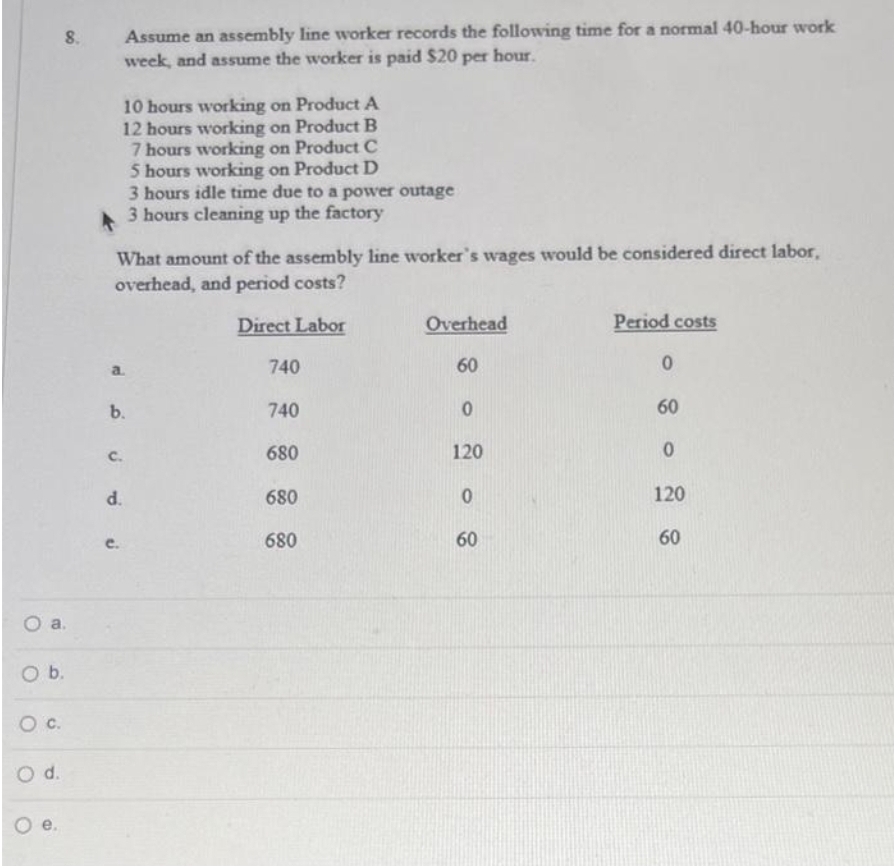

Assume an assembly line worker records the following time for a normal 40-hom week, and assume the worker is paid $20 per hour. 10 hours working on Product A 12 hours working on Product B 7 hours working on Product C 5 hours working on Product D 3 hours idle time due to a power outage 3 hours cleaning up the factory + What amount of the assembly line worker's wages would be considered directi overhead, and period costs? Direct Labor Overhead Period costs

Assume an assembly line worker records the following time for a normal 40-hom week, and assume the worker is paid $20 per hour. 10 hours working on Product A 12 hours working on Product B 7 hours working on Product C 5 hours working on Product D 3 hours idle time due to a power outage 3 hours cleaning up the factory + What amount of the assembly line worker's wages would be considered directi overhead, and period costs? Direct Labor Overhead Period costs

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 3PB: Event Forms expects $120,000 in overhead during the next year. It doesn't know whether it should...

Related questions

Question

Transcribed Image Text:O

a.

O b.

8.

0 с.

O d.

Assume an assembly line worker records the following time for a normal 40-hour work

week, and assume the worker is paid $20 per hour.

10 hours working on Product A

12 hours working on Product B

7 hours working on Product C

5 hours working on Product D

3 hours idle time due to a power outage

3 hours cleaning up the factory

What amount of the assembly line worker's wages would be considered direct labor,

overhead, and period costs?

Direct Labor

a.

b.

C.

e.

d.

740

740

680

680

680

Overhead

60

0

120

0

60

Period costs

0

60

0

120

60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub