Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 77E: Ratio Analysis The following information was taken from Logsden Manufacturings trial balances as of...

Related questions

Question

Please answer the following questions:

Cash Flow to Creditors and Stockholders

As part of your analysis, you are required to investigate Carrium Insights Inc. cash flows and compute selected financial ratios using the financial statements provided

Required:

(a) Calculate the following for 2020:

- Operating Cash Flow - DO NOT ANSWER

- Net Capital Spending - DO NOT ANSWER

- Change in Net Working Capital - DO NOT ANSWER

- Cash Flow from Assets - DO NOT ANSWER

- Cash Flow to Creditors

- Cash Flow to Stockholders

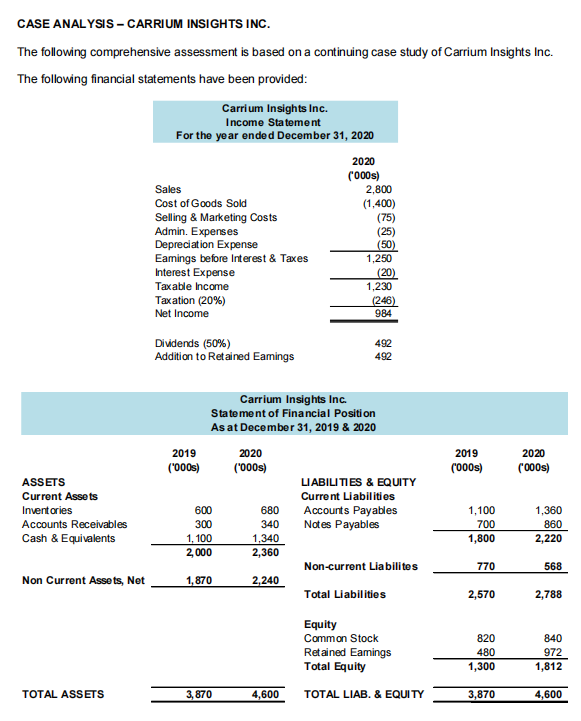

Transcribed Image Text:CASE ANALYSIS - CARRIUM INSIGHTS INC.

The following comprehensive assessment is based on a continuing case study of Carrium Insights Inc.

The following financial statements have been provided:

Carrium Insights Inc.

Income Statement

For the year ended December 31, 2020

2020

('000s)

2,800

Sales

Cost of Goods Sold

Selling & Marketing Costs

Admin. Expenses

Depreciation Expense

Eamings before Interest & Taxes

Interest Expense

(1,400)

(75)

(25)

(50)

1,250

(20)

1,230

Taxable Income

Taxation (20%)

Net Income

(246)

984

Dividends (50%)

Addition to Retained Eamings

492

492

Carrium Insights Inc.

State ment of Financial Positi on

As at December 31, 2019 & 2020

2019

2020

2019

2020

('000s)

('000s)

('000s)

('000s)

ASSETS

LIABILITIES & EQUITY

Current Asse ts

Current Liabilities

Inventories

600

680

Accounts Payables

Nates Payables

1,100

1,360

Accounts Receivables

300

340

700

860

1,340

2,360

Cash & Equivalents

1, 100

1,800

2,220

2,000

Non-current Liabilites

770

568

Non Current Asse ts, Net

1,870

2,240

Total Liabilities

2,570

2,788

Equity

Common Stock

820

840

Retained Eamings

Total Equity

480

972

1,300

1,812

TOTAL ASSETS

3,870

4,600

TOTAL LIAB. & EQUITY

3,870

4,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning