calculate Net Income and total assets

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 15.17EX: Profitability ratios The following selected data were taken from the financial statements of...

Related questions

Question

calculate Net Income and total assets

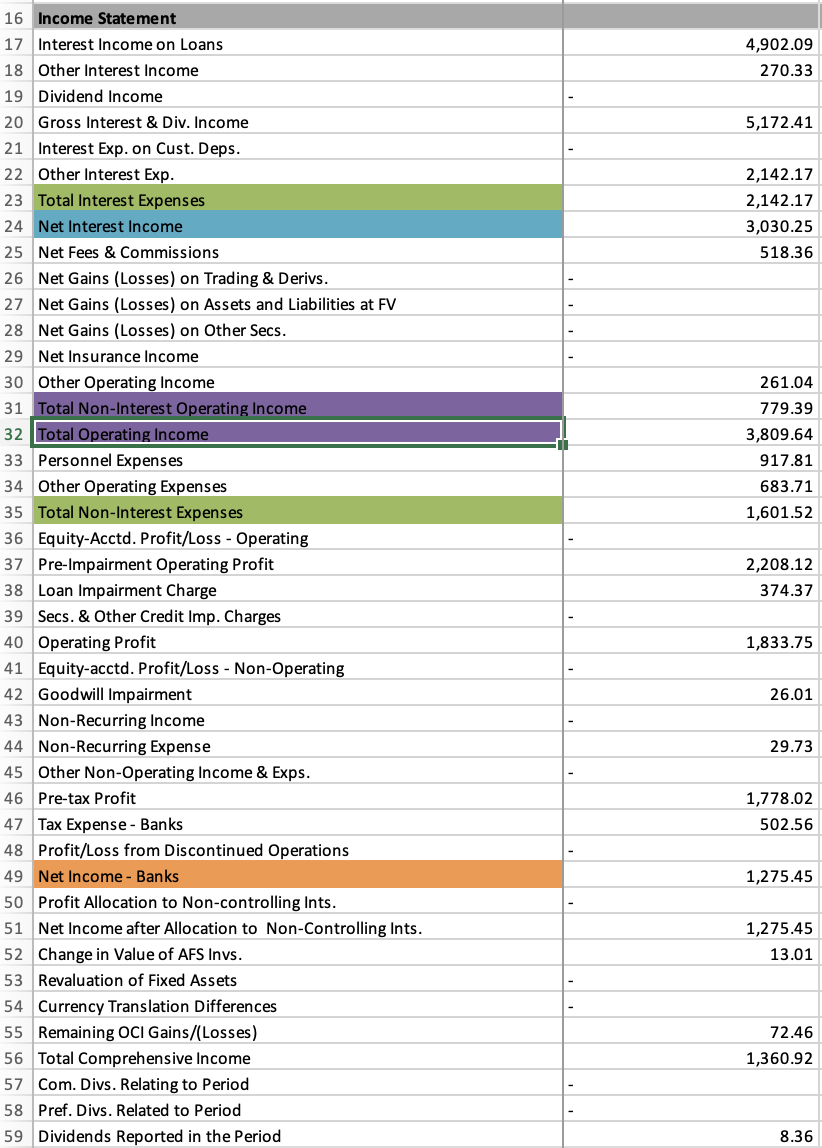

Transcribed Image Text:16 Income Statement

17 Interest Income on Loans

4,902.09

18 Other Interest Income

270.33

19 Dividend Income

20 Gross Interest & Div. Income

5,172.41

21 Interest Exp. on Cust. Deps.

22 Other Interest Exp.

2,142.17

23 Total Interest Expenses

24 Net Interest Income

2,142.17

3,030.25

25 Net Fees & Commissions

518.36

26 Net Gains (Losses) on Trading & Derivs.

27 Net Gains (Losses) on Assets and Liabilities at FV

28 Net Gains (Losses) on Other Secs.

29 Net Insurance Income

30 Other Operating Income

261.04

31 Total Non-Interest Operating Income

32 Total Operating Income

779.39

3,809.64

33 Personnel Expenses

917.81

34 Other Operating Expenses

683.71

35 Total Non-Interest Expenses

1,601.52

36 Equity-Acctd. Profit/Loss - Operating

37 Pre-Impairment Operating Profit

2,208.12

38 Loan Impairment Charge

374.37

39 Secs. & Other Credit Imp. Charges

40 Operating Profit

1,833.75

41 Equity-acctd. Profit/Loss - Non-Operating

42 Goodwill Impairment

26.01

43 Non-Recurring Income

44 Non-Recurring Expense

29.73

45 Other Non-Operating Income & Exps.

46 Pre-tax Profit

1,778.02

47 Tax Expense - Banks

502.56

48 Profit/Loss from Discontinued Operations

49 Net Income - Banks

1,275.45

50 Profit Allocation to Non-controlling Ints.

51 Net Income after Allocation to Non-Controlling Ints.

1,275.45

52 Change in Value of AFS Invs.

13.01

53 Revaluation of Fixed Assets

54 Currency Translation Differences

55 Remaining OCI Gains/(Losses)

72.46

56 Total Comprehensive Income

1,360.92

57 Com. Divs. Relating to Period

58 Pref. Divs. Related to Period

59 Dividends Reported in the Period

8.36

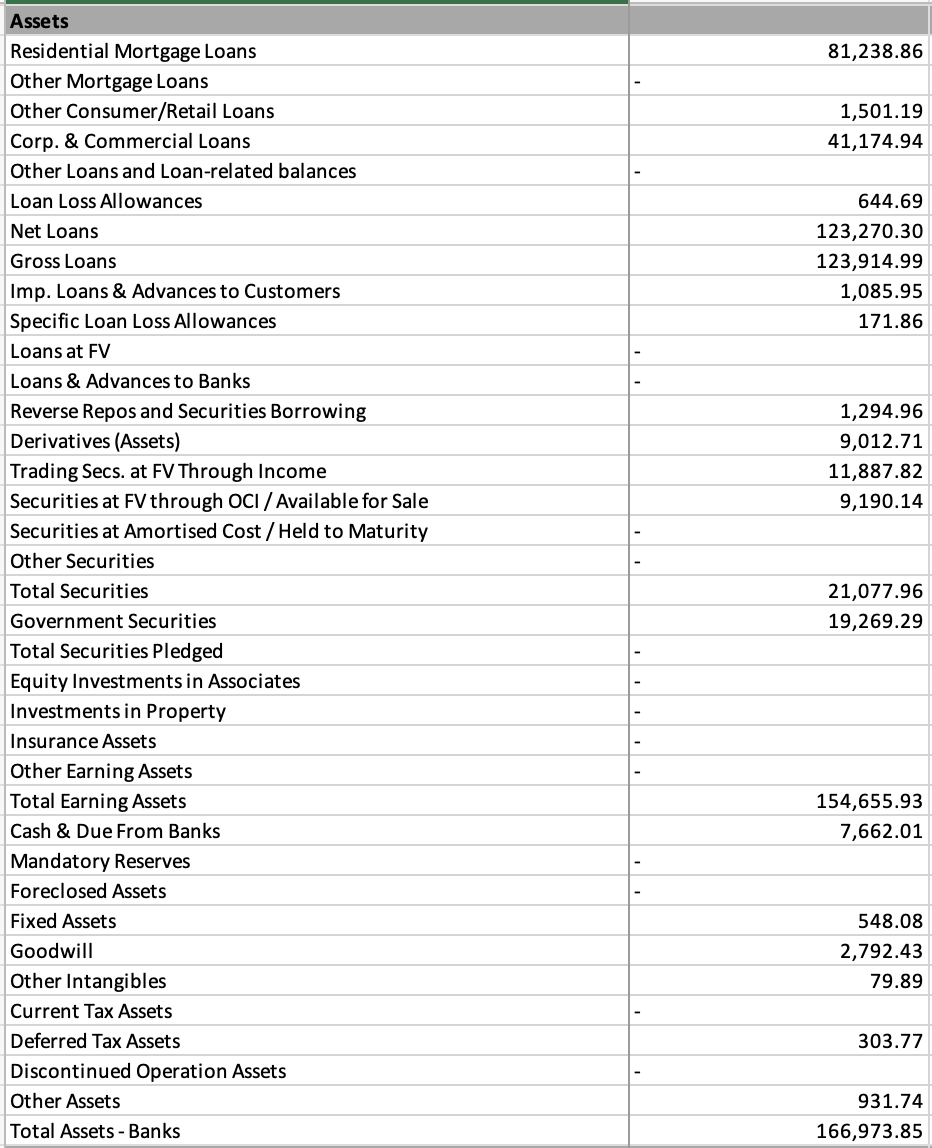

Transcribed Image Text:Assets

Residential Mortgage Loans

81,238.86

Other Mortgage Loans

Other Consumer/Retail Loans

1,501.19

Corp. & Commercial Loans

41,174.94

Other Loans and Loan-related balances

Loan Loss Allowances

644.69

Net Loans

123,270.30

Gross Loans

123,914.99

Imp. Loans & Advances to Customers

1,085.95

Specific Loan Loss Allowances

171.86

Loans at FV

Loans & Advances to Banks

Reverse Repos and Securities Borrowing

1,294.96

Derivatives (Assets)

9,012.71

Trading Secs. at FV Through Income

11,887.82

Securities at FV through OCI / Available for Sale

Securities at Amortised Cost /Held to Maturity

9,190.14

Other Securities

Total Securities

21,077.96

Government Securities

19,269.29

Total Securities Pledged

Equity Investments in Associates

Investments in Property

Insurance Assets

Other Earning Assets

Total Earning Assets

154,655.93

Cash & Due From Banks

7,662.01

Mandatory Reserves

Foreclosed Assets

Fixed Assets

548.08

Goodwill

2,792.43

Other Intangibles

79.89

Current Tax Assets

Deferred Tax Assets

303.77

Discontinued Operation Assets

Other Assets

931.74

Total Assets - Banks

166,973.85

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning