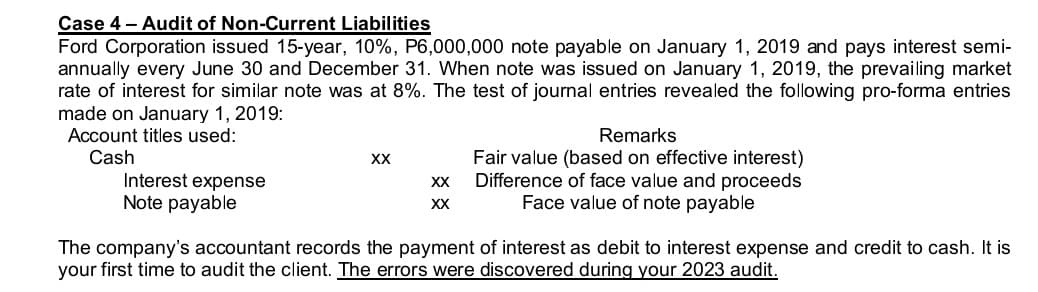

Case 4 - Audit of Non-Current Liabilities Ford Corporation issued 15-year, 10%, P6,000,000 note payable on January 1, 2019 and pays interest semi- annually every June 30 and December 31. When note was issued on January 1, 2019, the prevailing market rate of interest for similar note was at 8%. The test of journal entries revealed the following pro-forma entries made on January 1, 2019: Account titles used: Cash Interest expense Note payable XX XX XX Remarks Fair value (based on effective interest) Difference of face value and proceeds Face value of note payable The company's accountant records the payment of interest as debit to interest expense and credit to cash. It is your first time to audit the client. The errors were discovered during your 2023 audit.

Case 4 - Audit of Non-Current Liabilities Ford Corporation issued 15-year, 10%, P6,000,000 note payable on January 1, 2019 and pays interest semi- annually every June 30 and December 31. When note was issued on January 1, 2019, the prevailing market rate of interest for similar note was at 8%. The test of journal entries revealed the following pro-forma entries made on January 1, 2019: Account titles used: Cash Interest expense Note payable XX XX XX Remarks Fair value (based on effective interest) Difference of face value and proceeds Face value of note payable The company's accountant records the payment of interest as debit to interest expense and credit to cash. It is your first time to audit the client. The errors were discovered during your 2023 audit.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PB: Dixon Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Determine the following as a result of your audit:

subquestion a. How much is the correct amount of interest expense that should be reported in its Statement of Comprehensive Income for the period ending December 31, 2023?

subquestion b. As an audit manager, you review the working papers of your audit staff and senior auditor and summarized the proposed

include a credit to premium on note payable of?

please show solution.

Transcribed Image Text:Case 4 - Audit of Non-Current Liabilities

Ford Corporation issued 15-year, 10%, P6,000,000 note payable on January 1, 2019 and pays interest semi-

annually every June 30 and December 31. When note was issued on January 1, 2019, the prevailing market

rate of interest for similar note was at 8%. The test of journal entries revealed the following pro-forma entries

made on January 1, 2019:

Account titles used:

Cash

Interest expense

Note payable

XX

XX

XX

Remarks

Fair value (based on effective interest)

Difference of face value and proceeds

Face value of note payable

The company's accountant records the payment of interest as debit to interest expense and credit to cash. It is

your first time to audit the client. The errors were discovered during your 2023 audit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,