At the beginning of the year, a high school football coach decided to leave his job and give up his annual coaching salary of $65,000 and open his own sporting goods store. A partial income statement for follows: To get the sporting goods store opened, the former coach used $80,000 of his personal savings. The coach opened his store in a building that he owns. Prior to opening his store, the building was rented for $31,000 per year. The coach could have earned 5 percent retu

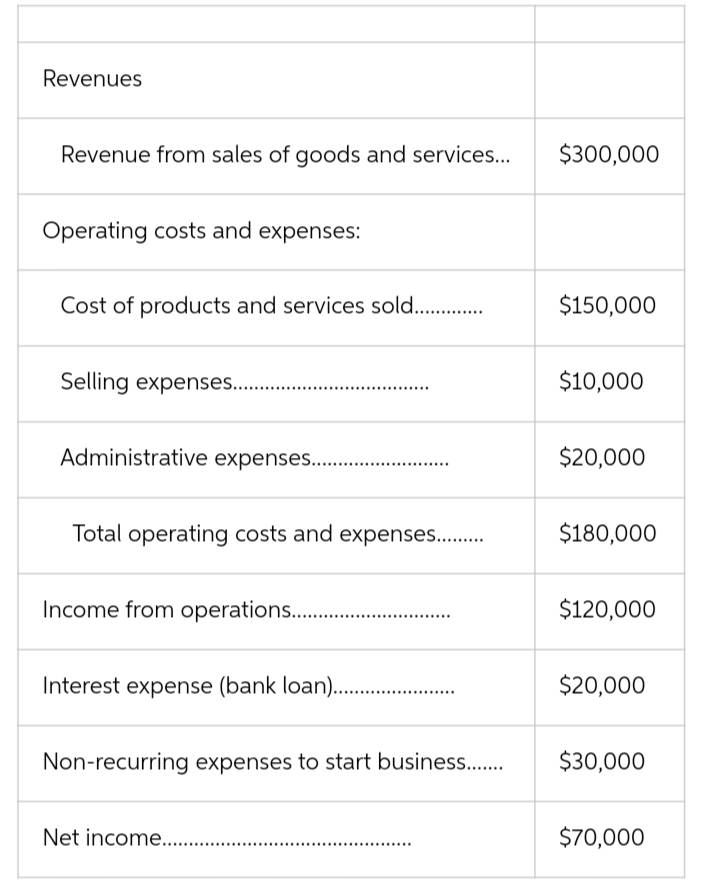

At the beginning of the year, a high school football coach decided to leave his job and give up his annual coaching salary of $65,000 and open his own sporting goods store. A partial income statement for follows:

To get the sporting goods store opened, the former coach used $80,000 of his personal savings. The coach opened his store in a building that he owns. Prior to opening his store, the building was rented for $31,000 per year. The coach could have earned 5 percent return by investing in stocks of other new businesses with risk levels similar to the risk level associated with his new sporting goods store.

1)The former high school coach incurs $_____ of total explicit costs for using market-supplied resources.

2)The opportunity cost of the owner’s equity capital is $_____ annually.

3)Total implicit cost of owner-supplied resources is $

4)Total economic cost is $_____.

5)Accounting profit is $_____

6)By how much did coach’s wealth change by opening the sporting goods store?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps