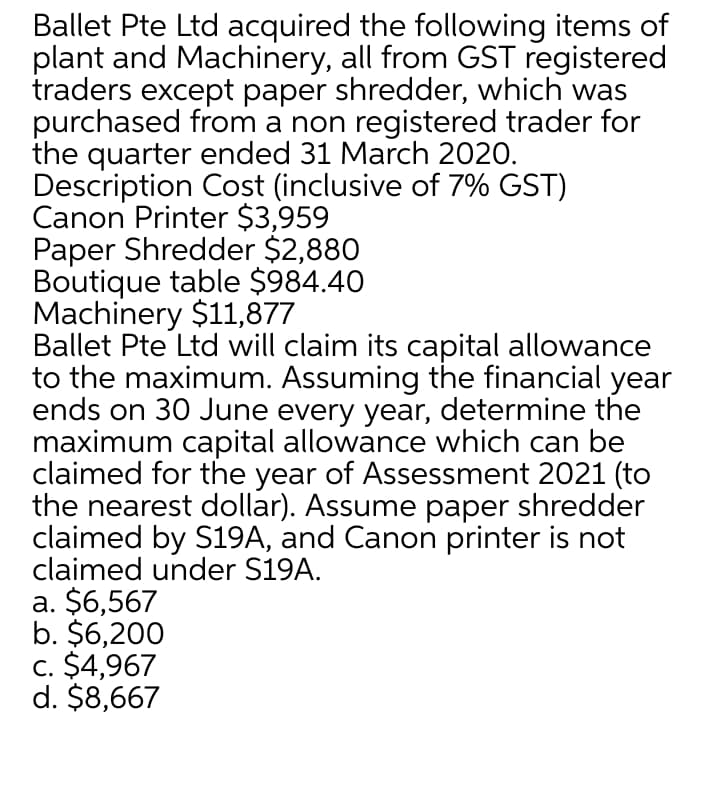

Ballet Pte Ltd acquired the following items of plant and Machinery, all from GST registered traders except paper shredder, which was purchased from a non registered trader for the quarter ended 31 March 2020. Description Cost (inclusive of 7% GST) Canon Printer $3,959 Paper Shredder $2,880 Boutique table $984.40 Machinery $11,877 Ballet Pte Ltd will claim its capital allowance to the maximum. Assuming the financial year ends on 30 June every year, determine the maximum capital allowance which can be claimed for the year of Assessment 2021 (to the nearest dollar). Assume paper shredder claimed by S19A, and Canon printer is not claimed under S19A. a. $6,567 b. $6,200 c. $4,967 d. $8,667

Ballet Pte Ltd acquired the following items of plant and Machinery, all from GST registered traders except paper shredder, which was purchased from a non registered trader for the quarter ended 31 March 2020. Description Cost (inclusive of 7% GST) Canon Printer $3,959 Paper Shredder $2,880 Boutique table $984.40 Machinery $11,877 Ballet Pte Ltd will claim its capital allowance to the maximum. Assuming the financial year ends on 30 June every year, determine the maximum capital allowance which can be claimed for the year of Assessment 2021 (to the nearest dollar). Assume paper shredder claimed by S19A, and Canon printer is not claimed under S19A. a. $6,567 b. $6,200 c. $4,967 d. $8,667

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Ballet Pte Ltd acquired the following items of

plant and Machinery, all from GST registered

traders except paper shredder, which was

purchased from a non registered trader for

the quarter ended 31 March 2020.

Description Cost (inclusive of 7% GST)

Canon Printer $3,959

Paper Shredder $2,880

Boutique table $984.40

Machinery $11,877

Ballet Pte Ltd will claim its capital allowance

to the maximum. Assuming the financial year

ends on 30 June every year, determine the

maximum capital allowance which can be

claimed for the year of Assessment 2021 (to

the nearest dollar). Assume paper shredder

claimed by S19A, and Canon printer is not

claimed under S19A.

a. $6,567

b. $6,200

c. $4,967

d. $8,667

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning