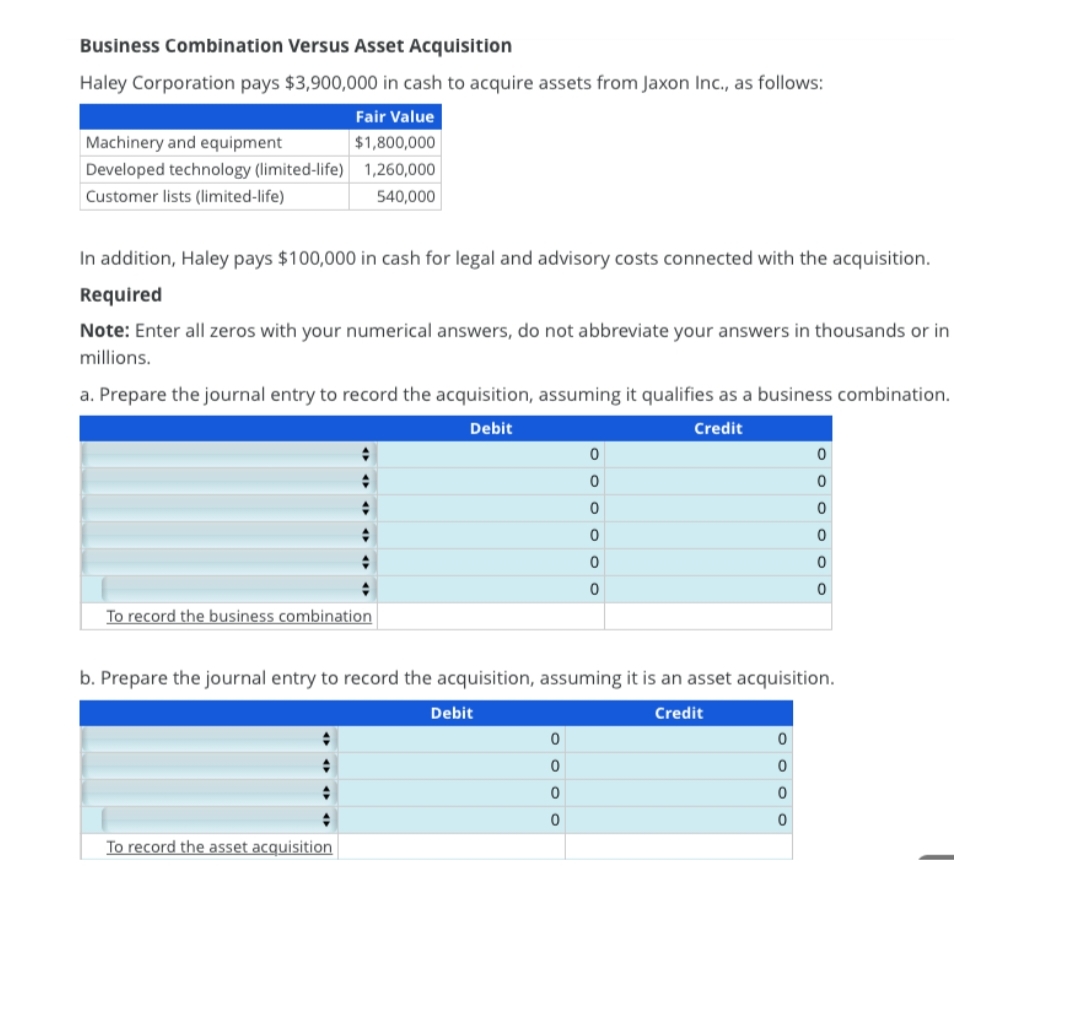

Business Combination Versus Asset Acquisition Haley Corporation pays $3,900,000 in cash to acquire assets from Jaxon Inc., as follows: Fair Value $1,800,000 1,260,000 540,000 Machinery and equipment Developed technology (limited-life) Customer lists (limited-life) In addition, Haley pays $100,000 in cash for legal and advisory costs connected with the acquisition. Required Note: Enter all zeros with your numerical answers, do not abbreviate your answers in thousands or in millions. a. Prepare the journal entry to record the acquisition, assuming it qualifies as a business combination.

Business Combination Versus Asset Acquisition Haley Corporation pays $3,900,000 in cash to acquire assets from Jaxon Inc., as follows: Fair Value $1,800,000 1,260,000 540,000 Machinery and equipment Developed technology (limited-life) Customer lists (limited-life) In addition, Haley pays $100,000 in cash for legal and advisory costs connected with the acquisition. Required Note: Enter all zeros with your numerical answers, do not abbreviate your answers in thousands or in millions. a. Prepare the journal entry to record the acquisition, assuming it qualifies as a business combination.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

Transcribed Image Text:Business Combination Versus Asset Acquisition

Haley Corporation pays $3,900,000 in cash to acquire assets from Jaxon Inc., as follows:

Fair Value

$1,800,000

1,260,000

540,000

Machinery and equipment

Developed technology (limited-life)

Customer lists (limited-life)

In addition, Haley pays $100,000 in cash for legal and advisory costs connected with the acquisition.

Required

Note: Enter all zeros with your numerical answers, do not abbreviate your answers in thousands or in

millions.

a. Prepare the journal entry to record the acquisition, assuming it qualifies as a business combination.

Debit

Credit

To record the business combination

+

+

+

+

+

+

+

+

+

+

To record the asset acquisition

b. Prepare the journal entry to record the acquisition, assuming it is an asset acquisition.

Credit

Debit

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning