b1. F Pe, which assumes continuous compounding, says that the Future value (F) of an amount (P) invested today at an annual rate (), expressed as a decimal for the time (), in years is given by the function. Thus if you invested $100 now at the annual rate of 5 1/2% for 6 years and 3 months you would get back (at the end of the time), FS1005 $100 0055y625) $100$100(1.4102) S141.02. Suppose you put $2000 in a savings account when your son was born for 18 years and 6 months to help pay for his college education. If you can earn 3% annually on it, what should you have in his education savings account in 18 years and 6 months?

b1. F Pe, which assumes continuous compounding, says that the Future value (F) of an amount (P) invested today at an annual rate (), expressed as a decimal for the time (), in years is given by the function. Thus if you invested $100 now at the annual rate of 5 1/2% for 6 years and 3 months you would get back (at the end of the time), FS1005 $100 0055y625) $100$100(1.4102) S141.02. Suppose you put $2000 in a savings account when your son was born for 18 years and 6 months to help pay for his college education. If you can earn 3% annually on it, what should you have in his education savings account in 18 years and 6 months?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 5PB: Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated...

Related questions

Question

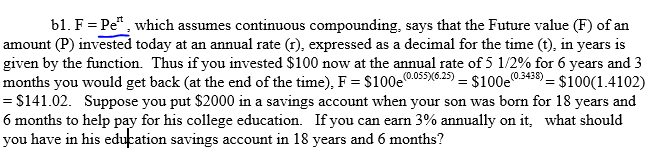

1. (See image), which assumes continuous compounding, says that the Future value (F) of an amount (P) invested today at an annual rate (r), expressed as a decimal for the time (t), in years is given by the function. Thus if you invested $100 now at the annual rate of 5 1/2% for 6 years and 3 months you would get back (at the end of the time), F = $100e^(0.055)^(6.25) = $100e^(0.3438) = $100(1.4102) = $141.02. Suppose you put $2000 in a savings account when your son was born for 18 years and 6 months to help pay for his college education. If you can earn 3% annually on it, what should you have in his education savings account in 18 years and 6 months?

Transcribed Image Text:b1. F

Pe, which assumes continuous compounding, says that the Future value (F) of an

amount (P) invested today at an annual rate (), expressed as a decimal for the time (), in years is

given by the function. Thus if you invested $100 now at the annual rate of 5 1/2% for 6 years and 3

months you would get back (at the end of the time), FS1005 $100

0055y625) $100$100(1.4102)

S141.02. Suppose you put $2000 in a savings account when your son was born for 18 years and

6 months to help pay for his college education. If you can earn 3% annually on it, what should

you have in his education savings account in 18 years and 6 months?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning