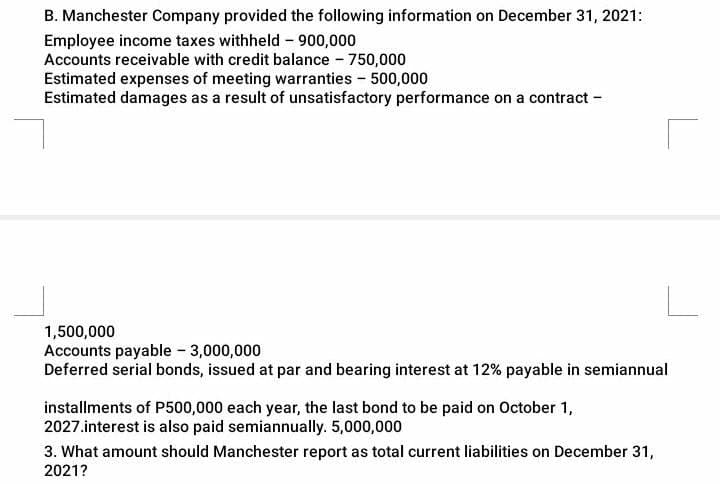

B. Manchester Company provided the following information on December 31, 2021: Employee income taxes withheld - 900,000 Accounts receivable with credit balance - 750,000 Estimated expenses of meeting warranties - 500,000 Estimated damages as a result of unsatisfactory performance on a contract -

B. Manchester Company provided the following information on December 31, 2021: Employee income taxes withheld - 900,000 Accounts receivable with credit balance - 750,000 Estimated expenses of meeting warranties - 500,000 Estimated damages as a result of unsatisfactory performance on a contract -

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 3MC: On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9%...

Related questions

Question

Transcribed Image Text:B. Manchester Company provided the following information on December 31, 2021:

Employee income taxes withheld - 900,000

Accounts receivable with credit balance - 750,000

Estimated expenses of meeting warranties - 500,000

Estimated damages as a result of unsatisfactory performance on a contract -

1,500,000

Accounts payable - 3,000,000

Deferred serial bonds, issued at par and bearing interest at 12% payable in semiannual

installments of P500,000 each year, the last bond to be paid on October 1,

2027.interest is also paid semiannually. 5,000,000

3. What amount should Manchester report as total current liabilities on December 31,

2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning