Break-Even Sales Suntory Holdings Limited is a Japanese beverage maker that produces alcoholic and non-alcoholic beverages including Suntory whiskey, Orangina, Ribena, and Lucozade. Suntory reported the following operating information for a recent year (in billions of JPY): Net sales JPY 1,411 Cost of goods sold 629 Selling, general and administration 688 1,317 Income from operations 94 In addition, assume that Suntory sold 250 million barrels of beverages during the year. Assume that variable costs were 70% of the cost of goods sold and 40% of selling, general, and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Suntory expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by JPY 4 billion. When computing the cost per unit amounts for the break-even formula, round to four decimal places. If required, round your final answer to the nearest whole barrel. a. Compute the break-even number of barrels for the current year. barrels b. Compute the anticipated break-even number of barrels for the following year. barrels

Break-Even Sales Suntory Holdings Limited is a Japanese beverage maker that produces alcoholic and non-alcoholic beverages including Suntory whiskey, Orangina, Ribena, and Lucozade. Suntory reported the following operating information for a recent year (in billions of JPY): Net sales JPY 1,411 Cost of goods sold 629 Selling, general and administration 688 1,317 Income from operations 94 In addition, assume that Suntory sold 250 million barrels of beverages during the year. Assume that variable costs were 70% of the cost of goods sold and 40% of selling, general, and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Suntory expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by JPY 4 billion. When computing the cost per unit amounts for the break-even formula, round to four decimal places. If required, round your final answer to the nearest whole barrel. a. Compute the break-even number of barrels for the current year. barrels b. Compute the anticipated break-even number of barrels for the following year. barrels

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter24: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 3MAD: Papa Johns International, Inc. (PZZA), operates over 5,000 restaurants in the United States and 45...

Related questions

Question

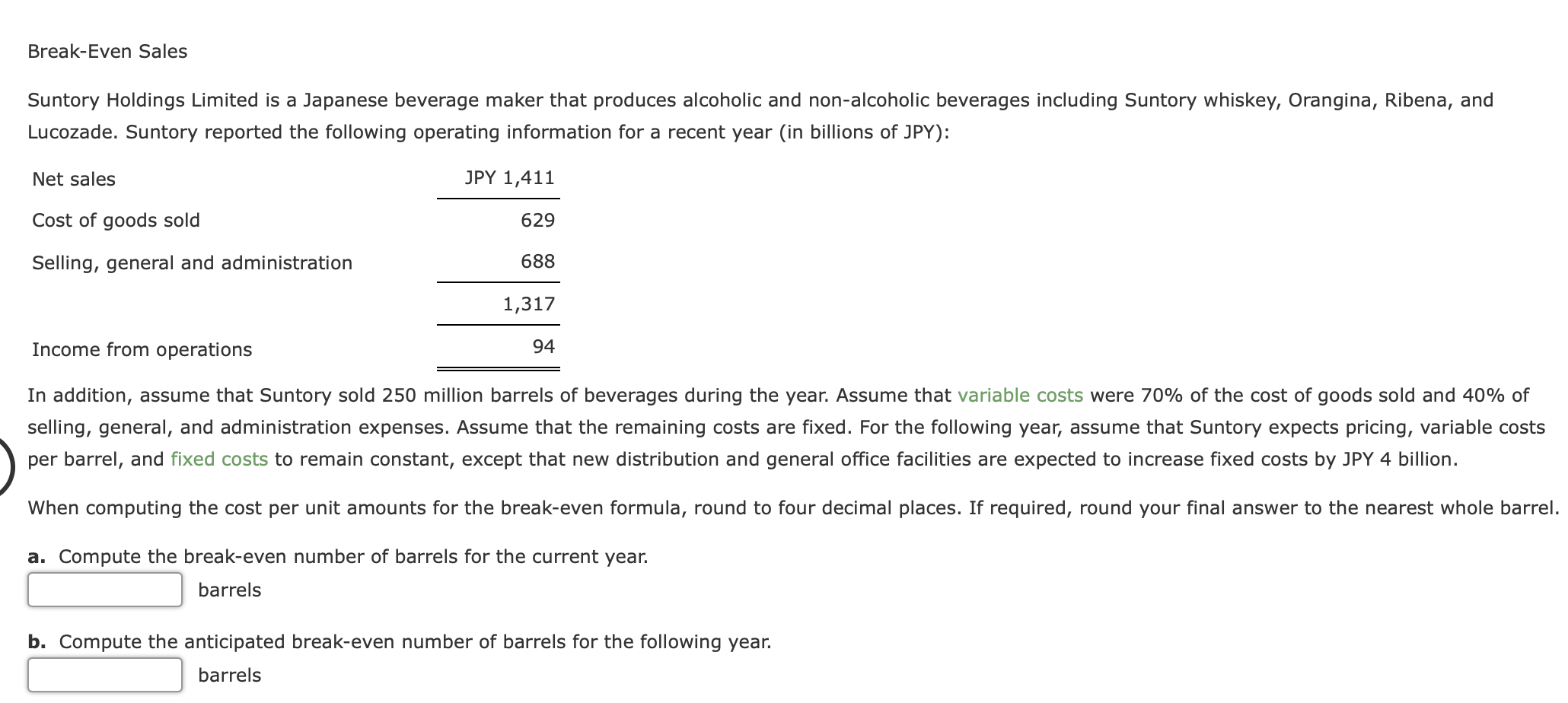

Transcribed Image Text:Break-Even Sales

Suntory Holdings Limited is a Japanese beverage maker that produces alcoholic and non-alcoholic beverages including Suntory whiskey, Orangina, Ribena, and

Lucozade. Suntory reported the following operating information for a recent year (in billions of JPY):

Net sales

JPY 1,411

Cost of goods sold

629

Selling, general and administration

688

1,317

Income from operations

94

In addition, assume that Suntory sold 250 million barrels of beverages during the year. Assume that variable costs were 70% of the cost of goods sold and 40% of

selling, general, and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Suntory expects pricing, variable costs

per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by JPY 4 billion.

When computing the cost per unit amounts for the break-even formula, round to four decimal places. If required, round your final answer to the nearest whole barrel.

a. Compute the break-even number of barrels for the current year.

barrels

b. Compute the anticipated break-even number of barrels for the following year.

barrels

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning