Calculate the amount of the payments required of M&B under each alternative. Quarterly fixed principal + interest payments option with manufacturer: Total amount of payments Fixed blended monthly instalment note with the bank including principal and interest: (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 5,275.25. Round interest rate per month to 5 decimal places, e.g. 1.25976%) Total amount of payments

Calculate the amount of the payments required of M&B under each alternative. Quarterly fixed principal + interest payments option with manufacturer: Total amount of payments Fixed blended monthly instalment note with the bank including principal and interest: (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 5,275.25. Round interest rate per month to 5 decimal places, e.g. 1.25976%) Total amount of payments

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Weat

Subject: acounting

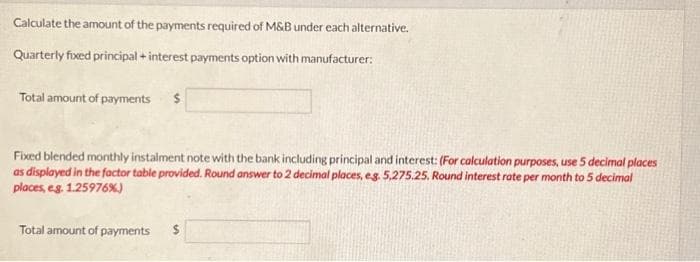

Transcribed Image Text:Calculate the amount of the payments required of M&B under each alternative.

Quarterly fixed principal + interest payments option with manufacturer:

Total amount of payments $

Fixed blended monthly instalment note with the bank including principal and interest: (For calculation purposes, use 5 decimal places

as displayed in the factor table provided. Round answer to 2 decimal places, eg. 5,275.25. Round interest rate per month to 5 decimal

places, e.g. 1.25976%)

Total amount of payments

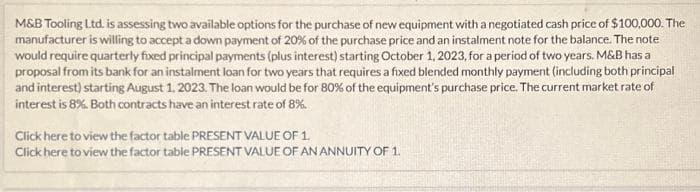

Transcribed Image Text:M&B Tooling Ltd. is assessing two available options for the purchase of new equipment with a negotiated cash price of $100,000. The

manufacturer is willing to accept a down payment of 20% of the purchase price and an instalment note for the balance. The note

would require quarterly fixed principal payments (plus interest) starting October 1, 2023, for a period of two years. M&B has a

proposal from its bank for an instalment loan for two years that requires a fixed blended monthly payment (including both principal

and interest) starting August 1, 2023. The loan would be for 80% of the equipment's purchase price. The current market rate of

interest is 8%. Both contracts have an interest rate of 8%

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning