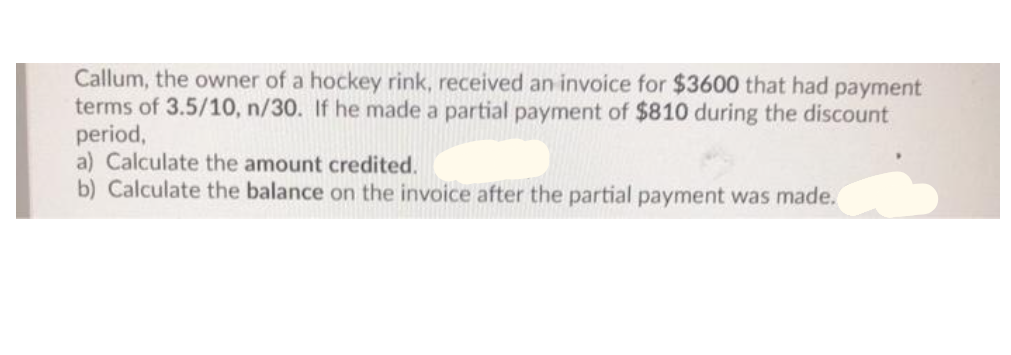

Callum, the owner of a hockey rink, received an invoice for $3600 that had payment terms of 3.5/10, n/30. If he made a partial payment of $810 during the discount period, a) Calculate the amount credited. b) Calculate the balance on the invoice after the partial payment was made.

Callum, the owner of a hockey rink, received an invoice for $3600 that had payment terms of 3.5/10, n/30. If he made a partial payment of $810 during the discount period, a) Calculate the amount credited. b) Calculate the balance on the invoice after the partial payment was made.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 46P: Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and...

Related questions

Question

Transcribed Image Text:Callum, the owner of a hockey rink, received an invoice for $3600 that had payment

terms of 3.5/10, n/30. If he made a partial payment of $810 during the discount

period,

a) Calculate the amount credited.

b) Calculate the balance on the invoice after the partial payment was made.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT