Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.) Comprehensive Problem 4-57 Part-a (Algo) a. What is Camille's taxable income?

Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.) Comprehensive Problem 4-57 Part-a (Algo) a. What is Camille's taxable income?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 8E: Incomc Taxes Then Company has been in operation for several years. It has both a deductible and a...

Related questions

Question

Help me fast

![Required information

Comprehensive Problem 4-57 (LO 4-1, LO 4-2, LO 4-3) (Algo)

[The following information applies to the questions displayed below.]

Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in

Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of

$82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of

alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that

qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.)

Comprehensive Problem 4-57 Part-a (Algo)

a. What is Camille's taxable income?

Description

Ar

(1)

Gross income

(2) For AGI deductions

(3) Adjusted gross income

$

(4) Standard deduction

(5) Itemized deductions

(6)

Taxable income](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F55f7e17a-bf33-4c09-981d-d6d267ec0a99%2F3641aa3a-ec59-49ea-a7e8-5025bd27dc08%2Fs05ushc_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

Comprehensive Problem 4-57 (LO 4-1, LO 4-2, LO 4-3) (Algo)

[The following information applies to the questions displayed below.]

Camille Sikorski was divorced in 2018. She currently provides a home for her 15-year-old daughter Kaly. Kaly lived in

Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of

$82,500 and contributed $5,300 of it to a qualified retirement account (a for AGI deduction). She also received $11,500 of

alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $16,400 of expenditures that

qualified as itemized deductions. (Use the tax rate schedules and 2020 rules.)

Comprehensive Problem 4-57 Part-a (Algo)

a. What is Camille's taxable income?

Description

Ar

(1)

Gross income

(2) For AGI deductions

(3) Adjusted gross income

$

(4) Standard deduction

(5) Itemized deductions

(6)

Taxable income

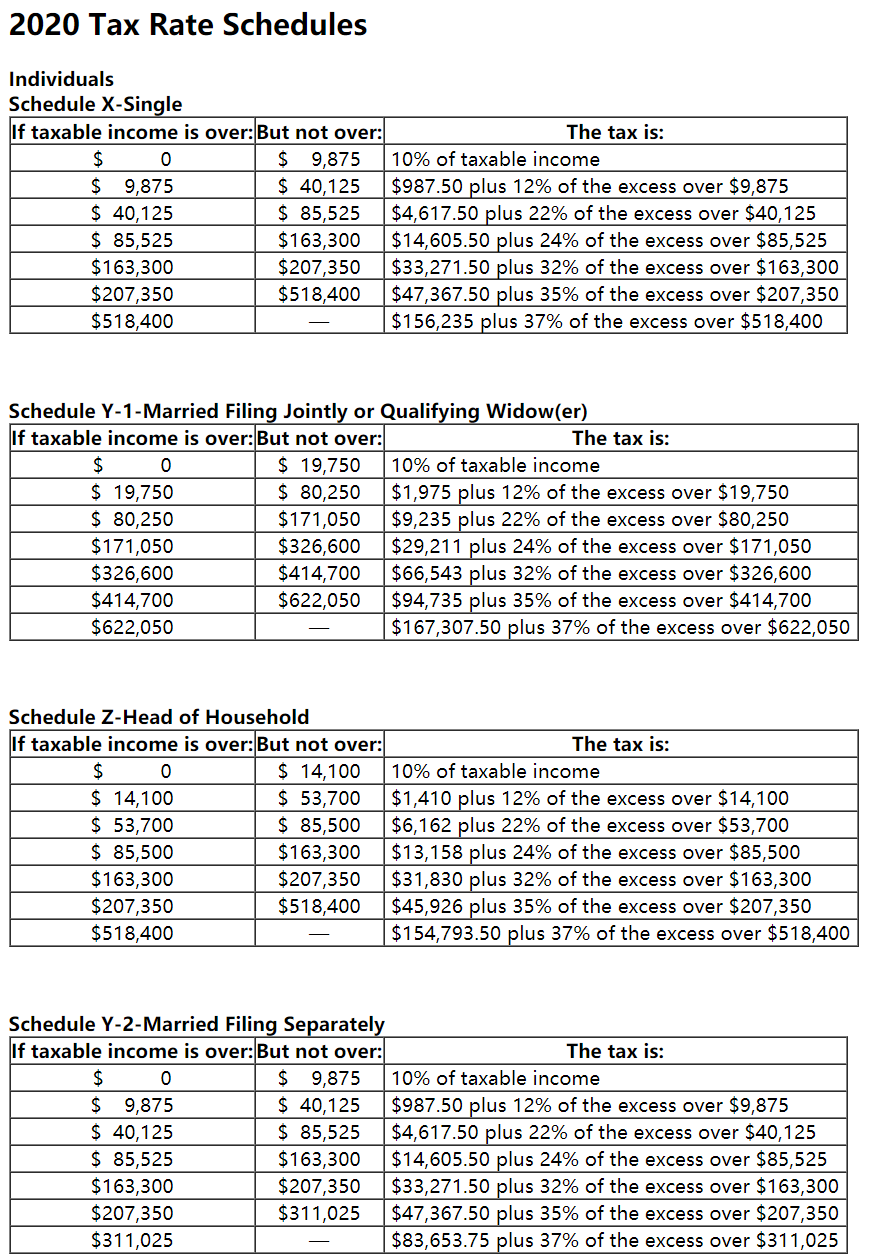

Transcribed Image Text:2020 Tax Rate Schedules

Individuals

Schedule X-Single

If taxable income is over: But not over:

The tax is:

$

$ 9,875

$ 40,125

$ 85,525

$163,300

$207,350

$518,400

$ 9,875

$ 40,125

$ 85,525

$163,300

$207,350

$518,400

10% of taxable income

$987.50 plus 12% of the excess over $9,875

$4,617.50 plus 22% of the excess over $40,125

$14,605.50 plus 24% of the excess over $85,525

$33,271.50 plus 32% of the excess over $163,300

$47,367.50 plus 35% of the excess over $207,350

$156,235 plus 37% of the excess over $518,400

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over:But not over:

The tax is:

$

$ 19,750

$ 80,250

$ 19,750

$ 80,250

$171,050

10% of taxable income

$1,975 plus 12% of the excess over $19,750

$9,235 plus 22% of the excess over $80,250

$29,211 plus 24% of the excess over $171,050

$66,543 plus 32% of the excess over $326,600

$171,050

$326,600

$414,700

$326,600

$414,700

$622,050

$94,735 plus 35% of the excess over $414,700

$167,307.50 plus 37% of the excess over $622,050

$622,050

Schedule Z-Head of Household

If taxable income is over:But not over:

$ 14,100

$ 53,700

$ 85,500

$163,300

$207,350

$518,400

The tax is:

10% of taxable income

$ 14,100

$ 53,700

$ 85,500

$163,300

$207,350

$518,400

$1,410 plus 12% of the excess over $14,100

$6,162 plus 22% of the excess over $53,700

$13,158 plus 24% of the excess over $85,500

$31,830 plus 32% of the excess over $163,300

$45,926 plus 35% of the excess over $207,350

$154,793.50 plus 37% of the excess over $518,400

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

The tax is:

$

$ 9,875

$ 40,125

$ 85,525

$163,300

$207,350

$311,025

$ 9,875

$ 40,125

$ 85,525

$163,300

$207,350

10% of taxable income

$987.50 plus 12% of the excess over $9,875

$4,617.50 plus 22% of the excess over $40,125

$14,605.50 plus 24% of the excess over $85,525

$33,271.50 plus 32% of the excess over $163,300

$47,367.50 plus 35% of the excess over $207,350

$83,653.75 plus 37% of the excess over $311,025

$311,025

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT