax Profit (Loss) 85,000 15,000 75,000 (25,000) 50,000 15,000 $ 35,000 Income Taxes Net Profit (Loss) Based on the above income statement data and the formula for calculating the interest coverage ratio presented on the Help section for p. 5 of the Footwear Industry Řeport, the company's interest coverage ratio is Copyright O by Glo-Bus Software, Inc. Copying, distributing, ar 3rd party website posting isexpressly prohibited and constitutes copyright vialation. O 1.40. O 2.00. O 22.4. 4.00. O 3.00.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 23E

Related questions

Question

100%

Transcribed Image Text:Assume a company's Income Statement for Year 12 is as follows:

Year 12

(in 000s)

Income Statement Data

Net Revenues from Footwear Sales

Cost of Pairs Sold

$ 560,000

340,000

45,000

Warehouse Expenses

Marketing Expenses

Administrative Expenses

Operating Profit (Loss)

Interest Income (Expense)

Pre-tax Profit (Loss)

85,000

15,000

75,000

(25,000)

50,000

15,000

$ 35,000

Income Taxes

Net Profit (Loss)

Based on the above income statement data and the formula for calculating the interest coverage

ratio presented on the Help section for p. 5 of the Footwear Industry Řeport, the company's

interest coverage ratio is

Copyright O by Glo-Bus Software, Inc. Copying, distributing, ar 3rd party website posting isexpressly prohibited and constitutes copyright vialation.

O 1.40.

O 2.00.

O 22.4.

4.00.

O 3.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage