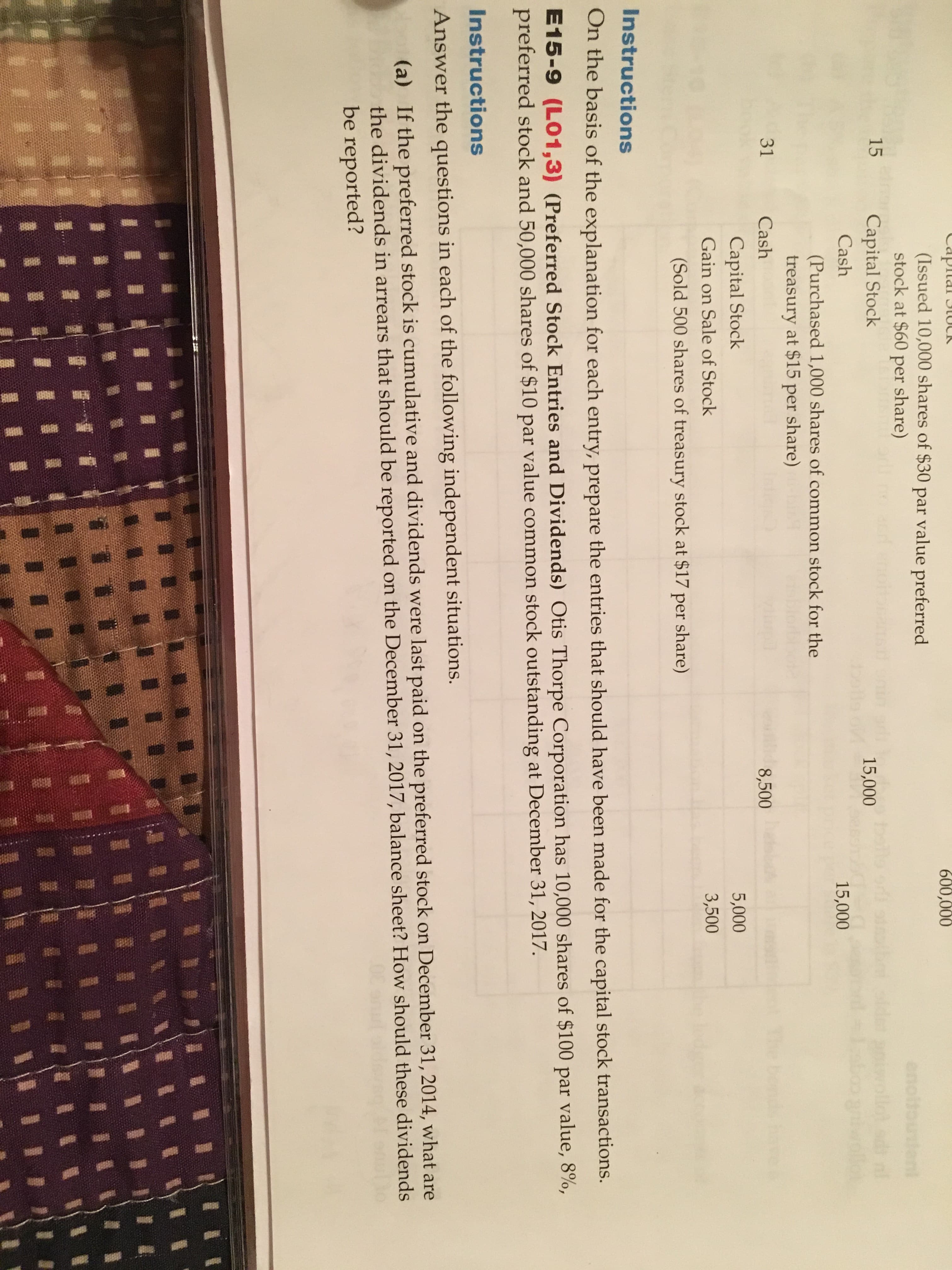

Capilal lUCK 600,000 (Issued 10,000 shares of $30 par value preferred stock at $60 per share) enoltouttent rollo ads n toognolok 15 Capital Stock S elder 15,000 Cash 15,000 (Purchased 1,000 shares of common stock for the treasury at $15 per share) 31 Cash 8,500 Capital Stock 5,000 Gain on Sale of Stock 3,500 (Sold 500 shares of treasury stock at $17 per share) Instructions On the basis of the explanation for each entry, prepare the entries that should have been made for the capital stock transactions. E15-9 (LO1,3) (Preferred Stock Entries and Dividends) Otis Thorpe Corporation has 10,000 shares of $100 par value, 8%, preferred stock and 50,000 shares of $10 par value common stock outstanding at December 31, 2017. Instructions Answer the questions in each of the following independent situations. If the preferred stock is cumulative and dividends were last paid on the preferred stock on December 31, 2014, what are (a) the dividends in arrears that should be reported on the December 31, 2017, balance sheet? How should these dividends be reported? 1 1 II 1 1 I 814 Chapter 15 Stockholders' Equity (b) If the preferred stock is convertible into seven shares of $10 par value common stock and 4,000 shares are converted, what entry is required for the conversion assuming the preferred stock was issued at par value? (c) If the preferred stock was issued at $107 per share, how should the preferred stock be reported in the stockholders equity section? E15-10 (LO2,4) (Analysis of Equity Data and Equity Section Preparation) For a recent 2-year period, the balance sheet of Santana Dotson Company showed the following stockholders' equity data at December 31 (in millions) 2017 2016 1 Additional paid-in capital borts $ 931 mo$ 817 540 omur UD Common stock 545 io abit DTPOH sdt 22 7,167 1,564 23 5,226 Retained earnings Treasury stock 918 Total stockholders' equity $7,079 $5,665 Common stock shares issued 218 216 Common stock shares authorized 500 O500 6loss3 34 27 Treasury stock shares noitoun Instructions (a) Answer the following questions. (1) What is the par value of the common stock? (2) What is the cost per share of treasury stock at December 31, 2017, and at December 31, 2016? (b) Prepare the stockholders' equity section at December 31, 2017. are selected transactions that may affect stockholders E15-11 (LO3,4) (Equity Items on the Balance Sheet) The following

Capilal lUCK 600,000 (Issued 10,000 shares of $30 par value preferred stock at $60 per share) enoltouttent rollo ads n toognolok 15 Capital Stock S elder 15,000 Cash 15,000 (Purchased 1,000 shares of common stock for the treasury at $15 per share) 31 Cash 8,500 Capital Stock 5,000 Gain on Sale of Stock 3,500 (Sold 500 shares of treasury stock at $17 per share) Instructions On the basis of the explanation for each entry, prepare the entries that should have been made for the capital stock transactions. E15-9 (LO1,3) (Preferred Stock Entries and Dividends) Otis Thorpe Corporation has 10,000 shares of $100 par value, 8%, preferred stock and 50,000 shares of $10 par value common stock outstanding at December 31, 2017. Instructions Answer the questions in each of the following independent situations. If the preferred stock is cumulative and dividends were last paid on the preferred stock on December 31, 2014, what are (a) the dividends in arrears that should be reported on the December 31, 2017, balance sheet? How should these dividends be reported? 1 1 II 1 1 I 814 Chapter 15 Stockholders' Equity (b) If the preferred stock is convertible into seven shares of $10 par value common stock and 4,000 shares are converted, what entry is required for the conversion assuming the preferred stock was issued at par value? (c) If the preferred stock was issued at $107 per share, how should the preferred stock be reported in the stockholders equity section? E15-10 (LO2,4) (Analysis of Equity Data and Equity Section Preparation) For a recent 2-year period, the balance sheet of Santana Dotson Company showed the following stockholders' equity data at December 31 (in millions) 2017 2016 1 Additional paid-in capital borts $ 931 mo$ 817 540 omur UD Common stock 545 io abit DTPOH sdt 22 7,167 1,564 23 5,226 Retained earnings Treasury stock 918 Total stockholders' equity $7,079 $5,665 Common stock shares issued 218 216 Common stock shares authorized 500 O500 6loss3 34 27 Treasury stock shares noitoun Instructions (a) Answer the following questions. (1) What is the par value of the common stock? (2) What is the cost per share of treasury stock at December 31, 2017, and at December 31, 2016? (b) Prepare the stockholders' equity section at December 31, 2017. are selected transactions that may affect stockholders E15-11 (LO3,4) (Equity Items on the Balance Sheet) The following

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 1MP: Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--,...

Related questions

Question

100%

E15-9

Transcribed Image Text:Capilal lUCK

600,000

(Issued 10,000 shares of $30 par value preferred

stock at $60 per share)

enoltouttent

rollo ads n

toognolok

15

Capital Stock

S elder

15,000

Cash

15,000

(Purchased 1,000 shares of common stock for the

treasury at $15 per share)

31

Cash

8,500

Capital Stock

5,000

Gain on Sale of Stock

3,500

(Sold 500 shares of treasury stock at $17 per share)

Instructions

On the basis of the explanation for each entry, prepare the entries that should have been made for the capital stock transactions.

E15-9 (LO1,3) (Preferred Stock Entries and Dividends) Otis Thorpe Corporation has 10,000 shares of $100 par value, 8%,

preferred stock and 50,000 shares of $10 par value common stock outstanding at December 31, 2017.

Instructions

Answer the questions in each of the following independent situations.

If the preferred stock is cumulative and dividends were last paid

on the preferred stock on December 31, 2014, what are

(a)

the dividends in arrears that should be reported on the December 31, 2017, balance sheet? How should these dividends

be reported?

1 1

II

1 1

I

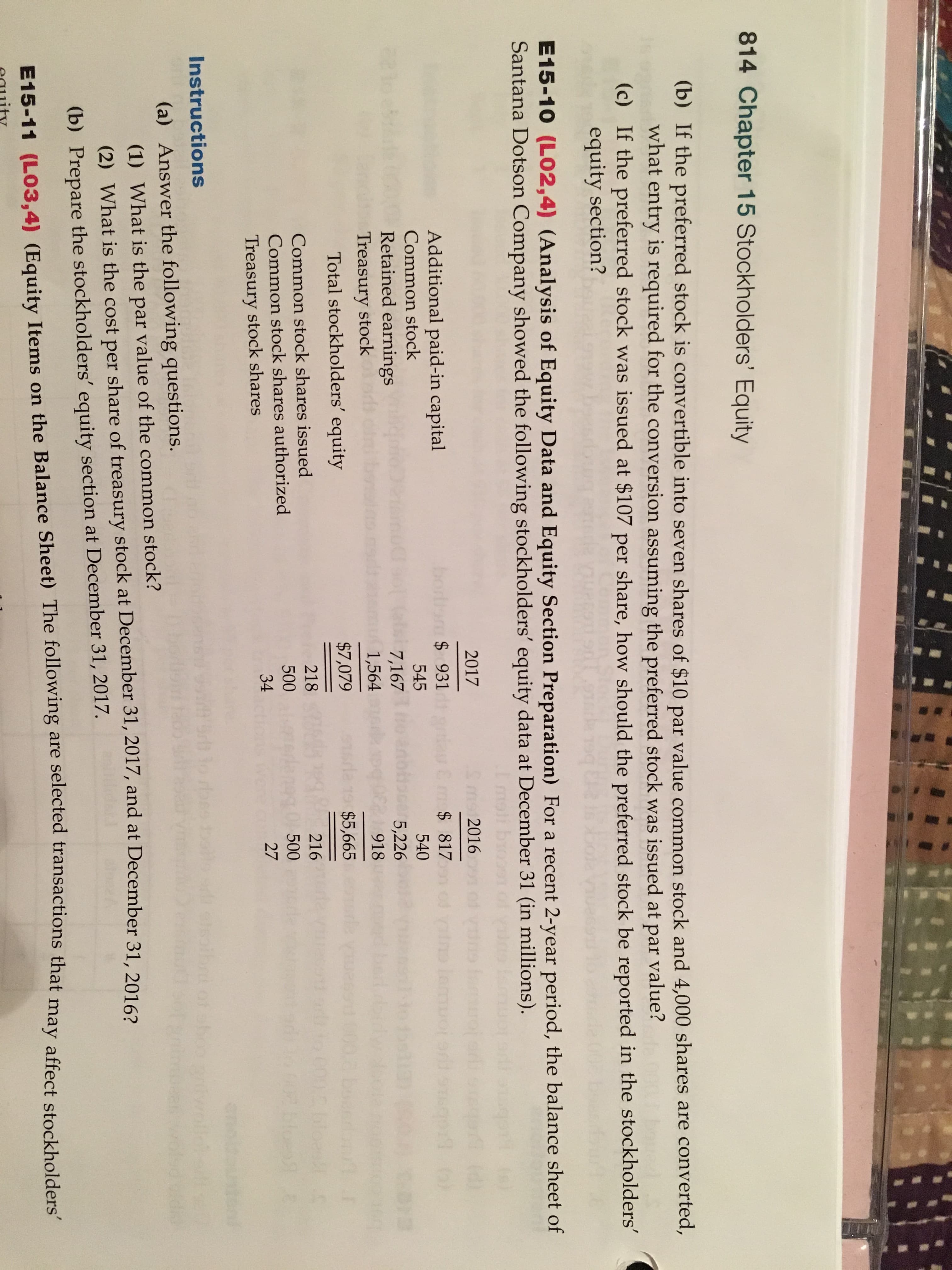

Transcribed Image Text:814 Chapter 15 Stockholders' Equity

(b) If the preferred stock is convertible into seven shares of $10 par value common stock and 4,000 shares are converted,

what entry is required for the conversion assuming the preferred stock was issued at par value?

(c) If the preferred stock was issued at $107 per share, how should the preferred stock be reported in the stockholders

equity section?

E15-10 (LO2,4) (Analysis of Equity Data and Equity Section Preparation) For a recent 2-year period, the balance sheet of

Santana Dotson Company showed the following stockholders' equity data at December 31 (in millions)

2017

2016

1

Additional paid-in capital

borts $ 931

mo$ 817

540

omur UD

Common stock

545

io abit

DTPOH

sdt

22

7,167

1,564

23

5,226

Retained earnings

Treasury stock

918

Total stockholders' equity

$7,079

$5,665

Common stock shares issued

218

216

Common stock shares authorized

500

O500

6loss3

34

27

Treasury stock shares

noitoun

Instructions

(a) Answer the following questions.

(1) What is the par value of the common stock?

(2) What is the cost per share of treasury stock at December 31, 2017, and at December 31, 2016?

(b) Prepare the stockholders' equity section at December 31, 2017.

are selected transactions that may affect stockholders

E15-11 (LO3,4) (Equity Items on the Balance Sheet) The following

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College