Book Value Falr Value Receivables $ 80,000 200,000 300,000 $ 90,000 210,000 Inventory. Buildings Liabilities . Common stock. Additional paid-in capital Retained earnings (deficit) 300,000 330,000 (70,000)

Q: Logan Corp. has incurred losses from operations for many years. At the recommendation of the newly…

A: Quasi re-organisation: This is the re organisation where All deficit in its retained earnings is…

Q: Jade Company has been incurring losses for several years. On December 31, 2019, the SEC permitted…

A: Quasi Recognition The purpose of implementing quasi recognition in the organisation when the firm…

Q: The Larisa Company is exiting bankruptcy reorganization with the following accounts: Book Value…

A:

Q: Bottomless Pit Inc. files a voluntary petition for bankruptcy on May 1, 200X which includes the…

A: Liquidation of company is the winding up of the company. This happens when wrapping up of the…

Q: The RAM Company at December 31 has cash $100,000, noncash assets $280,000, liabilities $138,000, and…

A: RAM Company…

Q: A company is in Chapter 7 bankruptcy, and you have compiled the following data: Liabilities: Wages…

A: The Statement of Affairs depicts the insolvent's monetary situation as of the date of the judicial…

Q: A Company recently petitioned for bankruptcy and is now in the process of preparing a statement of…

A: SOLUTION- UNSECURED CLAIM IS A LIABILITY FOR WHICH THERE IS NO COLLATERAL.

Q: At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining…

A: An amount of $600,000 is received from liquidation, the amount that is distributed to the claimants…

Q: The following information was gathered from the books of Gorgeous Company which is currently…

A: The amount which is available from the sale undertaken of the assets of the company after the…

Q: A company going through a Chapter 7 bankruptcy has the following account balances: Cash . . . . . .…

A: Compute the total amount to be paid for different liabilities:

Q: mcdonalds. is shutting down business and liquidating. The balances below will be used for the…

A: Vehicle Cost: 30,000-15000=$15000 Vehicle sold: $10,500 Therefore, Loss on sale of Vehicle=…

Q: A company declares bankruptcy with $60m in assets including a building worth $40m, $20m in equity, a…

A: Liquidation is a process in which the operations of a business entity are closed resulting in…

Q: Creditors of Jones Corporation are considering petitioning the courts to force the company into…

A: ANSWER Indicate the amount of money that each class of creditors can anticipate receiving

Q: Ristoni Company is in the process of emerging from a Chapter 11 bankruptcy. It will apply fresh…

A:

Q: Holmes Corporation has filed a voluntary petition with the bankruptcy court in hopes of…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: ABC Corporation is experiencing difficulty in paying its bills and is considering filing for…

A: The net free assets are the amount of realized value of an asset after secured creditor and…

Q: At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining…

A: Hey, since there are multiple questions posted, we will answer first three question. If you want any…

Q: Mario Company has been incurring losses for several years. On December 31, 2019, the SEC permitted…

A: Quasi-reorganization is a legal process of internal reconstruction which is carried out when a…

Q: At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining…

A: d) Other priority claimants are trustee’s cost, workers wages, and the taxes. These claims will be…

Q: The Larisa Company is exiting bankruptcy reorganization with the following accounts: Book…

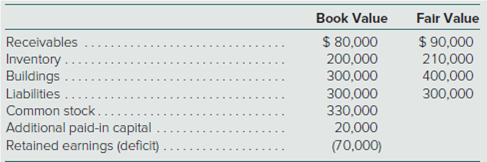

A: The assets of this Larisa company have a fair market value of $742,000 but the reorganization value…

Q: Mario Company has been incurring losses for several years. On December 31, 2019, the SEC permitted…

A: In this problem we will revalue assets and liabilities as per given…

Q: The Larisa Company is exiting bankruptcy reorganization with the following accounts: Book…

A: Journal entry is a process of initially recording and classifying business transactions into books…

Q: Hilfmir Corporation filed for Chapter 11 bankruptcy on January 1, 2014. A summary of their financial…

A: Condition Number (1) The new company's reorganization value must be less than prepetition and…

Q: Lui, Montavo, and Johnson plan to liquidate their Premium Pool and Spa business. They have always…

A: Liquidation of Partnership - Liquidation of partnership is the process of selling all the assets…

Q: Forever's Not Enough Co. is undergoing liquidation since January 1, 2018. Its condensed statement of…

A: Shareholder's equity is the ownership stake of the shareholders in any company. These are presented…

Q: Alitech Corporation is liquidating under Chapter 7 of the Bankruptcy Act. The accounts of Alitech at…

A:

Q: At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining…

A: Since the question has more than 3 sub-parts, the first 3 subparts are answered. If you want the…

Q: Company recently petitioned for bankruptcy and is now in the process of preparing a statement of…

A: When a company has to undergo a liquidation process, the liabilities that it has due has to be paid…

Q: Bamboo Company has sustained heavy losses over a period of time and conditions warrant that Bamboo…

A: Shareholders: Individual who has ownership of one or more shares of the business entity is known as…

Q: The Skinny Red Company has a deficit in retained earnings of P 1,000,000. Business appears to be…

A: The question is based on the concept of Financial Accounting.

Q: The Larisa Company is exiting bankruptcy reorganization with the following accounts: Book Value Fair…

A: Accounts Title and Explanation Debit Credit Receivables 29000 Inventory 29000 Buildings…

Q: Tessa Ltd. which operated under Chapter 11 of the bankruptcy act, released its balance sheet when…

A: The balance sheet is a statement prepared to ascertain the true position of assets and liabilities…

Q: ROBL MOVING ON Co. has been undergoing liquidation since January 1. As of March 31, its condensed…

A: Statement of realization and liquidation is the statement prepared by the entity which is used in…

Q: Marter Co. filed a bankruptcy petition and liquidated its noncash assets. Marter was paying forty…

A: Mortgage is a form of loan where an asset is produced as a collateral in order to receive the funds…

Q: Unsecured liabilities without priority P150,000 Fully secured creditors 20,000 Partially secured…

A: Partially secured creditors (Secured with asset valued at P10,000) = P15,000 Stockholder's equity…

Q: Oregon Corporation has filed a voluntary petition to reorganize under Chapter 11 of the Bankruptcy…

A: a.

Q: Alitech Corporation is liquidating under Chapter 7 of the Bankruptcy Act. The accounts of Alitech at…

A: Bankruptcy is a condition in which there is a need to appoint trustee in order to liquidate assets…

Q: Oregon Corporation has filed a voluntary petition to reorganize under Chapter 11 of the Bankruptcy…

A: Requirement a:

Q: A Company recently petitioned for bankruptcy and is now in the process of preparing a statement of…

A: SOLUTION- AMOUNT OF EQUITY = TOTAL ASSET AT BOOK VALUE -TOTAL DEBTS.…

Q: APA Corporation is in bankruptcy and is being liquidated by a court-appointed trus financial report…

A: Cash 100000 less :- Mortgage payable (secured by property) 50000 Balance 50000 Less:-…

Q: Dexter Company has sustained heavy losses over a period time and conditions warrant that Dexter…

A: Share premium After Quasi Reorganization = Share premium before After Quasi Reorganization x Par…

Q: Jaez Corporation is in the process of going through a reorganization. As of December 31, 2020, the…

A:

Q: Olds Company declares Chapter 7 bankruptcy. The following are the asset and liability book values at…

A: Working notes: Calculate the amount collected by B for notes payable.

Q: Kent Co. filed a voluntary bankruptcy petition on August 15, 2008, and the statement of affairs…

A: Bankruptcy refers to a legal process opted by a person who is not able to make the repayment of his…

Q: Ataway Company has severe financial difficulties and is considering filing a bankruptcy petition. At…

A:

Q: Smith Corporation has gone through bankruptcy and is ready to emerge as a reorganized entity on…

A:

Q: Olds Company declares Chapter 7 bankruptcy. The following are the book values of the asset and…

A:

Q: Interest on Notes Payable 2,400 Bonds Payable (secured by land and building)…

A: SOLUTION UNSECURED CREDITORS IS AN INDIVIDUAL OR INSTITUTION THAT LENDS MONEY WITHOUT WITHOUT…

The Larisa Company is exiting bankruptcy reorganization with the following accounts:

The company’s assets have a $760,000 reorganization value. As part of the reorganization, the company’s owners transferred 80 percent of the outstanding stock to the creditors.

Prepare the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Problem BPeter Senen Corporation provided the following account balances as of September 30, 2020: CashP112,000 Accumulated depreciationP 36,000Accounts Receivable64,000Accounts payable 40,000Finished Goods48,000Income tax payable9,000Work in process 36,000 Share Capital500,000Raw materials 52,000 Retained Earnings207,000Property and Equipment480,000The following transactions occurred during October:1. Materials purchased on account, P150,0002. Materials issued to production: direct materials- P90,000, Indirect materials- P10,000.3. Payroll for the month of October 2020 consisted of the following (also paid during the month):Direct labor P62,000Administrative salariesP16,000Indirect Labor 20,000Sales salaries 30,000Payroll deductions were as follows:Withholding taxes P19,800Phil health contributions P2,000SSS contributions 7,100HDMF contributions 2,0004. Employer contributions for the month were accrued:FactorySellingAdministrativeSSS contributionsP5,700P2,000P1,100Philhealth…Computational (Show your computations. Round off as follows: e.g. ₩10.64=> ₩11, 0.123456 => 12.35%, 2.4321 => 2.43) . KG Co. had total assets of ₩1,200,000, total liabilities of ₩500,000, and retainedearnings of ₩300,000 at the beginning of 20x1. For the year, the corporationdeclared cash dividends of ₩50,000. At the end of the year, the company hadtotal assets of ₩1,400,000 and showed the debt ratio of 0.4. The company hadno accumulated other comprehensive income.1) Compute the total stockholders’ equity at the end of 20x1. 2) Compute KG’s net profit for 20x1, assuming no change in contributed capitalduring the yearFinancial statement of ABC 31/12/2020 Notes receivable 20,000 Share capital (180,000stocks/face value 2€) 360,000 Taxes payable 15,000 Retained earnings ? Reservations and contributions payable 25,000 Mortgage loan 100,000 Notes in delay 15,000 Cash desk 40,000 Notes payable 25,000 Demand deposit 100,000 Goods 50,000 Securities 20,000 Packaging materials 17,000 Participations 34,500 Suppliers 20,000 Building (estimated life 20years/residual value 20,000) 220,000 Deposit-advanced payment of suppliers 5,000 Depreciated buildings 50,000 Deposit-advanced payment of customers 20,000 Furniture (estimated life 10years/residual value 1,000) 40,000 Customers 15,000 Depreciated furniture 39,000 Debtors 30,000 Economic unit 30,000 Difference above par 30,000 Track (estimated life 10years/residual value5,000) 70,000 Depreciated track value 58,500 Prepaid insurance 3,000 Negotiable promissory notes…

- Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)Given : Total Assets :120.000,Long Term Liabilities : 20.000,Current Assets :80.000, and,Current Liabilities : 60.000Net Profits : 24.000Choose the incorrect Answera) Total Liabilities / Total Sources : 0,67b) Total Debt / Equity :1c) Current Ratio: 1,33d) Return on assets : 0,20Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…

- Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Sandy Corporation’s balance sheet at January 2, 20x5 is as follows:Sandy-Dr(Cr)Cash and receivables P200,000,000Inventories 600,000,000.00Property, plant and equipment, net 7,500,000,000.00 Current liabilities (400,000,000.00)Long-term debt (7,200,000,000.00)Capital stock (7,200,000.00)Retained earnings (25,000,000.00)Accumulated othercomprehensive income (5,000,000.00) An analysis of Sandy’s assets and liabilities reveals that book values of some reported itemsdo not reflect their market values at the date of acquisition:● Inventories are overvalued by P200,000,000● Property, plant and equipment is overvalued by P2,000,000,000● Long-term debt is undervalued by P100,000,000 On January 2, 20x5, Velasco issues new stock with a market value of P700,000,000 toacquire the assets and liabilities of Sandy. Stock registration fees are P100,000,000, paid incash. Consulting, accounting, and legal fees connected with the merger are P150,000,000,paid in cash. In addition, Velasco enters into an…Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio. Please help with the both questions mentioned

- Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio.(Figures in $ millions) Assets 2021 2022 Liabilities and Shareholders' Equity 2021 2022 Current assets $ 310 $ 420 Current liabilities $ 210 $ 240 Net fixed assets 1,200 1,420 Long-term debt 830 920 Required: a&b. What was shareholders’ equity at the end of 2021 and 2022? c. If Newble paid dividends of $100 million in 2022 and made no stock issues, what must have been net income during the year? d. If Newble purchased $300 million in fixed assets during 2022, what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2021 and 2022? f. If Newble issued $200 million of new long-term debt, how much debt must have been paid off during the yearOrbit Limited Statement of Financial Position as at 31 December: 2022 2021 R R ASSETS Non-current assets 11 810 000 7 560 000 Property, plant and equipment 10 025 000 6 250 000 Investments 1 785 000 1 310 000 Current assets 4 190 000 4 690 000 Inventories 1 875 000 2 350 000 Accounts receivable 1 925 000 2 200 000 Cash 390 000 140 000 Total assets 16 000 000 12 250 000 EQUITY AND LIABILITIES Equity ? ? Ordinary share capital 5 480 000 3 680 000 Retained earnings ? ? Non-current liabilities 4 500 000 3 800 000 Loan (20% p.a.) 4 500 000 3 800 000 Current liabilities 2 300 000 1 500 000 Accounts payable 2 300 000 1 500 000 Total equity and liabilities 16 000 000 12 250 000 Statement of Comprehensive Income for the year ended 31 December: 2022 2021 R R Sales 10 800 000 7 150 000 Cost of sales (6 000 000) (3 650 000) Gross profit 4 800 000 3 500 000 Operating expenses (1 800 000) (1 200 000) Depreciation 580 000 200 000…