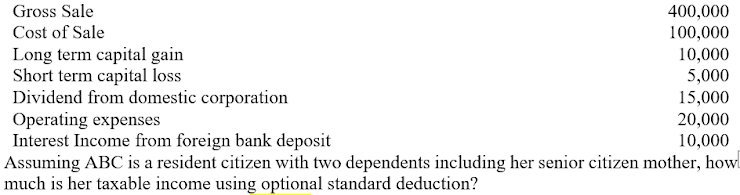

Assuming ABC is a resident citizen with two dependents including her senior citizen mother, how much is her taxable income using optional standard deduction?

Assuming ABC is a resident citizen with two dependents including her senior citizen mother, how much is her taxable income using optional standard deduction?

Chapter3: Organizing And Financing A New Venture

Section: Chapter Questions

Problem 2EP

Related questions

Question

ABC has the following information for 2020:

Transcribed Image Text:Gross Sale

400,000

Cost of Sale

100,000

Long term capital gain

Short term capital loss

Dividend from domestic corporation

Operating expenses

Interest Income from foreign bank deposit

Assuming ABC is a resident citizen with two dependents including her senior citizen mother, howl

much is her taxable income using optional standard deduction?

10,000

5,000

15,000

20,000

10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning