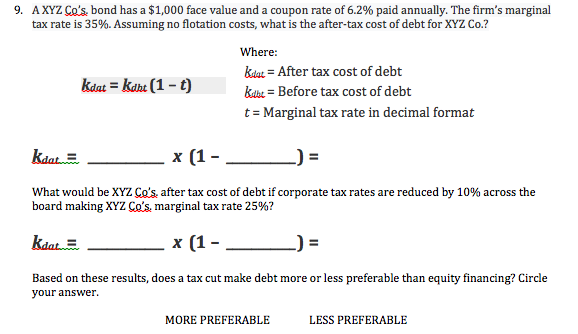

AXYZ Co's. bond has a $1,000 face value and a coupon rate of 6.2% paid annually. The firm's marginal tax rate is 35%. Assuming no flotation costs, what is the after-tax cost of debt for XYZ Co.? 9. Where kdtar =After tax cost of debt ka kahu (1-t) kabe = Before tax cost of debt t Marginal tax rate in decimal format x (1 kdat What would be XYZ Co's. after tax cost of debt if corporate tax rates are reduced by 10% across the board making XYZ Co's. marginal tax rate 25%? kdat x (1-_ Based on these results, does a tax cut make debt more or less preferable than equity financing? Circle your answer LESS PREFERABLE MORE PREFERABLE

AXYZ Co's. bond has a $1,000 face value and a coupon rate of 6.2% paid annually. The firm's marginal tax rate is 35%. Assuming no flotation costs, what is the after-tax cost of debt for XYZ Co.? 9. Where kdtar =After tax cost of debt ka kahu (1-t) kabe = Before tax cost of debt t Marginal tax rate in decimal format x (1 kdat What would be XYZ Co's. after tax cost of debt if corporate tax rates are reduced by 10% across the board making XYZ Co's. marginal tax rate 25%? kdat x (1-_ Based on these results, does a tax cut make debt more or less preferable than equity financing? Circle your answer LESS PREFERABLE MORE PREFERABLE

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 9P: Bond Yield and After-Tax Cost of Debt A companys 6% coupon rate, semiannual payment, 1,000 par value...

Related questions

Question

Transcribed Image Text:AXYZ Co's. bond has a $1,000 face value and a coupon rate of 6.2% paid annually. The firm's marginal

tax rate is 35%. Assuming no flotation costs, what is the after-tax cost of debt for XYZ Co.?

9.

Where

kdtar =After tax cost of debt

ka kahu (1-t)

kabe = Before tax cost of debt

t Marginal tax rate in decimal format

x (1

kdat

What would be XYZ Co's. after tax cost of debt if corporate tax rates are reduced by 10% across the

board making XYZ Co's. marginal tax rate 25%?

kdat

x (1-_

Based on these results, does a tax cut make debt more or less preferable than equity financing? Circle

your answer

LESS PREFERABLE

MORE PREFERABLE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning