Cash Accounts Receivable Supplies Prepaid Rent Merchandise Inventory (24 e $265; 1 e $260) Land $74,210 13,500 200 3,200 6,620 4,000 1,950 980 Accounts Payable Unearned Revenue Salaries Payable Common Stock Retained Earnings 1, eee 50, 800 47,880 During Year 6, Pacilio Security Services experienced the foliowing transactions: 1. Paid the salaries payable from Year 5. 2. On March 1, Year 6, Pacilio established a $100 petty cash fund to handle small expenditures. 3. Paid $4,800 on March 1, Year 6, for a one-year lease on the company van in advance. 4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance. 5. Purchased $400 of supplies on account. 6. Purchased 100 alarm systems for $28,000 cash during the year. 7. Sold 102 alarm systems for $57,120. All sales were on account 8. Record the cost of goods sold related to the sale from Event 7 using the FIFO method. 9. Paid $2,100 on accounts payable during the year. O. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following receipts: office supplies expense, $23; cutting grass, $55; and miscellancous expense, $14. 11. Billed $52,000 of monitoring services for the year. 2. Paid installers and other employees a total of $25,000 cash for salaries f00 200 of arcounts receivable during the year.

Cash Accounts Receivable Supplies Prepaid Rent Merchandise Inventory (24 e $265; 1 e $260) Land $74,210 13,500 200 3,200 6,620 4,000 1,950 980 Accounts Payable Unearned Revenue Salaries Payable Common Stock Retained Earnings 1, eee 50, 800 47,880 During Year 6, Pacilio Security Services experienced the foliowing transactions: 1. Paid the salaries payable from Year 5. 2. On March 1, Year 6, Pacilio established a $100 petty cash fund to handle small expenditures. 3. Paid $4,800 on March 1, Year 6, for a one-year lease on the company van in advance. 4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance. 5. Purchased $400 of supplies on account. 6. Purchased 100 alarm systems for $28,000 cash during the year. 7. Sold 102 alarm systems for $57,120. All sales were on account 8. Record the cost of goods sold related to the sale from Event 7 using the FIFO method. 9. Paid $2,100 on accounts payable during the year. O. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following receipts: office supplies expense, $23; cutting grass, $55; and miscellancous expense, $14. 11. Billed $52,000 of monitoring services for the year. 2. Paid installers and other employees a total of $25,000 cash for salaries f00 200 of arcounts receivable during the year.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 15CE: Classification of Cash Flows Patel Company reported the following items in its statement of cash...

Related questions

Question

Answer full question.

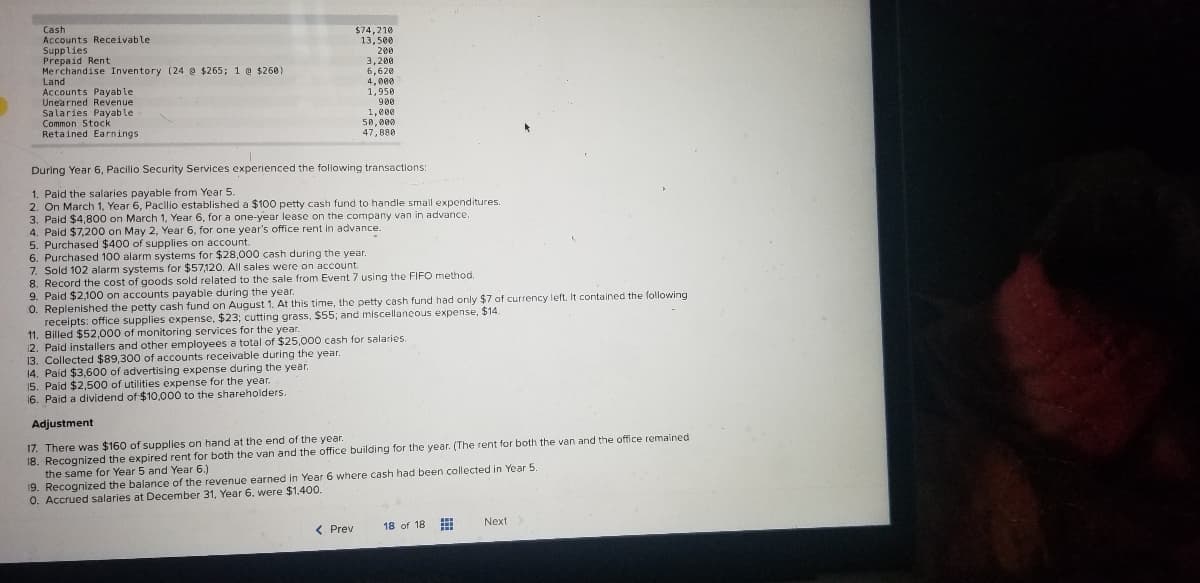

Transcribed Image Text:Cash

$74,210

13,500

200

Accounts Receivable

Supplies

Prepaid Rent

Merchandise Inventory (24 e $265; 1 @ $260)

Land

Accounts Payable

Unearned Revenue

Salaries Payable

Common Stock

3,200

6,620

4,000

1,950

900

1,000

50,000

47,880

Retained Earnings

During Year 6, Pacilio Security Services experienced the following transactions:

1. Pald the salaries payable from Year 5.

2. On March 1, Year 6, Pacilio established a $100 petty cash fund to handle small expenditures.

3. Paid $4,800 on March 1, Year 6, for a one-year leasc on the company van in advance.

4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance.

5. Purchased $400 of supplies on account.

6. Purchased 100 alarm systems for $28,000 cash during the year.

7. Sold 102 alarm systems for $57,120. All sales were on account.

8. Record the cost of goods sold related to the sale from Event 7 using the FIFO method.

9. Paid $2,100 on accounts payable during the year.

O. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following

receipts: office supplies expense, $23; cutting grass, $55; and miscellancous expense, $14.

11. Billed $52,000 of monitoring services for the year.

12. Paid installers and other employees a total of $25,000 cash for salaries.

13. Collected $89,300 of accounts receivable during the year.

14. Paid $3,600 of advertising expense during the year.

15. Paid $2,500 of utilities expense for the year.

16. Paid a dividend of $10.000 to the shareholders.

Adjustment

17. There was $160 of supplies on hand at the end of the year.

18. Recognized the expired rent for both the van and the office building for the year. (The rent for both the van and the office remained

the same for Year 5 and Year 6.)

19. Recognized the balance of the revenue earned in Year 6 where cash had been collected in Year 5

0. Accrued salaries at December 31, Year 6, were $1.400.

Next

18 of 18

( Prev

Transcribed Image Text:General

General

Income

Changes in

Balance

Statement

Analysis

BRS

Requirement

Trial Balance

of CF

Journal

Ledger

Statement

SE

Sheet

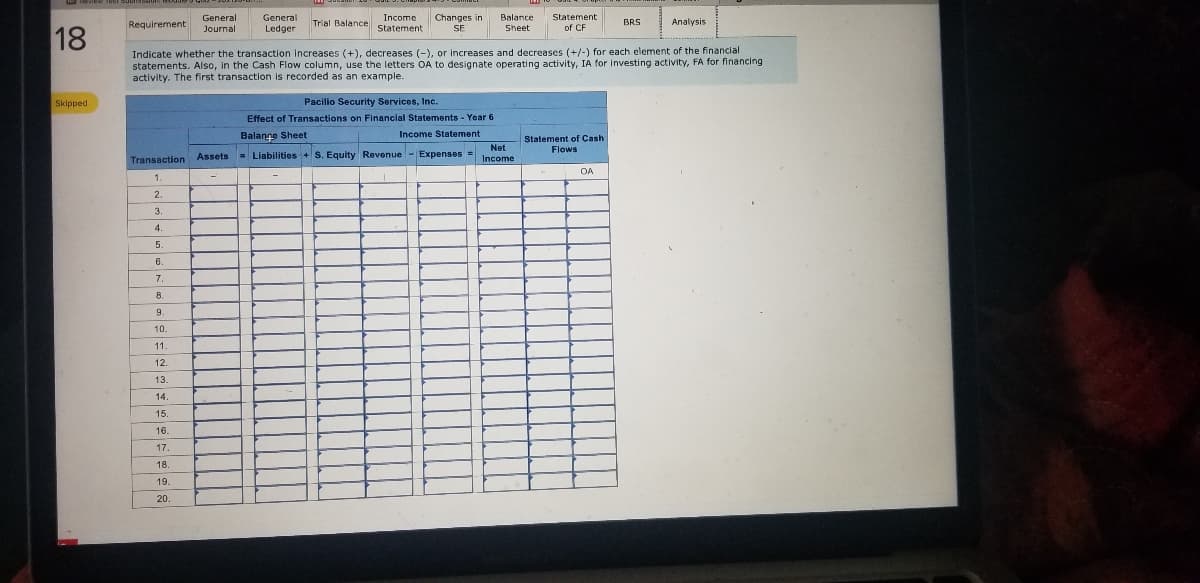

18

Indicate whether the transaction increases (+), decreases (-), or increases and decreases (+/-) for each element of the financial

statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing

activity. The first transaction is recorded as an example.

Skipped

Pacilio Security Services, Inc.

Effect of Transactions on Financial Statements - Year 6

Balange Sheet

Income Statement

Statement of Cash

Flows

Net

Assets

= Expenses =

Liabilitios +S. Equity Revenue-

Transaction

Income

OA

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18

19.

20.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning