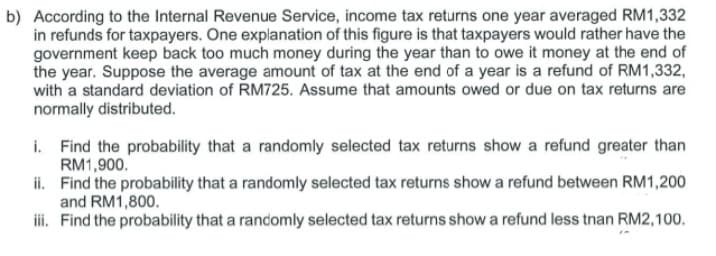

b) According to the Internal Revenue Service, income tax returns one year averaged RM1,332 in refunds for taxpayers. One explanation of this figure is that taxpayers would rather have the government keep back too much money during the year than to owe it money at the end of the year. Suppose the average amount of tax at the end of a year is a refund of RM1,332, with a standard deviation of RM725. Assume that amounts owed or due on tax returns are normally distributed. i. Find the probability that a randomly selected tax returns show a refund greater than RM1,900. ii. Find the probability that a randomly selected tax returns show a refund between RM1,200 and RM1,800. iii. Find the probability that a randomly selected tax returns show a refund less than RM2,100.

b) According to the Internal Revenue Service, income tax returns one year averaged RM1,332 in refunds for taxpayers. One explanation of this figure is that taxpayers would rather have the government keep back too much money during the year than to owe it money at the end of the year. Suppose the average amount of tax at the end of a year is a refund of RM1,332, with a standard deviation of RM725. Assume that amounts owed or due on tax returns are normally distributed. i. Find the probability that a randomly selected tax returns show a refund greater than RM1,900. ii. Find the probability that a randomly selected tax returns show a refund between RM1,200 and RM1,800. iii. Find the probability that a randomly selected tax returns show a refund less than RM2,100.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Please answer all parts with in 30 mins handwritten .

Transcribed Image Text:b) According to the Internal Revenue Service, income tax returns one year averaged RM1,332

in refunds for taxpayers. One explanation of this figure is that taxpayers would rather have the

government keep back too much money during the year than to owe it money at the end of

the year. Suppose the average amount of tax at the end of a year is a refund of RM1,332,

with a standard deviation of RM725. Assume that amounts owed or due on tax returns are

normally distributed.

i. Find the probability that a randomly selected tax returns show a refund greater than

RM1,900.

ii. Find the probability that a randomly selected tax returns show a refund between RM1,200

and RM1,800.

iii. Find the probability that a randomly selected tax returns show a refund less than RM2,100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill