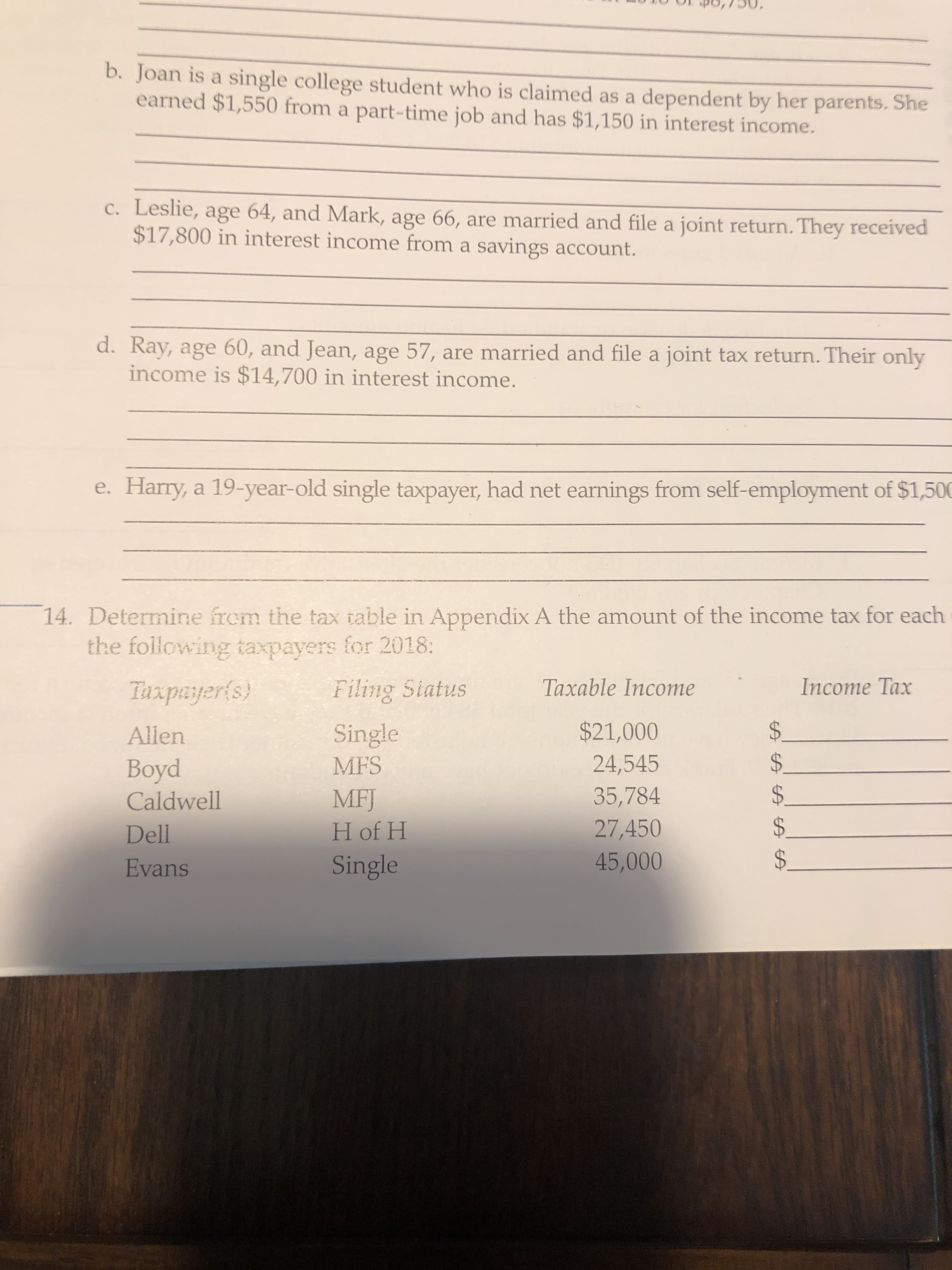

b. Joan is a single college student who is claimed as a earned $1,550 from a part-time job and has $1,150 in interest income. dependent by her parents. She C. Leslie, age 64, and Mark, age 66, are married and file a joint return. They received $17,800 in interest income from a savings account. d. Ray, age 60, and Jean, age 57, are married and file a joint tax return. Their only income is $14,700 in interest income. e. Harry, a 19-year-old single taxpayer, had net earnings from self-employment of $1,500 14. Determine from the tax table in Appendix A the amount of the income tax for each the following taxpayers for 2018: Taxable Income Income Tax Filing Status Taxpayeris) S. $21,000 Single Allen $ $ $ 24,545 MFS Boyd 35,784 MFJ Caldwell 27,450 45,000 H of H Dell Single Evans

b. Joan is a single college student who is claimed as a earned $1,550 from a part-time job and has $1,150 in interest income. dependent by her parents. She C. Leslie, age 64, and Mark, age 66, are married and file a joint return. They received $17,800 in interest income from a savings account. d. Ray, age 60, and Jean, age 57, are married and file a joint tax return. Their only income is $14,700 in interest income. e. Harry, a 19-year-old single taxpayer, had net earnings from self-employment of $1,500 14. Determine from the tax table in Appendix A the amount of the income tax for each the following taxpayers for 2018: Taxable Income Income Tax Filing Status Taxpayeris) S. $21,000 Single Allen $ $ $ 24,545 MFS Boyd 35,784 MFJ Caldwell 27,450 45,000 H of H Dell Single Evans

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 20P: Sheila, a single taxpayer, is a retired computer executive with a taxable income of 100,000 in the...

Related questions

Question

Problem 14. I’m not sure how to calculate

Transcribed Image Text:b. Joan is a single college student who is claimed as a

earned $1,550 from a part-time job and has $1,150 in interest income.

dependent by her parents. She

C. Leslie, age 64, and Mark, age 66, are married and file a joint return. They received

$17,800 in interest income from a savings account.

d. Ray, age 60, and Jean, age 57, are married and file a joint tax return. Their only

income is $14,700 in interest income.

e. Harry, a 19-year-old single taxpayer, had net earnings from self-employment of $1,500

14. Determine from the tax table in Appendix A the amount of the income tax for each

the following taxpayers for 2018:

Taxable Income

Income Tax

Filing Status

Taxpayeris)

S.

$21,000

Single

Allen

$

$

$

24,545

MFS

Boyd

35,784

MFJ

Caldwell

27,450

45,000

H of H

Dell

Single

Evans

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT