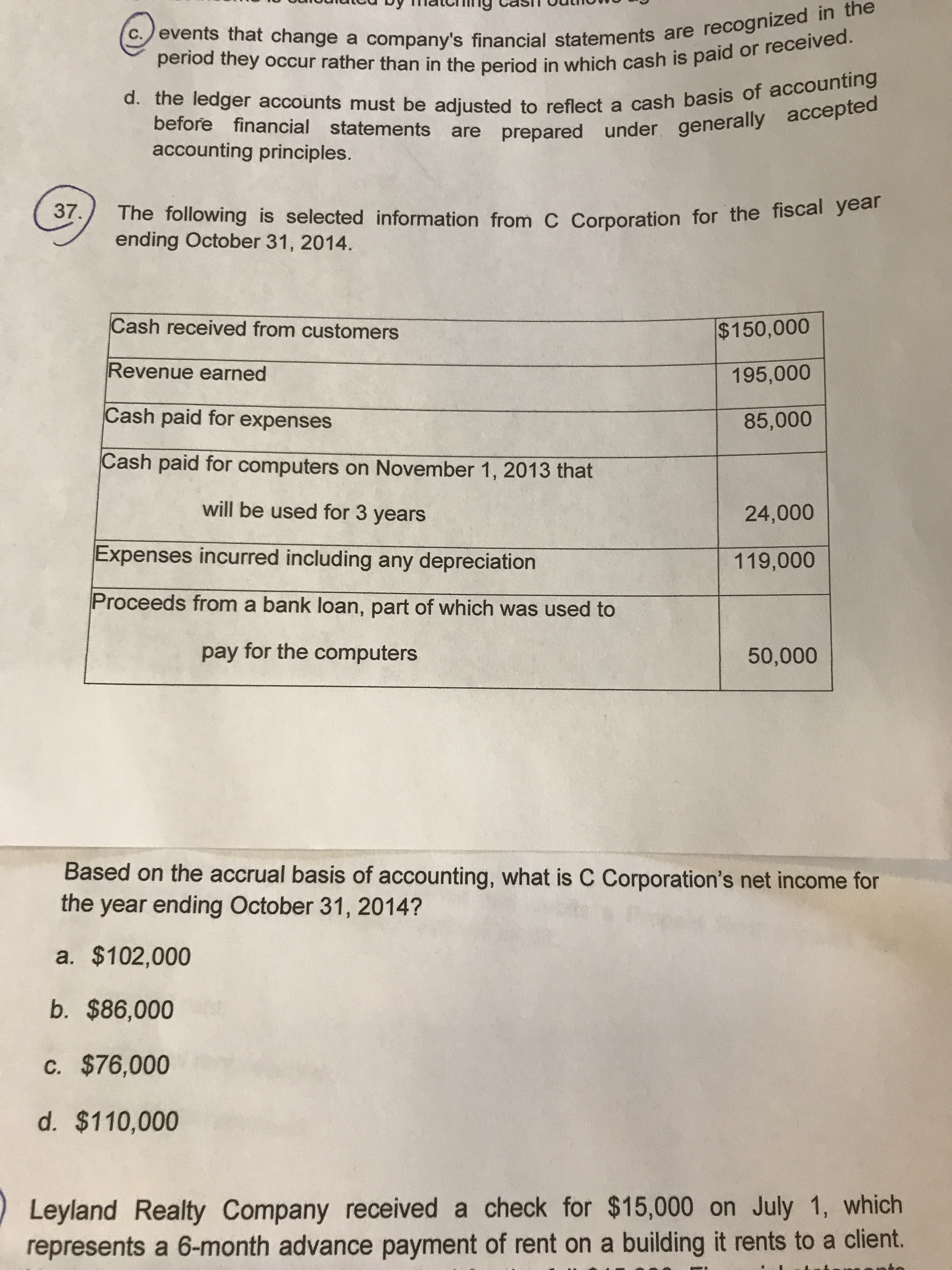

c. events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received. d. the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles. 37. The following is selected information from C Corporation for the fiscal yea ending October 31, 2014. Cash received from customers $150,000 Revenue earned 195,000 Cash paid for expenses 85,000 Cash paid for computers on November 1, 2013 that will be used for 3 years 24,000 Expenses incurred including any depreciation 119,000 Proceeds from a bank loan, part of which was used to pay for the computers 50,000 Based on the accrual basis of accounting, what is C Corporation's net income for the year ending October 31, 2014? a. $102,000 b. $86,000 C. $76,000 d. $110,000 Leyland Realty Company received a check for $15,000 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client.

c. events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received. d. the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared under generally accepted accounting principles. 37. The following is selected information from C Corporation for the fiscal yea ending October 31, 2014. Cash received from customers $150,000 Revenue earned 195,000 Cash paid for expenses 85,000 Cash paid for computers on November 1, 2013 that will be used for 3 years 24,000 Expenses incurred including any depreciation 119,000 Proceeds from a bank loan, part of which was used to pay for the computers 50,000 Based on the accrual basis of accounting, what is C Corporation's net income for the year ending October 31, 2014? a. $102,000 b. $86,000 C. $76,000 d. $110,000 Leyland Realty Company received a check for $15,000 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:c. events that change a company's financial statements are recognized in the

period they occur rather than in the period in which cash is paid or received.

d. the ledger accounts must be adjusted to reflect a cash basis of accounting

before financial statements are prepared under generally accepted

accounting principles.

37.

The following is selected information from C Corporation for the fiscal yea

ending October 31, 2014.

Cash received from customers

$150,000

Revenue earned

195,000

Cash paid for expenses

85,000

Cash paid for computers on November 1, 2013 that

will be used for 3 years

24,000

Expenses incurred including any depreciation

119,000

Proceeds from a bank loan, part of which was used to

pay for the computers

50,000

Based on the accrual basis of accounting, what is C Corporation's net income for

the year ending October 31, 2014?

a. $102,000

b. $86,000

C. $76,000

d. $110,000

Leyland Realty Company received a check for $15,000 on July 1, which

represents a 6-month advance payment of rent on a building it rents to a client.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning