Assume the charitable contribution deduction for non-itemized applies to 2022. What is Jeremy’s tax refund or tax due

Assume the charitable contribution deduction for non-itemized applies to 2022. What is Jeremy’s tax refund or tax due

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 26P

Related questions

Question

Jeremy (unmarried) earned $100,300 in salary and $6,300 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $23,300 in itemized dedications, including $2,000 of charitable contributions to his church.

-Determine Jeremy’s tax refund or taxes due.

-Assume that in addition to the original facts, Jeremy had a long term capital gain of $5,050. What is Jeremy’s tax refund or tax due including the tax on the capital gain ?

-Assume the original facts except that Jeremy has only $7,000 in itemized deductions. Assume the charitable contribution deduction for non-itemized applies to 2022. What is Jeremy’s tax refund or tax due?

Transcribed Image Text:$85,550

$ 178,150

$340,100

$431,900

$ 647,850

$ 178,

$340,100

$431,900

$ 647,850

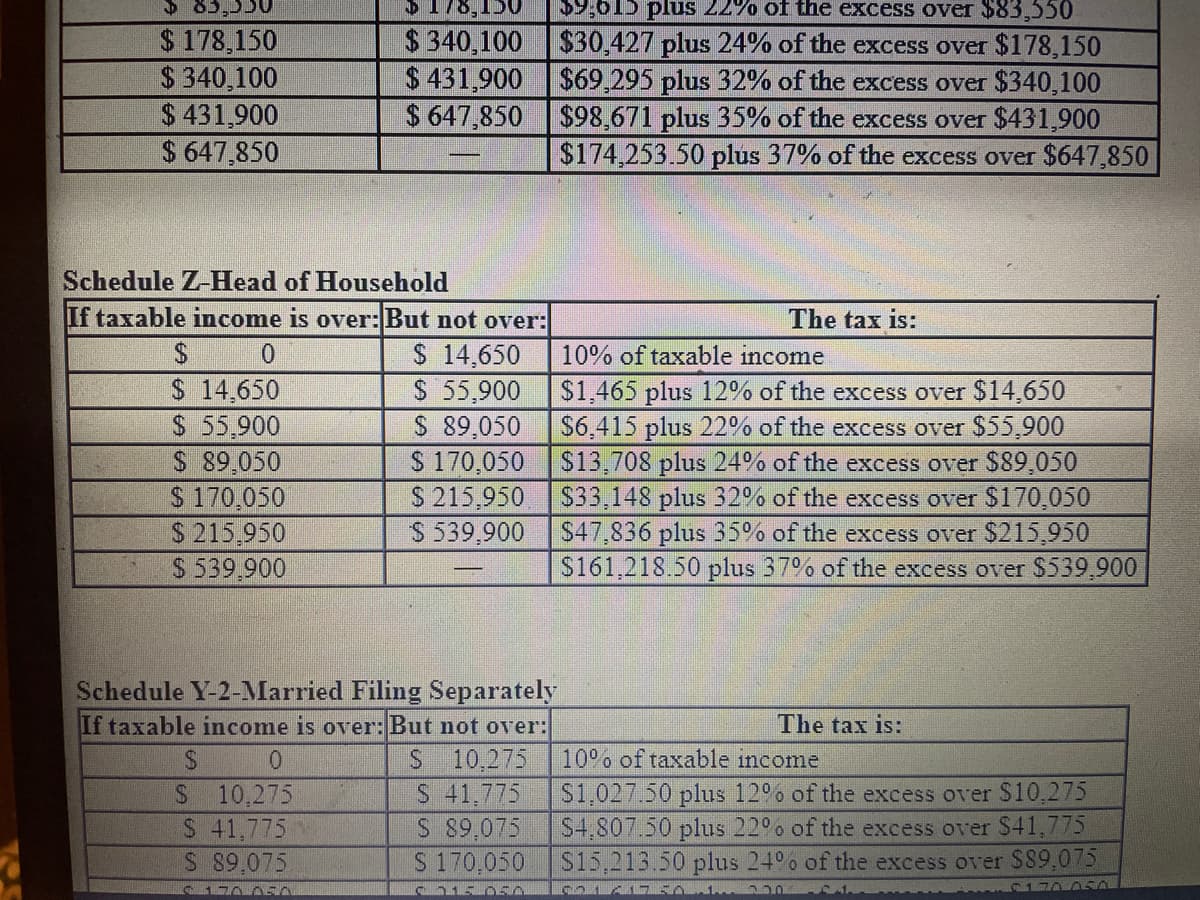

Schedule Z-Head of Household

If taxable income is over: But not over:

$

0

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$ 215,950

$ 539,900

S

0

S 10,275

$ 41,775

$ 89,075

6 170 ASA

$ 14,650

$ 55,900

$ 89,050

170,050

$ 215,950

$ 539,900

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

S 10,275

S 41,775

$ 89,075

S 170,050

C 015 05

$9,615 plus 22% of the excess over $83,550

$30,427 plus 24% of the excess over $178,150

$69,295 plus 32% of the excess over $340,100

$98,671 plus 35% of the excess over $431,900

$174,253.50 plus 37% of the excess over $647,850

The tax is:

10% of taxable income

$1,465 plus 12% of the excess over $14,650

$6,415 plus 22% of the excess over $55,900

708 plus 24% of the excess over 9,050

$33,148 plus 32% of the excess over $170,050

$47,836 plus 35% of the excess over $215,950

$161,218.50 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

CO1A17501 200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you