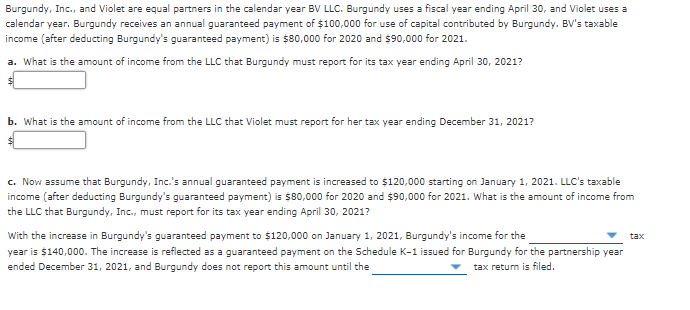

Burgundy, Inc., and Violet are equal partners in the calendar year BV LLC. Burgundy uses a fiscal year ending April 30, and Violet uses a calendar year. Burgundy receives an annual guaranteed payment of $100,000 for use of capital contributed by Burgundy. BV's taxable income (after deducting Burgundy's guaranteed payment) is $80,000 for 2020 and $90,000 for 2021. a. What is the amount of income from the LLC that Burgundy must report for its tax year ending April 30, 2021? b. What is the amount of income from the LLC that Violet must report for her tax year ending December 31, 2021? c. Now assume that Burgundy, Inc.'s annual guaranteed payment is increased to $120,000 starting on January 1, 2021. LLC's taxable income (after deducting Burgundy's guaranteed payment) is $80,000 for 2020 and $90,000 for 2021. What is the amount of income from the LLC that Burgundy, Inc., must report for its tax year ending April 30, 2021? With the increase in Burgundy's guaranteed payment to $120,000 on January 1, 2021, Burgundy's income for the tax year is $140,000. The increase is reflected as a guaranteed payment on the Schedule K-1 issued for Burgundy for the partnership year ended December 31, 2021, and Burgundy does not report this amount until the tax return is filed.

Burgundy, Inc., and Violet are equal partners in the calendar year BV LLC. Burgundy uses a fiscal year ending April 30, and Violet uses a calendar year. Burgundy receives an annual guaranteed payment of $100,000 for use of capital contributed by Burgundy. BV's taxable income (after deducting Burgundy's guaranteed payment) is $80,000 for 2020 and $90,000 for 2021. a. What is the amount of income from the LLC that Burgundy must report for its tax year ending April 30, 2021? b. What is the amount of income from the LLC that Violet must report for her tax year ending December 31, 2021? c. Now assume that Burgundy, Inc.'s annual guaranteed payment is increased to $120,000 starting on January 1, 2021. LLC's taxable income (after deducting Burgundy's guaranteed payment) is $80,000 for 2020 and $90,000 for 2021. What is the amount of income from the LLC that Burgundy, Inc., must report for its tax year ending April 30, 2021? With the increase in Burgundy's guaranteed payment to $120,000 on January 1, 2021, Burgundy's income for the tax year is $140,000. The increase is reflected as a guaranteed payment on the Schedule K-1 issued for Burgundy for the partnership year ended December 31, 2021, and Burgundy does not report this amount until the tax return is filed.

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 58P

Related questions

Question

See Attached

Transcribed Image Text:Burgundy, Inc., and Violet are equal partners in the calendar year BV LLC. Burgundy uses a fiscal year ending April 30, and Violet uses a

calendar year. Burgundy receives an annual guaranteed payment of $100,000 for use of capital contributed by Burgundy. BV's taxable

income (after deducting Burgundy's guaranteed payment) is $80,000 for 2020 and $90,000 for 2021.

a. What is the amount of income from the LLC that Burgundy must report for its tax year ending April 30, 2021?

b. What is the amount of income from the LLC that Violet must report for her tax year ending December 31, 2021?

c. Now assume that Burgundy, Inc.'s annual guaranteed payment is increased to $120,000 starting on January 1, 2021. LLC's taxable

income (after deducting Burgundy's guaranteed payment) is $80,000 for 2020 and $90,000 for 2021. What is the amount of income from

the LLC that Burgundy, Inc., must report for its tax year ending April 30, 2021?

With the increase in Burgundy's guaranteed payment to $120,000 on January 1, 2021, Burgundy's income for the

year is $140,000. The increase is reflected as a guaranteed payment on the Schedule K-1 issued for Burgundy for the partnership year

ended December 31, 2021, and Burgundy does not report this amount until the

tax

tax returm is filed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you