Can someone anwser and help me through these please? Thank you!

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

Can someone anwser and help me through these please? Thank you!

Transcribed Image Text:%06

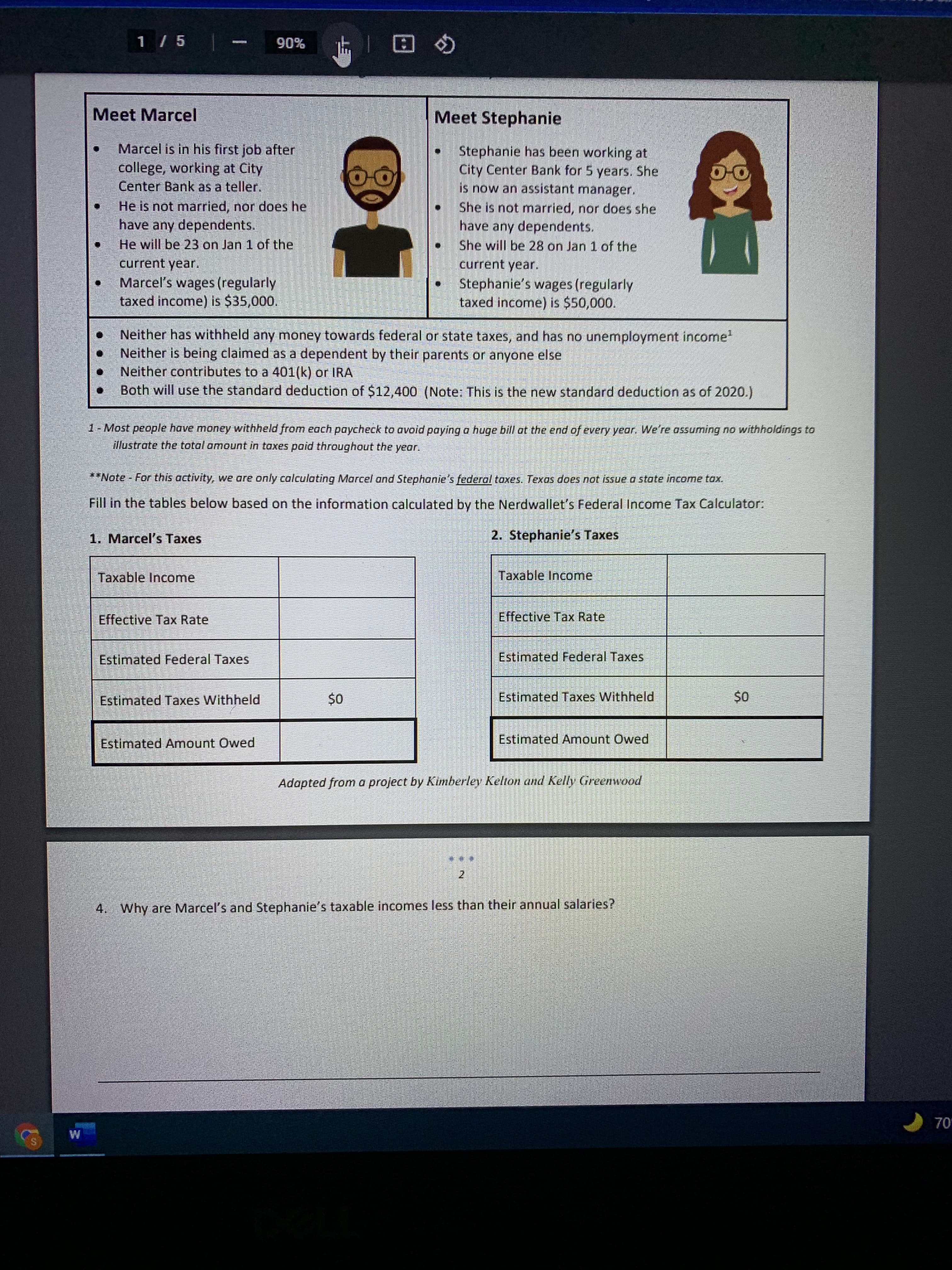

Meet Marcel

Meet Stephanie

Marcel is in his first job after

college, working at City

Center Bank as a teller.

Stephanie has been working at

City Center Bank for 5 years. She

is now an assistant manager.

0-O

He is not married, nor does he

have any dependents.

He will be 23 on Jan 1 of the

She is not married, nor does she

have any dependents.

She will be 28 on Jan 1 of the

current year.

Marcel's wages (regularly

taxed income) is $35,000.

current year.

Stephanie's wages (regularly

taxed income) is $50,000.

Neither has withheld any money towards federal or state taxes, and has no unemployment income

Neither is being claimed as a dependent by their parents or anyone else

Neither contributes to a 401(k) or IRA

Both will use the standard deduction of $12,400 (Note: This is the new standard deduction as of 2020.)

1-Most people have money withheld from each paycheck to avoid paying a huge bill at the end of every year. We're assuming no withholdings to

illustrate the total amount in taxes poid throughout the year.

**Note - For this activity, we are only calculating Marcel and Stephonie's federal taxes. Texos does not issue a state income tax,

Fill in the tables below based on the information calculated by the Nerdwallet's Federal Income Tax Calculator:

1. Marcel's Taxes

2. Stephanie's Taxes

Taxable Income

Taxable Income

Effective Tax Rate

Effective Tax Rate

Estimated Federal Taxes

Estimated Federal Taxes

Estimated Taxes Withheld

Estimated Taxes Withheld

0$

Estimated Amount Owed

Estimated Amount Owed

Adapted from a project by Kimberley Kelton and Kelly Greenwood

21

Why are Marcel's and Stephanie's taxable incomes less than their annual salaries?

70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning