BALANCE SHEETS December 31, 2017 Patrick Sean Cash $ 80,000 $ 60,000 Accounts receivable (net) Inventories . Plant and equipment (net) Investment in Sean.. 140,000 25,000 90,000 50,000 625,000 280,000 460,000 Total assets $1,395,000 $415,000 $ 160,000 $ 95,000 Accounts payable. Long-term debt Common stock ($10 par). Additional paid-in capital. 110,000 30,000 340,000 50,000 10,000 Retained earnings... 785,000 230,000 Total liabilities and shareholders' equity $1,395,000 $415,000

BALANCE SHEETS December 31, 2017 Patrick Sean Cash $ 80,000 $ 60,000 Accounts receivable (net) Inventories . Plant and equipment (net) Investment in Sean.. 140,000 25,000 90,000 50,000 625,000 280,000 460,000 Total assets $1,395,000 $415,000 $ 160,000 $ 95,000 Accounts payable. Long-term debt Common stock ($10 par). Additional paid-in capital. 110,000 30,000 340,000 50,000 10,000 Retained earnings... 785,000 230,000 Total liabilities and shareholders' equity $1,395,000 $415,000

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Question

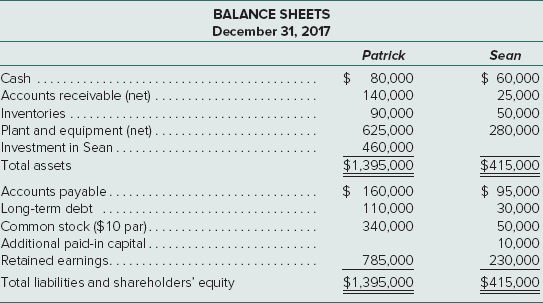

The separate condensed balance sheets of Patrick Corporation and its wholly owned subsidiary, Sean Corporation, are as follows:

Additional Information:

-

On December 31, 2017, Patrick acquired 100 percent of Sean’s voting stock in exchange for $500,000.

-

At the acquisition date, the fair values of Sean’s assets and liabilities equaled their carrying amounts, respectively, except that the fair value of certain items in Sean’s inventory were $25,000 more than their carrying amounts.

In the December 31, 2017, consolidated balance sheet of Patrick and its subsidiary, what amount of total assets should be reported?

Transcribed Image Text:BALANCE SHEETS

December 31, 2017

Patrick

Sean

Cash

$ 80,000

$ 60,000

Accounts receivable (net)

Inventories .

Plant and equipment (net)

Investment in Sean..

140,000

25,000

90,000

50,000

625,000

280,000

460,000

Total assets

$1,395,000

$415,000

$ 160,000

$ 95,000

Accounts payable.

Long-term debt

Common stock ($10 par).

Additional paid-in capital.

110,000

30,000

340,000

50,000

10,000

Retained earnings...

785,000

230,000

Total liabilities and shareholders' equity

$1,395,000

$415,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning