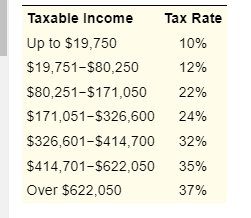

Cameron is single and has taxable income of $92,616. Determine his tax liability using the tax tables and using the tax rate schedule. Why is there a difference between the two amounts?

Q: Marcus a single taxpayer has taxable income of $60,000. Using the US 2020 tax rate schedule. How…

A: Taxable Income: Taxable income is the amount of a person's gross income that the government deems…

Q: Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates…

A: Tax is a compulsory payment made to the government of the country by the citizens of the country.…

Q: What is the tax liability for a married couple with a taxable income of $92,225? What is the tax…

A: Tax rates for married couple: Tax rate Amount($) 10%…

Q: Johanna resides in Saskatchewan and has taxable income of $85,000 for the current year. Determine…

A: The amount of tax payable means the amount of tax that the taxpayer needs to pay. the amount of tax…

Q: Use the marginal tax rates in the table below to compute the tax owed in the following situation.…

A: Marginal tax rate is the tax rate which is applicable and changed as per each additional changed…

Q: Chuck, a single taxpayer, earns $77,000 in taxable income and $10,000 in interest from an investment…

A: Taxable income: It is the amount of income that is used to compute the amount tax has to be paid by…

Q: meron is single and has taxable income of $93,656. Determine his tax liability using the tax tables…

A: Income tax: - Income tax is the tax that has to be paid to the income tax department by the…

Q: Use the marginal tax rates in the table below to compute the tax owed in the following situation.…

A: Income Tax: Income tax is a direct tax which is paid by the taxpayer depending on his level of…

Q: Gabriella and Steve have adjusted gross income of $96,600 and $82,300 respectively. Calculate their…

A: Tax is the amount that is charged by the tax authority from the individual and companies on their…

Q: If husband and wife are both employed, which is correct regarding their income tax exemption in the…

A: As per our protocol we provide solution to the one question only and you have asked more than one…

Q: Henrich is a single taxpayer. In 2021, his taxable income is $461,500. What is his income tax and…

A: A tax is a compulsory charge paid to the government by everyone who is generating any kind of…

Q: Eduardo, a single taxpayer, has $80,000 of taxable income plus $25,000 income from tax-exempt bonds.…

A: Effective tax rate: Effective tax rate is the rate at which a person pays the taxes. This effective…

Q: Comparing the tax on $350,000 of taxable income for each tax filing status, the filing status that…

A: The tax liability is the total amount of tax debt owed by corporation, individual or other entity to…

Q: "Xavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as…

A: The income tax refers to the amount of tax that is put by the government on the income earned by…

Q: Which one of the following conditions must be satisfied in order for a married taxpayer to be taxed…

A: Correct option is A i.e. Husband and wife must live apart for the entire year

Q: Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she…

A: Amount of AMT Deduction phases out or decreases 25% for every increase in AMTI above $1,047,200…

Q: duela dent is single and had $189,000 in taxable income. Using the rates from table 2.3 in the…

A: given that, duela dent is a single filer and her taxable income = $189000 the federal standard…

Q: Using the tax table in Exhibit 4-6, determine the amount of taxes for the following situations:…

A: Table used:

Q: Cameron is single and has taxable income of $53,342. Determine his tax liability using the tax…

A: Particulars Amount$ Taxable Income 53,342 Upto $9,950 at 10% 995 $9,951-$40,525…

Q: A married taxpayer with $80,000 of taxable income filing married filing seperately will have a…

A: The tax brackets and the taxable rate for unmarried taxpayers and married taxpayer filing under…

Q: What is the amount of the tax liability for a qualifying widow(er) with a dependent child and having…

A: Qualifying widow/widower filing status refers to the concept which applies to the surviving spouses…

Q: Ross is single with an adjusted gross income of $69,100, and he uses the standard deduction for…

A:

Q: Matteo (unmarried) files his tax return using head of household filing status. His taxable income is…

A: The Tax rate Schedule for Head of Household will be as per below Tax rate Taxable income bracket…

Q: Havel and Petra are married and will file a joint tax return. Havel has W-2 income of $38,840, and…

A: Their taxable income is $63,382 ($38,840+$49,642-$25,100). Remember that you need to subtract the…

Q: Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two…

A: SOLUTION CALCULATION- PARTICULARS AMOUNT INCOME 235300 LESS - ITEMIZED DEDUCTIONS -27750…

Q: Jenni is married filling separately with taxable income of $68,000. How much tax does she owe? (…

A: Given: Taxable Income =$68000

Q: Chuck, a single taxpayer, earns $76,600 in taxable income and $11,700 in interest from an investment…

A: Marginal tax rate is the rate charged on taxable income for every additional dollar earned. In this…

Q: Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she…

A: AMTI is alternate minimum tax amount that needs to be paid by the companies. This is different from…

Q: Xavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as…

A: Tax Liability: the tax liability is the amount of money owed to the IRS in the form of tax debt.…

Q: mary is single and has two children, age 8 and 10. Calculate mary's reduction in tax from tax…

A: The child tax credit is a refundable tax benefit for the taxpayers in the annual tax. As a result,…

Q: Benjamin is a taxpayer who qualifies because he has the following dependents: 17-year-old child…

A: The question is related to taxation. The credit amount is up to $3,600 (previously it was $2000)…

Q: a. Tyler and Candice are married and file a joint tax return. They have adjusted gross income of…

A: Determining the amount of social security subject to taxation for married and filing returns…

Q: Cassy reports a gross tax liability of $1,190. She also claims $590 of nonrefundable personal…

A: Correct Answer = $ 585 Refund Calculation Calculaton Tax liability due / Refund of Cassy ($)…

Q: Cameron is single and has taxable income of $92,616. Determine his tax liability using the tax…

A: Progressive Slab Rate: It is a system in which the rate of taxation rises as taxable income rises.…

Q: Consider the following couple, who are engaged to be married. Assume that each person takes one…

A: There are 5 filing status under the IRS with specified tax brackets. They are as follows:- Single;…

Q: Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she…

A: Since Olga is married and files Joint Return, the appropriate exemption would be $114,600. However,…

Q: What tax forms should be used for the following tax return? Tim is a self-employed business person…

A: Introduction A Tax Return is tax form used to file the income, expenses etc to tax authorities. Tax…

Q: Chuck, a single taxpayer, earns $76,300 in taxable income and $11,500 in interest from an investment…

A: A taxpayer is a person or a legal body (such as a corporation) who is obligated to pay a tax. The…

Q: nd will file a joint tax return. Havel has W-2 income of $38,924, and Petra has W-2 income of…

A: Tax refers to the percentile deduction imposed by the government on the income earned by an entity.

Q: tax liability, marginal tax rate, and average tax rate

A: Taxable income $45,000 Tax rate on first $9,525 10% Tax rate on $9,525 to $38,700 12% Tax rate…

Q: What tax forms are needed for the following example? Tim and Sarah Lawrence are married and filing a…

A: Step 1: Compute the taxable income for Tim and Sarah for the year for 2019.

Q: Using the combined wage bracket tables, what is the total amount of income tax to be withheld from…

A: Under wage bracket method, federal withholdings are calculated on the basis of number of allowances,…

Q: Sara is filing as head of household and has 2021 taxable income of $59,000, which includes $3,000 of…

A: An alternative minimum tax (AMT) places a floor on the percentage of taxes that a filer must pay to…

Q: 10. Anna is single, and she files taxes based on a taxable income of $90,000. Given the tax bracket…

A: In case when there is calculation of taxable income according to the slab rates are apply and the…

Q: Caleb is a resident of the fictional state of Vernetticut. Vernetticut begins its income tax…

A: Tax is a charge which is the charged on the taxable income of a taxpayer on the taxable income which…

Q: Use the marginal tax rates in the table below to compute the tax owed in the following situation.…

A: Given, Taxable Income of Winona & Jim are Married filing jointly = $398,000, Tax credit =…

Q: Eddie, a single taxpayer, has W-2 income of $36,741. Using the tax tables, he has determined that…

A: The tax liability is calculated by multiplying the income falling under tax bracket with the tax…

Cameron is single and has taxable income of $92,616. Determine his tax liability using the tax tables and using the tax rate schedule. Why is there a difference between the two amounts?

Grading Criteria: Determines tax liabilities using tax tables and tax rate schedules (P41).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Amount in excess of P490,000.00 taxable income is to be multiplied to_______to compute for the graduated tax due a. 30% b. 32% c. 35%Taxable Income (income tax brackets) Tax rates 15% on the first $50,197 of taxable income, plus20.5% on the next $50,195 of taxable income (on the portion of taxable income over 50,197 up to $100,392), plus 26% on the next $55,233 of taxable income (on the portion of taxable income over $100,392 up to $155,625), plus 29% on the next $66,083 of taxable income (on the portion of taxable income over 155,625 up to $221,708), plus 33% of taxable income over $221,708 a) Danny had a taxable income of $126,500. How much federal income tax should he report? (assuming tax rates remain the same) b) Danny expects his taxable income to increase by 25%. How much federal tax should he expect to pay the following year (assuming tax rates remain the same).taxable income : 1225000 income taxes payable: 245000

- 1. A VAT-registered business makes a sale of P10,000, inclusive of VAT. The VAT on the sale can be computed asa. P10,000 x 12%b. P10,000 12%.c. P10,000 x 12%/112%d. P10,000 -12%/112%2. A Non-VAT registered business makes total sales of P110.000 during a taxable period.The percentage tax can be computed asa. P110,000 x 3%.b. P110,000 3%.c. P110,000 x 3%/103%d. P110,000 3%/103%3. A VAT-registered business makes a sale of P34,500, inclusive of VAT. The amount of sale that was reported in the statement of comprehensive income can be computed asa. P34,500 x 112%.b. P34,500 112%.c. P34,500 x 12%/112%d. P34,500 12%/112%4. A VAT-registered business has total sales of P62,720 and total purchases of P25,088, both inclusive of VAT. How much is the net VAT payable to the BIR?a. 1,882 b. 4,032 c. 4,516 d. 5,2245. A Non-VAT business has total sales of P200,720. How much is the sales tax payable to the BIR?a. 2,007b. 4,015c. 4,516d. 6,022E18-4 Single Temporary Difference: Multiple Rates At the end of 2019, Fulhage Company reported taxable income of $9,000 and pretax financial income of $10,600. The difference is due to depreciation for tax purposes in excess of depreciation for financial reporting purposes. The income tax rate for the current year is 40%, but Congress has enacted tax rates of 35% for 2020 and 30% for 2021 and beyond. Fulhage has calculated the excess of its financial depreciation over its tax depreciation for future years as follows: 2020, $600; 2021, $700; and 2022, $300. Prior to 2019, the company had no deferred tax liability or asset. Required: Prepare Fulhage’s income tax journal entry at the end of 2019.ABC Corporation has the following information for the taxable year 2022: Quarter RCIT MCIT CWT 1st P200,000 P160,000 P40,000 2nd 240,000 500,000 60,000 3Rd 500,000 150,000 80,000 4th 300,000 200,000 70,000 MCIT carry-over from prior year amounts to P60,000 and excess tax credits from prior year amounts to P20,000. How much was the income tax payable for the first quarter? How much was the income tax payable for the third quarter? How much was the annual income tax payable?

- Beckett Corporation has nexus with States A and B. Apportionable income for the year totals $1,190,000 . Beckett's apportionment factors for the year use the following data. Compute Beckett's B taxable income for the year; B uses a three-factor apportionment formula with a double-weighted sales factor. State AState BTotalSales$1,428,000$856,800$2,284,800Property$238,000$0 $238,000Payroll$357,000$0 $357,000*see attached What amount of permanent difference between accounting income and taxable income existed at year-end?a. P 520,000b. P 360,000c. P 800,000d. P 280,000Compute for the tax due (A,B,C) for the below taxable income based on the Income Tax Tables: TAXABLE INCOME (Annual) TAX DUE P300,000 A P500,000 B P800,000 C .

- Kent Inc.’s reconciliation between financial statement and taxable income for 20X1 follows: Pre-tax financial income $ 150,000 Permanent difference (12,000 ) 138,000 Temporary difference—depreciation (9,000 ) Taxable income $ 129,000 Additional Information: At December 31, 20X0 20X1 Cumulative temporary difference(future taxable amounts) $ 11,000 $ 20,000 The enacted tax rate is 21%. Required: In its 20X1 income statement, what amount should Kent report as the deferred portion of income tax expense?taxale interest =$3,665, Other income from schedule 1, line 10=$134,655. wages =$76,925.04, Itemized deductions=$39,655. Calculate the Taxable income?8. An entity reported pretax financial income of P8,000,000 for the current year. The taxable income was P7,000,000 for the current year. The difference is due to accelerated depreciation for income tax purpose. The income tax rate is 30% and the entity made estimated tax payment of P500,000 during the current year. What amount should be reported as income tax payable at year-end? 1,600,000 2,100,000 2,400,000 1,900,000