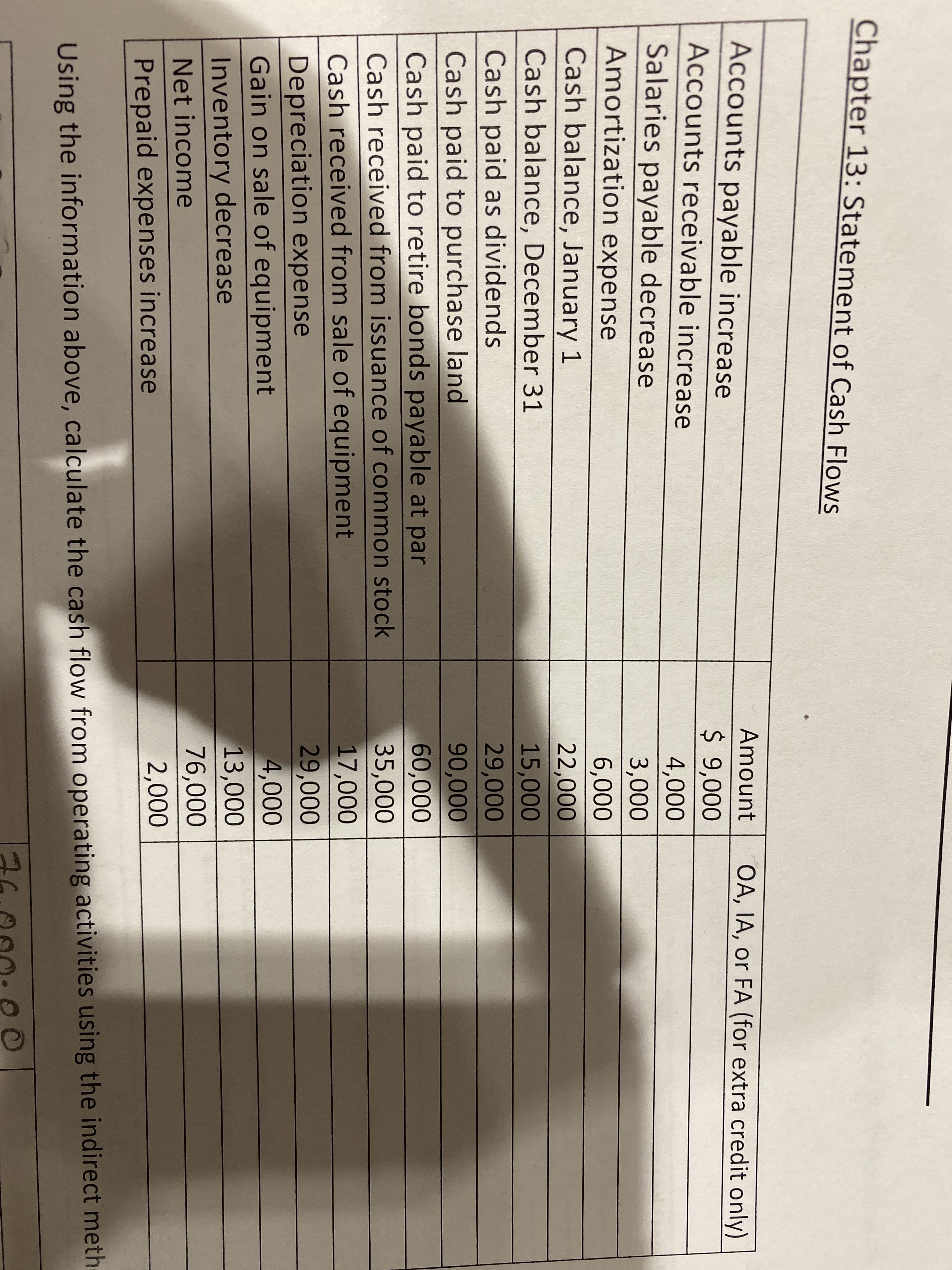

Chapter 13: Statement of Cash Flows Accounts payable increase Amount OA, IA, or FA (for extra credit only) $ 9,000 Accounts receivable increase 4,000 Salaries payable decrease Amortization expense 3,000 6,000 Cash balance, January 1 22,000 Cash balance, December 31 15,000 Cash paid as dividends 29,000 Cash paid to purchase land Cash paid to retire bonds payable at par 90,000 60,000 35,000 17,000 29,000 4,000 13,000 Cash received from issuance of common stock Cash received from sale of equipment Depreciation expense Gain on sale of equipment Inventory decrease 76,000 Net income 2,000 Prepaid expenses increase Using the information above, calculate the cash flow from operating activities using the indirect meth

Chapter 13: Statement of Cash Flows Accounts payable increase Amount OA, IA, or FA (for extra credit only) $ 9,000 Accounts receivable increase 4,000 Salaries payable decrease Amortization expense 3,000 6,000 Cash balance, January 1 22,000 Cash balance, December 31 15,000 Cash paid as dividends 29,000 Cash paid to purchase land Cash paid to retire bonds payable at par 90,000 60,000 35,000 17,000 29,000 4,000 13,000 Cash received from issuance of common stock Cash received from sale of equipment Depreciation expense Gain on sale of equipment Inventory decrease 76,000 Net income 2,000 Prepaid expenses increase Using the information above, calculate the cash flow from operating activities using the indirect meth

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.3APR

Related questions

Question

Transcribed Image Text:Chapter 13: Statement of Cash Flows

Accounts payable increase

Amount

OA, IA, or FA (for extra credit only)

$ 9,000

Accounts receivable increase

4,000

Salaries payable decrease

Amortization expense

3,000

6,000

Cash balance, January 1

22,000

Cash balance, December 31

15,000

Cash paid as dividends

29,000

Cash paid to purchase land

Cash paid to retire bonds payable at par

90,000

60,000

35,000

17,000

29,000

4,000

13,000

Cash received from issuance of common stock

Cash received from sale of equipment

Depreciation expense

Gain on sale of equipment

Inventory decrease

76,000

Net income

2,000

Prepaid expenses increase

Using the information above, calculate the cash flow from operating activities using the indirect meth

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning