CengageNOWv2| Online teachin × Cengage Learning x b Answered: CengageNOWv2| Onli x i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLoca. ☆ 00 Ch 14-2 Practice Exercises Discount Amortization On the first day of the fiscal year, a company issues a $7,400,000, 8%, 9-year bond that pays semiannual interest of $296,000 ($7,400,000 × 8% × ½), receiving cash of $6,950,082. Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense 320,995.45 X Discount on Bonds Payable 24,995.45 K Cash 296,000 Feedback Check My Work 2:35 PM P Type here to search 3/17/2020 II

CengageNOWv2| Online teachin × Cengage Learning x b Answered: CengageNOWv2| Onli x i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLoca. ☆ 00 Ch 14-2 Practice Exercises Discount Amortization On the first day of the fiscal year, a company issues a $7,400,000, 8%, 9-year bond that pays semiannual interest of $296,000 ($7,400,000 × 8% × ½), receiving cash of $6,950,082. Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense 320,995.45 X Discount on Bonds Payable 24,995.45 K Cash 296,000 Feedback Check My Work 2:35 PM P Type here to search 3/17/2020 II

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 2MC

Related questions

Question

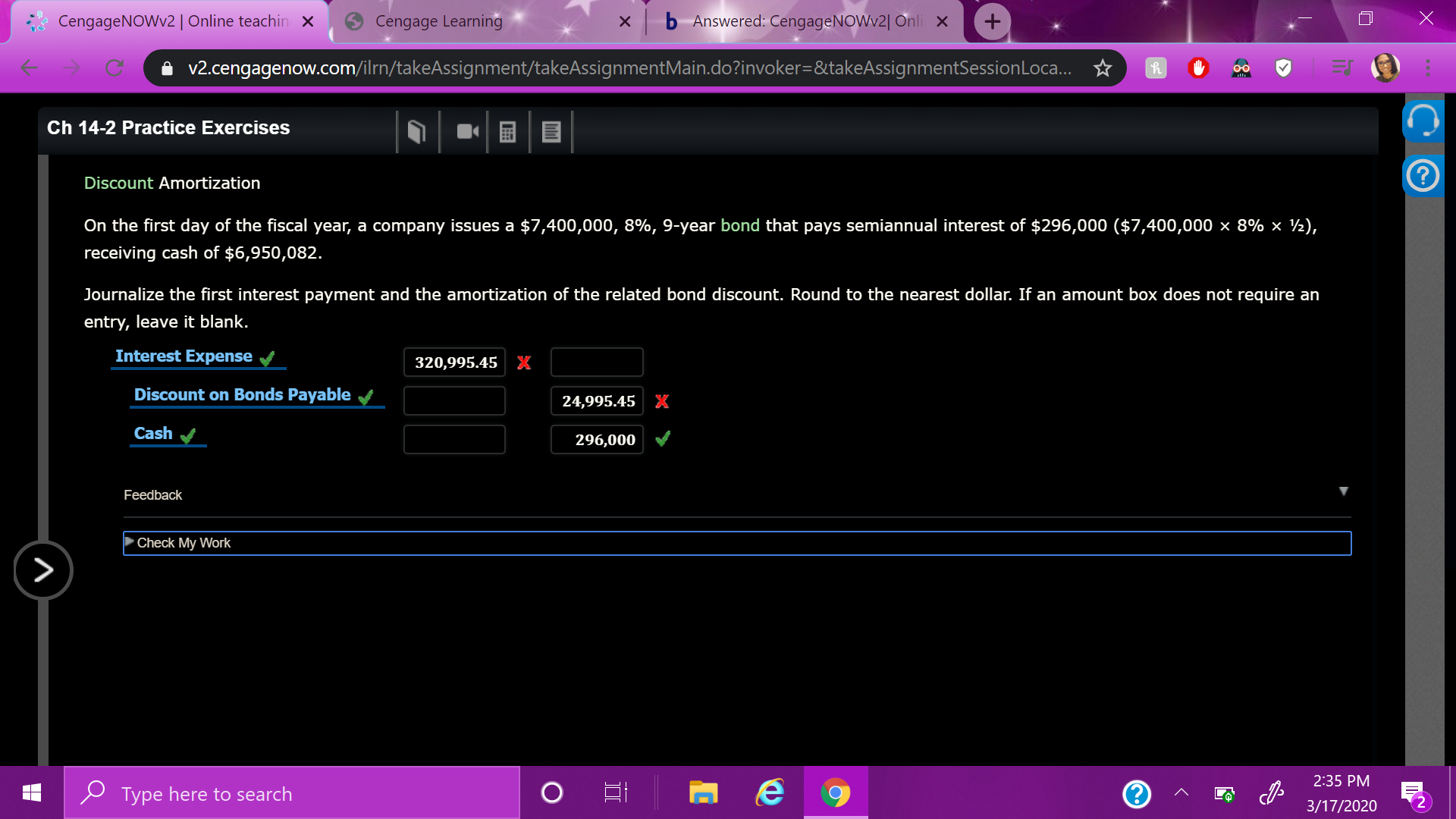

what would be the discount on bonds payable?

Transcribed Image Text:CengageNOWv2| Online teachin ×

Cengage Learning

x b Answered: CengageNOWv2| Onli x

i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLoca. ☆

00

Ch 14-2 Practice Exercises

Discount Amortization

On the first day of the fiscal year, a company issues a $7,400,000, 8%, 9-year bond that pays semiannual interest of $296,000 ($7,400,000 × 8% × ½),

receiving cash of $6,950,082.

Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an

entry, leave it blank.

Interest Expense

320,995.45 X

Discount on Bonds Payable

24,995.45 K

Cash

296,000

Feedback

Check My Work

2:35 PM

P Type here to search

3/17/2020

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning