Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $20,000 and has an estimated useful life of four years and an estimated salvage value of $4,600. Required: a-1. Calculate depreciation expense for each year of the truck’s life using Straight-line depreciation. a-2. Calculate depreciation expense for each year of the truck’s life using Double-declining-balance depreciation.

Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $20,000 and has an estimated useful life of four years and an estimated salvage value of $4,600. Required: a-1. Calculate depreciation expense for each year of the truck’s life using Straight-line depreciation. a-2. Calculate depreciation expense for each year of the truck’s life using Double-declining-balance depreciation.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 2MC

Related questions

Question

Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $20,000 and has an estimated useful life of four years and an estimated salvage value of $4,600.

Required:

a-1. Calculate

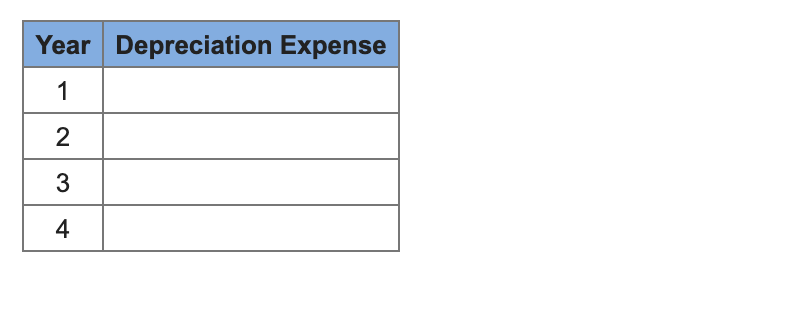

a-2. Calculate depreciation expense for each year of the truck’s life using Double-declining-balance depreciation.

Transcribed Image Text:Depreciation expense

per year

Transcribed Image Text:Year Depreciation Expense

1

2

3

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College