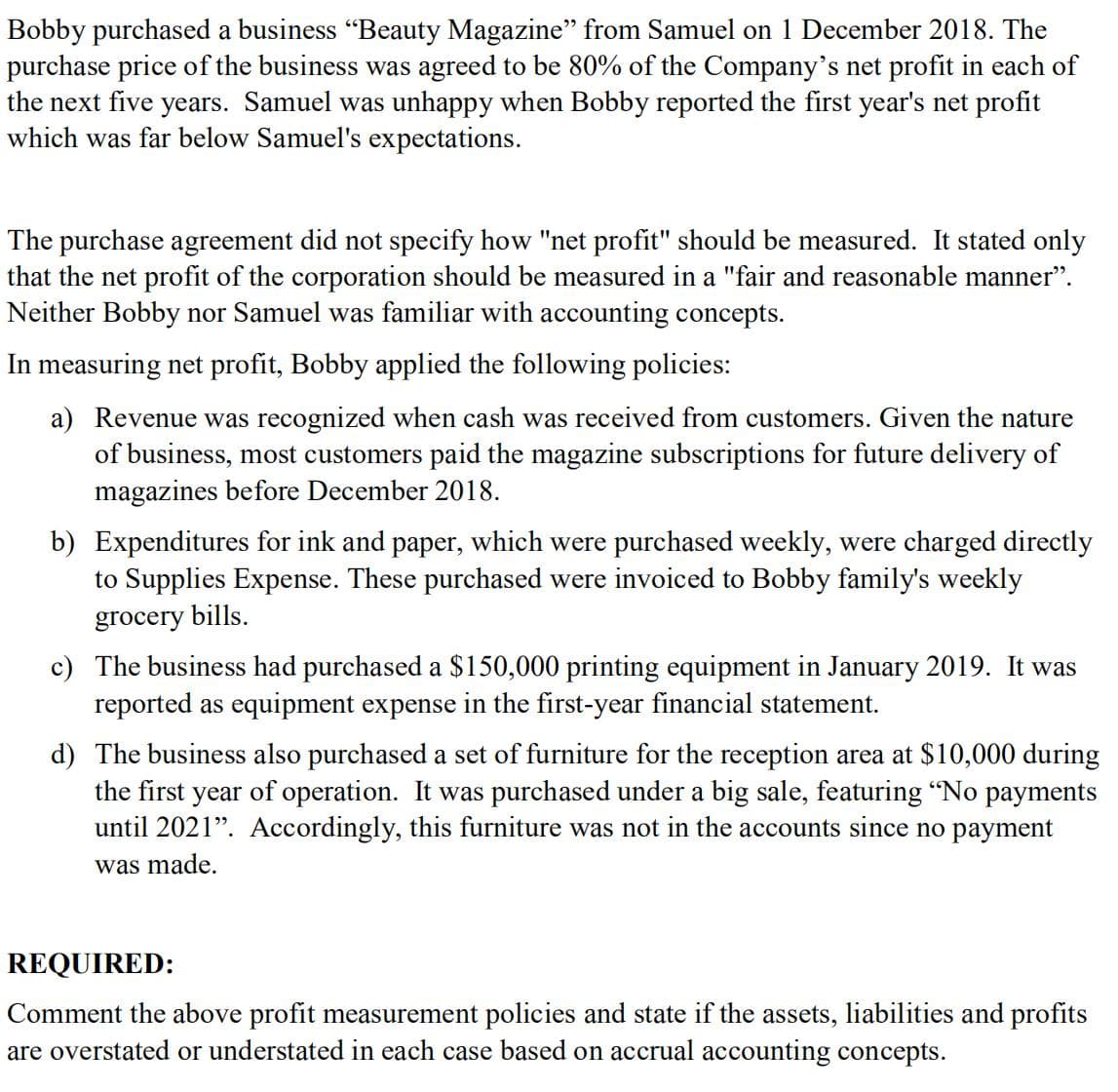

Bobby purchased a business "Beauty Magazine" from Samuel on 1 December 2018. The purchase price of the business was agreed to be 80% of the Company's net profit in each of the next five years. Samuel was unhappy when Bobby reported the first year's net profit which was far below Samuel's expectations. The purchase agreement did not specify how "net profit" should be measured. It stated only that the net profit of the corporation should be measured in a "fair and reasonable manner". Neither Bobby nor Samuel was familiar with accounting concepts. In measuring net profit, Bobby applied the following policies: a) Revenue was recognized when cash was received from customers. Given the nature of business, most customers paid the magazine subscriptions for future delivery of magazines before December 2018. b) Expenditures for ink and paper, which were purchased weekly, were charged directly to Supplies Expense. These purchased were invoiced to Bobby family's weekly grocery bills. c) The business had purchased a $150,000 printing equipment in January 2019. It was reported as equipment expense in the first-year financial statement. d) The business also purchased a set of furniture for the reception area at $10,000 during the first year of operation. It was purchased under a big sale, featuring "No payments until 2021". Accordingly, this furniture was not in the accounts since no payment was made. REQUIRED: Comment the above profit measurement policies and state if the assets, liabilities and profits are overstated or understated in each case based on accrual accounting concepts.

Bobby purchased a business "Beauty Magazine" from Samuel on 1 December 2018. The purchase price of the business was agreed to be 80% of the Company's net profit in each of the next five years. Samuel was unhappy when Bobby reported the first year's net profit which was far below Samuel's expectations. The purchase agreement did not specify how "net profit" should be measured. It stated only that the net profit of the corporation should be measured in a "fair and reasonable manner". Neither Bobby nor Samuel was familiar with accounting concepts. In measuring net profit, Bobby applied the following policies: a) Revenue was recognized when cash was received from customers. Given the nature of business, most customers paid the magazine subscriptions for future delivery of magazines before December 2018. b) Expenditures for ink and paper, which were purchased weekly, were charged directly to Supplies Expense. These purchased were invoiced to Bobby family's weekly grocery bills. c) The business had purchased a $150,000 printing equipment in January 2019. It was reported as equipment expense in the first-year financial statement. d) The business also purchased a set of furniture for the reception area at $10,000 during the first year of operation. It was purchased under a big sale, featuring "No payments until 2021". Accordingly, this furniture was not in the accounts since no payment was made. REQUIRED: Comment the above profit measurement policies and state if the assets, liabilities and profits are overstated or understated in each case based on accrual accounting concepts.

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 64IIP

Related questions

Question

100%

Please help me solve this question, thanks! It requires to comment the above profit measurement policies and state if the assets, liabilities and profits are overstated or understated in each case based on accrual accounting concepts. The answer should be more than 500 words.

Transcribed Image Text:Bobby purchased a business "Beauty Magazine" from Samuel on 1 December 2018. The

purchase price of the business was agreed to be 80% of the Company's net profit in each of

the next five years. Samuel was unhappy when Bobby reported the first year's net profit

which was far below Samuel's expectations.

The purchase agreement did not specify how "net profit" should be measured. It stated only

that the net profit of the corporation should be measured in a "fair and reasonable manner".

Neither Bobby nor Samuel was familiar with accounting concepts.

In measuring net profit, Bobby applied the following policies:

a) Revenue was recognized when cash was received from customers. Given the nature

of business, most customers paid the magazine subscriptions for future delivery of

magazines before December 2018.

b) Expenditures for ink and paper, which were purchased weekly, were charged directly

to Supplies Expense. These purchased were invoiced to Bobby family's weekly

grocery bills.

c) The business had purchased a $150,000 printing equipment in January 2019. It was

reported as equipment expense in the first-year financial statement.

d) The business also purchased a set of furniture for the reception area at $10,000 during

the first year of operation. It was purchased under a big sale, featuring "No payments

until 2021". Accordingly, this furniture was not in the accounts since no payment

was made.

REQUIRED:

Comment the above profit measurement policies and state if the assets, liabilities and profits

are overstated or understated in each case based on accrual accounting concepts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT