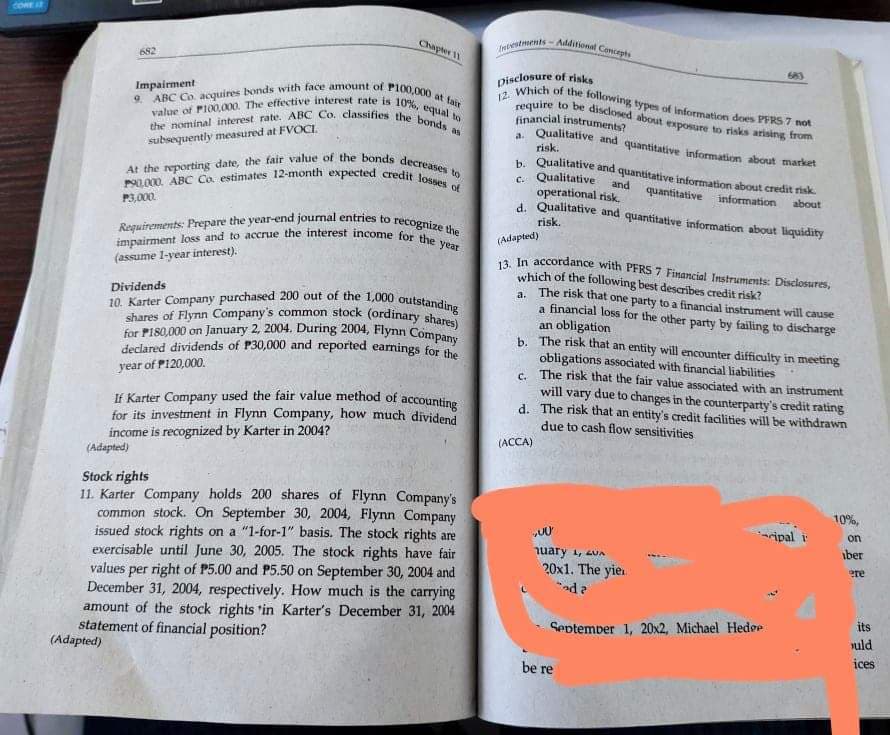

Chapter 1 Instments- Additional Concepts 682 683 Disclosure of risks 12. Which of the following types of information does PFRS 7 not 9. ABC Co acquires bonds with face amount of Pl00,000 at tair value of PIO0,000. The effective interest rate is 10%, equal to the nominal interest rate. ABC Co. classifies the bonds as Impairment require to be disclosed about exposure to risks arising from financial instruments? Qualitative and quantitative information about market risk. b. Qualitative and quantitative information about credit risk. Qualitative and operational risk. d. Qualitative and quantitative information about liquidity a. subsequently measured at FVOCI. At the reporting date, the fair value of the bonds decreases to PL000. ABC Co. estimates 12-month expected credit losses of C. quantitative information about P3,000. Requirements: Prepare the year-end jourmal entries to recognize the impairment loss and to accrue the interest income for the year risk. (Adapted) a In accordance with PFRS 7 Financia! Instruments: Disclosures, which of the following best describes credit risk? The risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge obligation b. The risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities c. The risk that the fair value associated with an instrument (assume 1-year interest). Dividends a. 10. Karter Company purchased 200 out of the 1,000 outstanding shares of Flynn Company's common stock (ordinary shares) for P180,000 on January 2, 2004. During 2004, Flynn Company declared dividends of P30,000 and reported earnings for the an year of P120,000. will vary due to changes in the counterparty's credit rating d. The risk that an entity's credit facilities will be withdrawn If Karter Company used the fair value method of accountine for its investment in Flynn Company, how much dividend income is recognized by Karter in 2004? (Adapted) due to cash flow sensitivities (ACCA) Stock rights 11. Karter Company holds 200 shares of Flynn Company's common stock. On September 30, 2004, Flynn Company issued stock rights on a "1-for-1" basis. The stock rights are exercisable until June 30, 2005. The stock rights have fair values per right of P5.00 and P5.50 on September 30, 2004 and December 31, 2004, respectively. How much is the carrying amount of the stock rights 'in Karter's December 31, 2004 statement of financial position? (Adapted) 10%, aripal on iber nuary 1, auA 20x1. The yie d ere its September 1, 20x2, Michael Hedoe uld ices be re

Chapter 1 Instments- Additional Concepts 682 683 Disclosure of risks 12. Which of the following types of information does PFRS 7 not 9. ABC Co acquires bonds with face amount of Pl00,000 at tair value of PIO0,000. The effective interest rate is 10%, equal to the nominal interest rate. ABC Co. classifies the bonds as Impairment require to be disclosed about exposure to risks arising from financial instruments? Qualitative and quantitative information about market risk. b. Qualitative and quantitative information about credit risk. Qualitative and operational risk. d. Qualitative and quantitative information about liquidity a. subsequently measured at FVOCI. At the reporting date, the fair value of the bonds decreases to PL000. ABC Co. estimates 12-month expected credit losses of C. quantitative information about P3,000. Requirements: Prepare the year-end jourmal entries to recognize the impairment loss and to accrue the interest income for the year risk. (Adapted) a In accordance with PFRS 7 Financia! Instruments: Disclosures, which of the following best describes credit risk? The risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge obligation b. The risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities c. The risk that the fair value associated with an instrument (assume 1-year interest). Dividends a. 10. Karter Company purchased 200 out of the 1,000 outstanding shares of Flynn Company's common stock (ordinary shares) for P180,000 on January 2, 2004. During 2004, Flynn Company declared dividends of P30,000 and reported earnings for the an year of P120,000. will vary due to changes in the counterparty's credit rating d. The risk that an entity's credit facilities will be withdrawn If Karter Company used the fair value method of accountine for its investment in Flynn Company, how much dividend income is recognized by Karter in 2004? (Adapted) due to cash flow sensitivities (ACCA) Stock rights 11. Karter Company holds 200 shares of Flynn Company's common stock. On September 30, 2004, Flynn Company issued stock rights on a "1-for-1" basis. The stock rights are exercisable until June 30, 2005. The stock rights have fair values per right of P5.00 and P5.50 on September 30, 2004 and December 31, 2004, respectively. How much is the carrying amount of the stock rights 'in Karter's December 31, 2004 statement of financial position? (Adapted) 10%, aripal on iber nuary 1, auA 20x1. The yie d ere its September 1, 20x2, Michael Hedoe uld ices be re

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PB: Dixon Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Transcribed Image Text:CORE

require to be disclosed about exposure to risks arising from

At the reporting date, the fair value of the bonds decreases to

9. ABC Co. acquires bonds with face amount of P100,000 at tair

P90,000. ABC Co. estimates 12-month expected credit losses of

Requirements: Prepare the year-end journal entries to recognize the

impairment loss and to accrue the interest income for the year

the nominal interest rate. ABC Co. classifies the bonds as

10. Karter Company purchased 200 out of the 1,000 outstanding

for P180,000 on January 2, 2004. During 2004, Flynn Company

value of PI00,000. The effective interest rate is 10%, equal to

shares of Flynn Company's common stock (ordinary shares)

Instments-Additional Concepts

Chapter 11

682

683

Disclosure of risks

12.

Which of the following types of Information does PFRS 7 not

Impairment

financial instruments?

Qualitative and quantitative information about market

a.

subsequently measured at FVOCI.

risk.

h. Qualitative and quantitative information about credit risk.

C. Qualitative and

operational risk,

d. Qualitative and quantitative information about liquidity

quantitative information

about

P3,000.

risk.

(Adapted)

a In accordance with PFRS7 Financial Instruments: Disclosures,

which of the following best describes credit risk?

The risk that one party to a financial instrument willcause

a financial loss for the other party by failing to discharge

obligation

b. The risk that an entity will encounter difficulty in meeting

obligations associated with financial liabilities

s The risk that the fair value associated with an instrument

(assume l-year interest).

Dividends

a.

an

declared dividends of P30,000 and reported earnings for t

year of P120,000.

If Karter Company used the fair value method of accountine

for its investment in Flynn Company, how much dividend

income is recognized by Karter in 2004?

(Adapted)

will vary due to changes in the counterparty's credit rating

d. The risk that an entity's credit facilities will be withdrawn

due to cash flow sensitivities

(ACCA)

Stock rights

11. Karter Company holds 200 shares of Flynn Company's

common stock. On September 30, 2004, Flynn Company

issued stock rights on a "1-for-1" basis. The stock rights are

exercisable until June 30, 2005. The stock rights have fair

values per right of P5.00 and P5.50 on September 30, 2004 and

December 31, 2004, respectively. How much is the carrying

amount of the stock rights 'in Karter's December 31, 2004

statement of financial position?

(Adapted)

10%,

ripal i

on

iber

nuary 1, suA

20x1. The yie

ad ?

ere

its

September 1, 20x2, Michael Hedee

nuld

ices

be re

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub