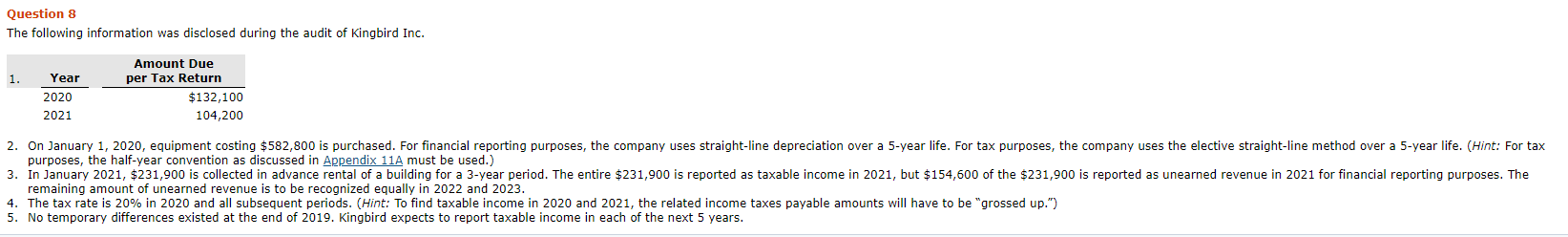

buestion 0 The folowing information was disdosed during the audit of Kingbird Inc. Amount Due per Tax Return $132.100 104,200 1. Year 2020 2021 On January 1, 2020, equipment costing $582,500 is purchased. For finanda reporting purposes, the company Uses straight-line depreciation over a 3-year Ife. For tax purposes, the company uses the electire straight-line method over a 5-vear life. (Hint: For tax p.rposes, the har-year convantion as discussed in aensedix 11A must be used) In January 2021, $231,900 is collected in advance rental of a building for a 3-vear period. The entire $231,500 is reported as taable income in 2021. but $154,000 of the $231,900 is reported as uneamed revenue in 2021 for financial reporting purposes. The remaining amount of unearnad revenue is to be recognized equally in 2022 and 2023. The tax rate is 20% in 2020 and al subsequent periods. (Hint: To find taxeble income in 2020 and 2021, the related income taxes payable amounts wil have to be "grossed up.) . ke tamporary differences existed at the and of 2019. Kingbird expacts to report taxable income in cach of the next 5 years.

buestion 0 The folowing information was disdosed during the audit of Kingbird Inc. Amount Due per Tax Return $132.100 104,200 1. Year 2020 2021 On January 1, 2020, equipment costing $582,500 is purchased. For finanda reporting purposes, the company Uses straight-line depreciation over a 3-year Ife. For tax purposes, the company uses the electire straight-line method over a 5-vear life. (Hint: For tax p.rposes, the har-year convantion as discussed in aensedix 11A must be used) In January 2021, $231,900 is collected in advance rental of a building for a 3-vear period. The entire $231,500 is reported as taable income in 2021. but $154,000 of the $231,900 is reported as uneamed revenue in 2021 for financial reporting purposes. The remaining amount of unearnad revenue is to be recognized equally in 2022 and 2023. The tax rate is 20% in 2020 and al subsequent periods. (Hint: To find taxeble income in 2020 and 2021, the related income taxes payable amounts wil have to be "grossed up.) . ke tamporary differences existed at the and of 2019. Kingbird expacts to report taxable income in cach of the next 5 years.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.14E

Related questions

Question

Transcribed Image Text:buestion 0

The folowing information was disdosed during the audit of Kingbird Inc.

Amount Due

per Tax Return

$132.100

104,200

1.

Year

2020

2021

On January 1, 2020, equipment costing $582,500 is purchased. For finanda reporting purposes, the company Uses straight-line depreciation over a 3-year Ife. For tax purposes, the company uses the electire straight-line method over a 5-vear life. (Hint: For tax

p.rposes, the har-year convantion as discussed in aensedix 11A must be used)

In January 2021, $231,900 is collected in advance rental of a building for a 3-vear period. The entire $231,500 is reported as taable income in 2021. but $154,000 of the $231,900 is reported as uneamed revenue in 2021 for financial reporting purposes. The

remaining amount of unearnad revenue is to be recognized equally in 2022 and 2023.

The tax rate is 20% in 2020 and al subsequent periods. (Hint: To find taxeble income in 2020 and 2021, the related income taxes payable amounts wil have to be "grossed up.)

. ke tamporary differences existed at the and of 2019. Kingbird expacts to report taxable income in cach of the next 5 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning