Cardinal Bear has come to you for advice regarding a potential investment. He is willing to spend $500,000 to purchase a basketball equipment manufacturer and is hoping to generate $50,000 a year from the investment. The owners have been looking to sell the company since 2017. Mr. Bear doesn’t have all of the information, but he does have the financial statements for the last two years. Based on the information, prepare a one-page report to Mr. Bear.

Cardinal Bear has come to you for advice regarding a potential investment. He is willing to spend $500,000 to purchase a basketball equipment manufacturer and is hoping to generate $50,000 a year from the investment. The owners have been looking to sell the company since 2017. Mr. Bear doesn’t have all of the information, but he does have the financial statements for the last two years. Based on the information, prepare a one-page report to Mr. Bear.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Question

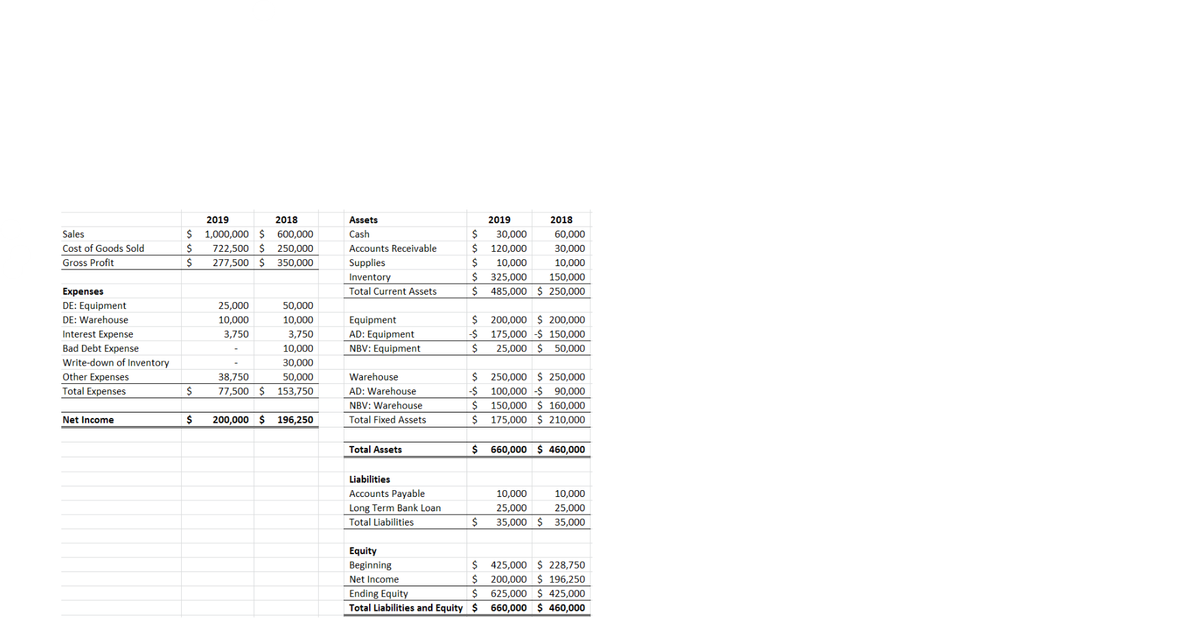

Cardinal Bear has come to you for advice regarding a potential investment. He is willing to spend $500,000 to purchase a basketball equipment manufacturer and is hoping to generate $50,000 a year from the investment. The owners have been looking to sell the company since 2017.

Mr. Bear doesn’t have all of the information, but he does have the financial statements for the last two years. Based on the information, prepare a one-page report to Mr. Bear.

Transcribed Image Text:2019

2018

Assets

2019

2018

Sales

$ 1,000,000 $

600,000

Cash

30,000

60,000

Cost of Goods Sold

722,500 $

250,000

Accounts Receivable

$

120,000

30,000

Gross Profit

277,500 $

350,000

Supplies

10,000

10,000

$

$

485,000 $ 250,000

Inventory

325,000

150,000

Expenses

Total Current Assets

DE: Equipment

25,000

50,000

200,000 $ 200,000

175,000 -$ 150,000

-$

DE: Warehouse

10,000

10,000

Equipment

Interest Expense

Bad Debt Expense

3,750

3,750

AD: Equipment

10,000

NBV: Equipment

25,000 $

50,000

Write-down of Inventory

30,000

50.000

$

100,000 -$ 90,000

150,000 $ 160,000

$

250,000 $ 250,000

Other Expenses

Total Expenses

38,750

Warehouse

$

77,500 $

153,750

AD: Warehouse

NBV: Warehouse

$

Net Income

200,000 $

196,250

Total Fixed Assets

175,000 $ 210,000

Total Assets

$

660,000 $ 460,000

Liabilities

Accounts Payable

10,000

10,000

Long Term Bank Loan

Total Liabilities

25,000

25.000

$

35,000 $ 35,000

Equity

$

425,000 $ 228,750

200,000 $ 196,250

$

Beginning

Net Income

$

Ending Equity

Total Liabilities and Equity $

625,000 $ 425,000

660,000 $ 460,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you