Assume that two pieces of equipment have the following characteristics: Expected life (years) Equlpment Initlal cost Operating cost per year A 9 $20,000 $10,000 B 5 25,000 8,000 Using a hurdle rate of 0.10, which equipment is the more desirable?

Assume that two pieces of equipment have the following characteristics: Expected life (years) Equlpment Initlal cost Operating cost per year A 9 $20,000 $10,000 B 5 25,000 8,000 Using a hurdle rate of 0.10, which equipment is the more desirable?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 104.4C

Related questions

Question

CH 5 #5 Assume that two pieces of equipment have the following characteristics:

Using a hurdle rate of 0.10, which equipment is the more desirable?

Transcribed Image Text:A Week 3 Assignment

1 VitalSource Bookshelf: The Cap x

O Mail - outlook 8E6AAB8B8EB6 x

G It has been said that few stockl x

b My Questions | bartleby

+

X

A online.vitalsource.com/#/books/9781135656232/cfi/6/26!/4/186/24/8/4@0:0

vears

a < 5. Annual Equivalent ...

years.

Which model should be purchased if the hurdle rate is 0.05?

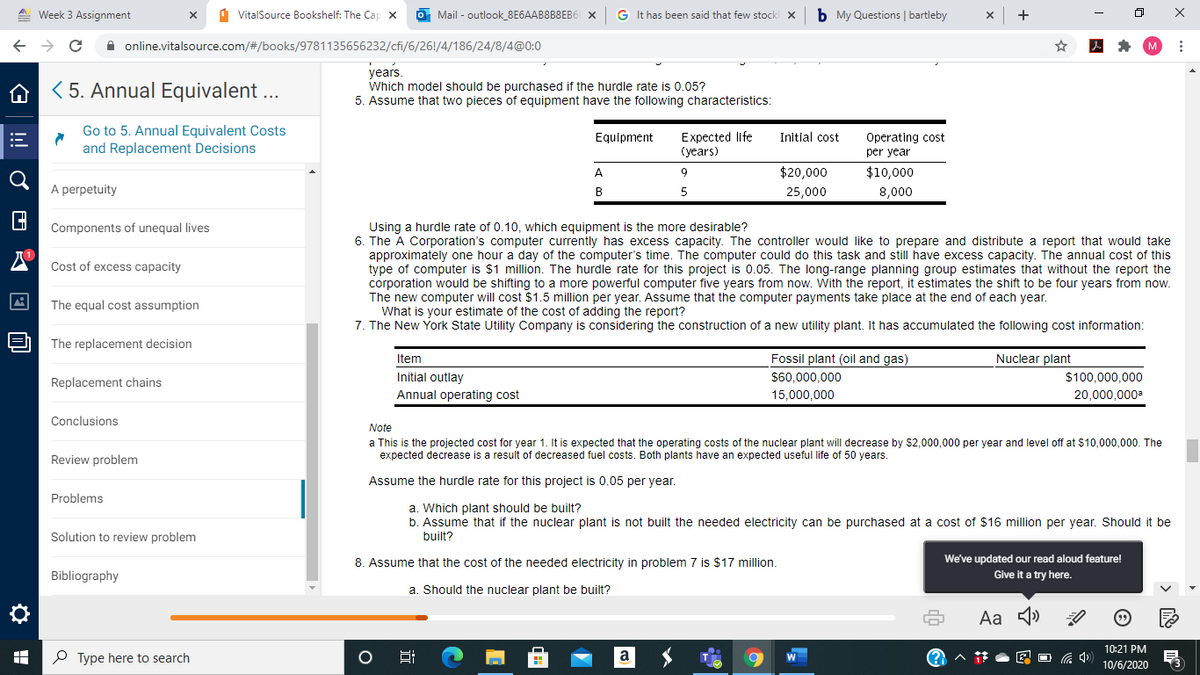

5. Assume that two pieces of equipment have the following characteristics:

Go to 5. Annual Equivalent Costs

and Replacement Decisions

Initlal cost

Expected life

(years)

Equipment

Operating cost

per year

A

9

$20,000

$10,000

A perpetuity

B

25,000

8,000

Using a hurdle rate of 0.10, which equipment is the more desirable?

6. The A Corporation's computer currently has excess capacity. The controller would like to prepare and distribute a report that would take

approximately one hour a day of the computer's time. The computer could do this task and still have excess capacity. The annual cost of this

type of computer is $1 million. The hurdle rate for this project is 0.05. The long-range planning group estimates that without the report the

corporation would be shifting to a more powerful computer five years from now. With the report, it estimates the shift to be four years from now.

The new computer will cost $1.5 million per year. Assume that the computer payments take place at the end of each year.

What is your estimate of the cost of adding the report?

7. The New York State Utility Company is considering the construction of a new utility plant. It has accumulated the following cost information:

Components of unequal lives

Cost of excess capacity

The equal cost assumption

The replacement decision

Item

Fossil plant (oil and gas)

Nuclear plant

Initial outlay

$100,000,000

20,000,000

$60,000,000

Replacement chains

Annual operating cost

15,000,000

Conclusions

Note

a This is the projected cost for year 1. It is expected that the operating costs of the nuclear plant will decrease by $2,000,000 per year and level off at $10,000,000. The

expected decrease is a result of decreased fuel costs. Both plants have an expected useful life of 50 years.

Review problem

Assume the hurdle rate for this project is 0.05 per year.

Problems

a. Which plant should be built?

b. Assume that if the nuclear plant is not built the needed electricity can be purchased at a cost of $16 million per year. Should it be

built?

Solution to review problem

We've updated our read aloud feature!

Give it a try here.

8. Assume that the cost of the needed electricity in problem 7 is $17 million.

Bibliography

a. Should the nuclear plant be built?

Aa 4)

10:21 PM

P Type here to search

a

10/6/2020

近

!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning