Ch 2-2 Practice exercises Trial Balance Errors For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much. If the debit and credit totals would be equal, enter zero ("0") in the amount box a. The payment of an insurance premium of $5,610 for a three-year policy was debited to Prepaid Insurance for $6,510 and credited to Cash for $5,610. Which of the following is true? The debit and credit totals of the trial balance would be equal. If the totals on the trial balance are not equal, by how much is one column higher than the other? b. A payment of $2,200 on account was debited to Accounts Payable for $2,420 and credited to Cash for $2,420 Which of the following is true? The debit and credit totals of the trial balance would be equal. If the totals on the trial balance are not equal, by how much is one column higher than the other? $ c. A purchase of supplies on account for $3,720 was credited to Supplies for $3,720 and credited to Accounts Payable for $3,720. Which of the following is true? If the totals on the trial balance are not equal, by how much is one column higher than the other? $

Ch 2-2 Practice exercises Trial Balance Errors For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much. If the debit and credit totals would be equal, enter zero ("0") in the amount box a. The payment of an insurance premium of $5,610 for a three-year policy was debited to Prepaid Insurance for $6,510 and credited to Cash for $5,610. Which of the following is true? The debit and credit totals of the trial balance would be equal. If the totals on the trial balance are not equal, by how much is one column higher than the other? b. A payment of $2,200 on account was debited to Accounts Payable for $2,420 and credited to Cash for $2,420 Which of the following is true? The debit and credit totals of the trial balance would be equal. If the totals on the trial balance are not equal, by how much is one column higher than the other? $ c. A purchase of supplies on account for $3,720 was credited to Supplies for $3,720 and credited to Accounts Payable for $3,720. Which of the following is true? If the totals on the trial balance are not equal, by how much is one column higher than the other? $

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter2: Analyzing Transactions

Section: Chapter Questions

Problem 2.22EX

Related questions

Question

100%

not sure how to slove those questions

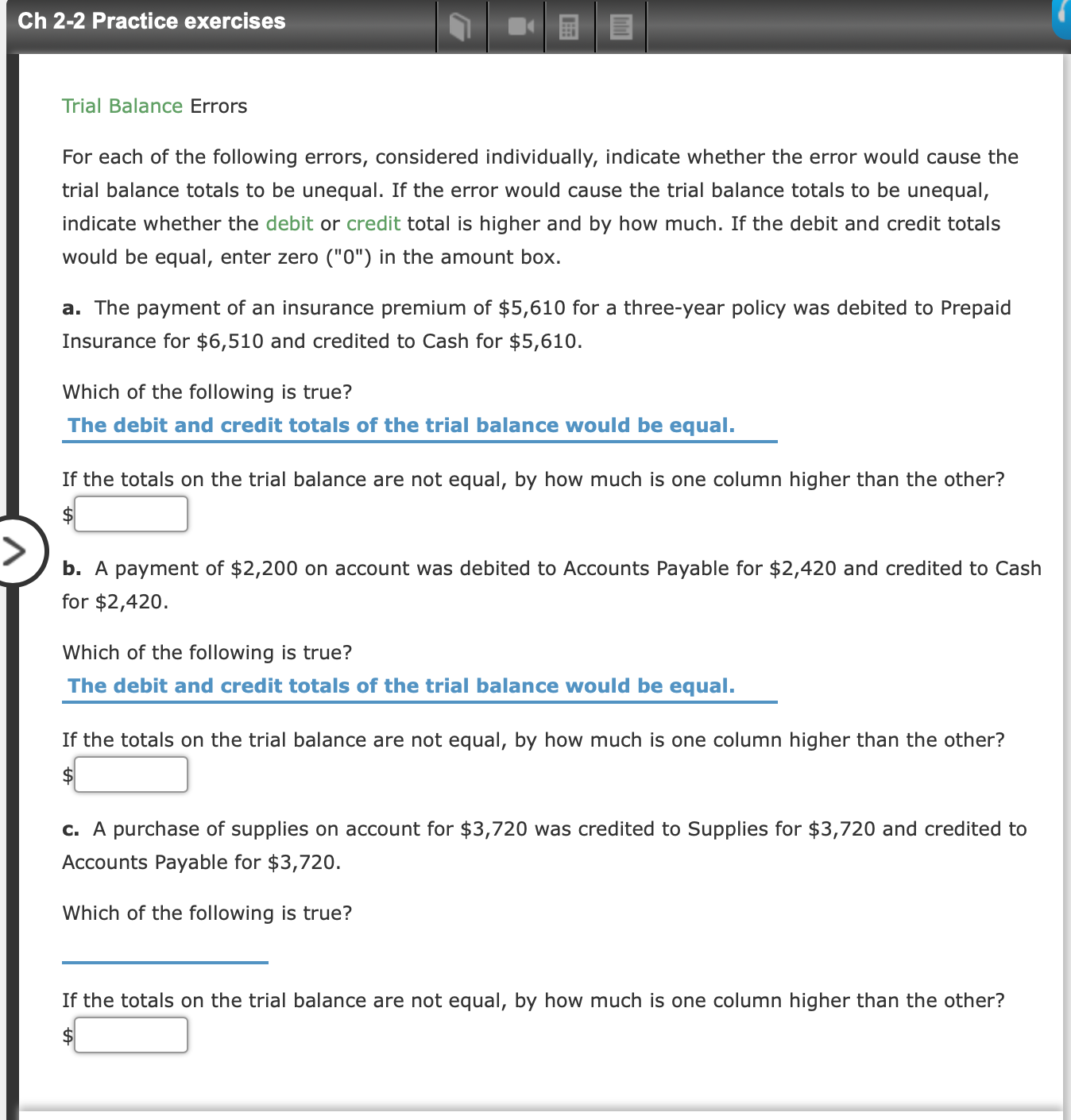

Transcribed Image Text:Ch 2-2 Practice exercises

Trial Balance Errors

For each of the following errors, considered individually, indicate whether the error would cause the

trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal,

indicate whether the debit or credit total is higher and by how much. If the debit and credit totals

would be equal, enter zero ("0") in the amount box

a. The payment of an insurance premium of $5,610 for a three-year policy was debited to Prepaid

Insurance for $6,510 and credited to Cash for $5,610.

Which of the following is true?

The debit and credit totals of the trial balance would be equal.

If the totals on the trial balance are not equal, by how much is one column higher than the other?

b. A payment of $2,200 on account was debited to Accounts Payable for $2,420 and credited to Cash

for $2,420

Which of the following is true?

The debit and credit totals of the trial balance would be equal.

If the totals on the trial balance are not equal, by how much is one column higher than the other?

$

c. A purchase of supplies on account for $3,720 was credited to Supplies for $3,720 and credited to

Accounts Payable for $3,720.

Which of the following is true?

If the totals on the trial balance are not equal, by how much is one column higher than the other?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning