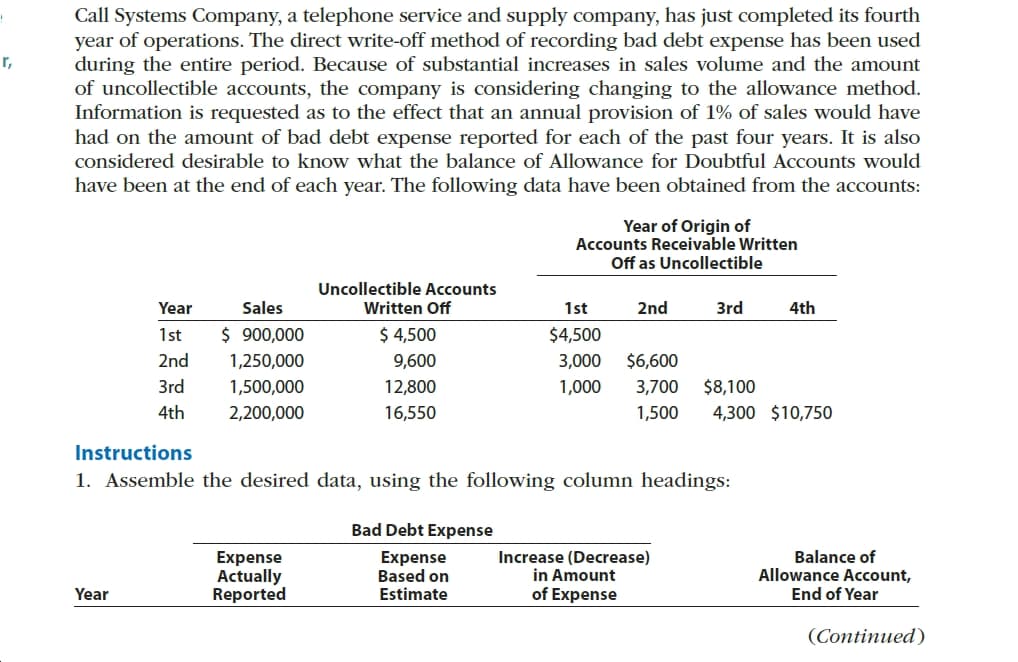

Call Systems Company, a telephone service and supply company, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 1% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to know what the balance of Allowance for Doubtful Accounts would have been at the end of each year. The following data have been obtained from the accounts: r, Year of Origin of Accounts Receivable Written Off as Uncollectible Uncollectible Accounts Written Off Sales 2nd 3rd 4th Year 1st $ 900,000 $ 4,500 $4,500 1st 2nd $6,600 1,250,000 9,600 3,000 3rd 1,500,000 $8,100 12,800 1,000 3,700 4th 4,300 $10,750 2,200,000 16,550 1,500 Instructions 1. Assemble the desired data, using the following column headings: Bad Debt Expense Increase (Decrease) in Amount of Expense Balance of Allowance Account, End of Year Expense Actually Reported Expense Based on Estimate Year (Continued) Experience during the first four years of operations indicated that the receiv- ables either were collected within two years or had to be written off as uncollectible. Does the estimate of 1% of sales appear to be reasonably close to the actual experi- ence with uncollectible accounts originating during the first two years? Explain. 2.

Call Systems Company, a telephone service and supply company, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 1% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to know what the balance of Allowance for Doubtful Accounts would have been at the end of each year. The following data have been obtained from the accounts: r, Year of Origin of Accounts Receivable Written Off as Uncollectible Uncollectible Accounts Written Off Sales 2nd 3rd 4th Year 1st $ 900,000 $ 4,500 $4,500 1st 2nd $6,600 1,250,000 9,600 3,000 3rd 1,500,000 $8,100 12,800 1,000 3,700 4th 4,300 $10,750 2,200,000 16,550 1,500 Instructions 1. Assemble the desired data, using the following column headings: Bad Debt Expense Increase (Decrease) in Amount of Expense Balance of Allowance Account, End of Year Expense Actually Reported Expense Based on Estimate Year (Continued) Experience during the first four years of operations indicated that the receiv- ables either were collected within two years or had to be written off as uncollectible. Does the estimate of 1% of sales appear to be reasonably close to the actual experi- ence with uncollectible accounts originating during the first two years? Explain. 2.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

Transcribed Image Text:Call Systems Company, a telephone service and supply company, has just completed its fourth

year of operations. The direct write-off method of recording bad debt expense has been used

during the entire period. Because of substantial increases in sales volume and the amount

of uncollectible accounts, the company is considering changing to the allowance method.

Information is requested as to the effect that an annual provision of 1% of sales would have

had on the amount of bad debt expense reported for each of the past four years. It is also

considered desirable to know what the balance of Allowance for Doubtful Accounts would

have been at the end of each year. The following data have been obtained from the accounts:

r,

Year of Origin of

Accounts Receivable Written

Off as Uncollectible

Uncollectible Accounts

Written Off

Sales

2nd

3rd

4th

Year

1st

$ 900,000

$ 4,500

$4,500

1st

2nd

$6,600

1,250,000

9,600

3,000

3rd

1,500,000

$8,100

12,800

1,000

3,700

4th

4,300 $10,750

2,200,000

16,550

1,500

Instructions

1. Assemble the desired data, using the following column headings:

Bad Debt Expense

Increase (Decrease)

in Amount

of Expense

Balance of

Allowance Account,

End of Year

Expense

Actually

Reported

Expense

Based on

Estimate

Year

(Continued)

Transcribed Image Text:Experience during the first four years of operations indicated that the receiv-

ables either were collected within two years or had to be written off as uncollectible.

Does the estimate of 1% of sales appear to be reasonably close to the actual experi-

ence with uncollectible accounts originating during the first two years? Explain.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,