Cengage ㄨ : CengageNOWv2 ㅣ O × exhibit-6-11.jpg (74 × Q Accounting Midtern × b My Questions | bart × I 0416( × + box- saania ← → С â https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&n ☆ Ch 6-3 Exercises & Problems eBook Show Me Hovw Calculator Print Itemm On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: Accumulated Depreciation-Building Administrative Expenses Building Cash Cost of Merchandise Sold Interest Expense Kathy Melman, Capital Kathy Melman, Drawing a. Prepare a multiple-step income statement for the year ended March 31, 2019 $757,100 551,400 2,426,500 177,450 3,719,200 10,150 1,512,500 170,000 Merchandise Inventory Notes Payable Office Supplies Salaries Payable Sales Selling Expenses Store Supplies $1,001,650 243,400 20,100 8,050 6,696,700 749,700 89,300 Racine Furnishings Company Income Statement For the Year Ended March 31, 2019 Cash x Cost of merchandise sold Gross profit Expenses: 177,450 X 3,719,200 3,541,750 | X Selling expenses 749,700 V Administrative expenses551,400 Total expenses 1,301,100V Loss from operations x 4,842,850 | X Other expense Interest 10,150 Net loss x 4,853,000 | X Check My Work 1 more Check My Work uses remaining Previous Next Assignment Score: 25.07% All work saved Email InstructorSave and Exit Submit Assignment for Grading

Cengage ㄨ : CengageNOWv2 ㅣ O × exhibit-6-11.jpg (74 × Q Accounting Midtern × b My Questions | bart × I 0416( × + box- saania ← → С â https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&n ☆ Ch 6-3 Exercises & Problems eBook Show Me Hovw Calculator Print Itemm On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: Accumulated Depreciation-Building Administrative Expenses Building Cash Cost of Merchandise Sold Interest Expense Kathy Melman, Capital Kathy Melman, Drawing a. Prepare a multiple-step income statement for the year ended March 31, 2019 $757,100 551,400 2,426,500 177,450 3,719,200 10,150 1,512,500 170,000 Merchandise Inventory Notes Payable Office Supplies Salaries Payable Sales Selling Expenses Store Supplies $1,001,650 243,400 20,100 8,050 6,696,700 749,700 89,300 Racine Furnishings Company Income Statement For the Year Ended March 31, 2019 Cash x Cost of merchandise sold Gross profit Expenses: 177,450 X 3,719,200 3,541,750 | X Selling expenses 749,700 V Administrative expenses551,400 Total expenses 1,301,100V Loss from operations x 4,842,850 | X Other expense Interest 10,150 Net loss x 4,853,000 | X Check My Work 1 more Check My Work uses remaining Previous Next Assignment Score: 25.07% All work saved Email InstructorSave and Exit Submit Assignment for Grading

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

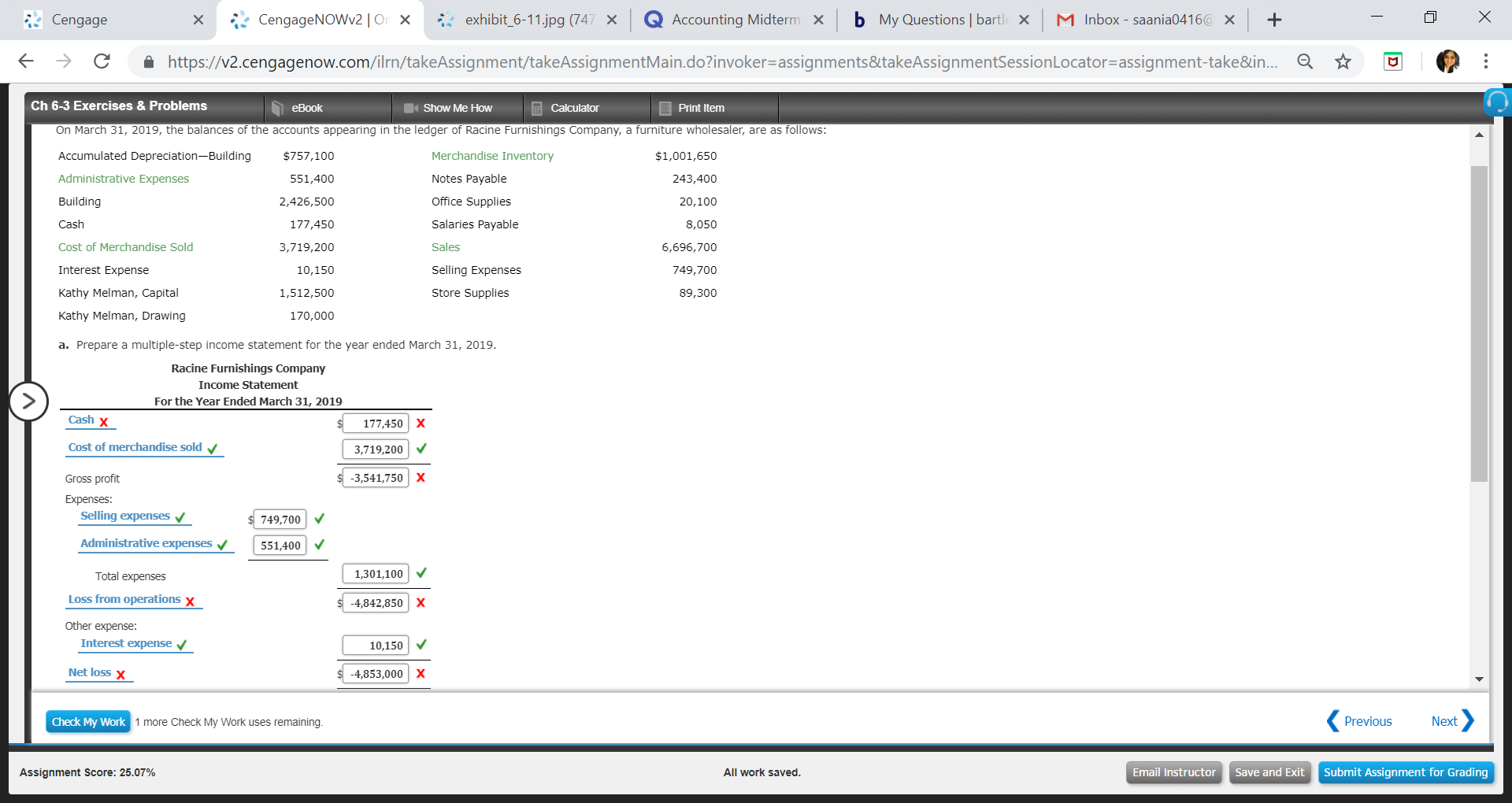

Hi, I was hoping you could double check my work on this? I have attached a picture of the answers I put on my first attempt of the question but after looking into it more, I think I see where I went wrong but wanted to know if you could look over it to see if I did it correctly and if my values are correct?

So the first entry should be 'sales' instead of cash with the value of 6,696,700 and the gross profit would then be 2,977,500.

Next, the income from operations would be 1,676,400 and finally the net income would be 1,666,250.

Is this right?

Transcribed Image Text:Cengage

ㄨ

: CengageNOWv2 ㅣ O ×

exhibit-6-11.jpg (74

×

Q Accounting Midtern

×

b

My Questions | bart

×

I

0416( × +

box- saania

←

→

С

â

https://v2.cengagenow.com/rn/takeAssignment takeAssignmentMain doinvoker-assignments&takeAssignmentSessionLocator-assignment take&n

☆

Ch 6-3 Exercises & Problems

eBook

Show Me Hovw

Calculator

Print Itemm

On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows:

Accumulated Depreciation-Building

Administrative Expenses

Building

Cash

Cost of Merchandise Sold

Interest Expense

Kathy Melman, Capital

Kathy Melman, Drawing

a. Prepare a multiple-step income statement for the year ended March 31, 2019

$757,100

551,400

2,426,500

177,450

3,719,200

10,150

1,512,500

170,000

Merchandise Inventory

Notes Payable

Office Supplies

Salaries Payable

Sales

Selling Expenses

Store Supplies

$1,001,650

243,400

20,100

8,050

6,696,700

749,700

89,300

Racine Furnishings Company

Income Statement

For the Year Ended March 31, 2019

Cash x

Cost of merchandise sold

Gross profit

Expenses:

177,450 X

3,719,200

3,541,750 | X

Selling expenses

749,700 V

Administrative expenses551,400

Total expenses

1,301,100V

Loss from operations x

4,842,850 | X

Other expense

Interest

10,150

Net loss x

4,853,000 | X

Check My Work

1 more Check My Work uses remaining

Previous

Next

Assignment Score: 25.07%

All work saved

Email InstructorSave and Exit Submit Assignment for Grading

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you