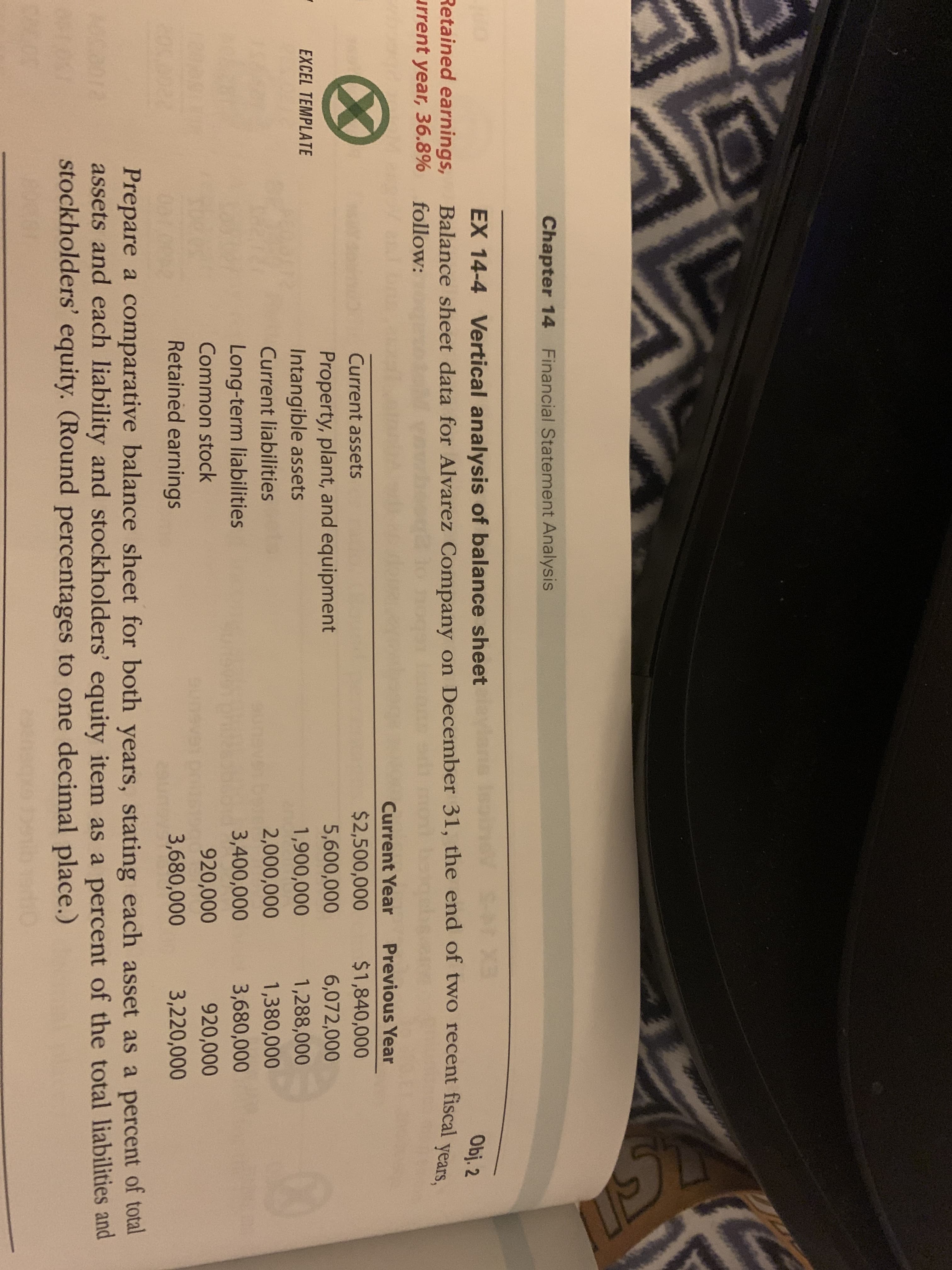

Chapter 14 Financial Statement Analysis Retained earnings, urrent year, 36.8% EX 14-4 Vertical analysis of balance sheet Balance sheet data for Alvarez Company on December 31, the end of two recent follow: Obj. 2 fiscal years, Current Year Previous Year $2,500,000 $1,840,000 Current assets 5,600,000 6,072,000 Property, plant, and equipment Intangible assets EXCEL TEMPLATE 1,900,000 1,288,000 Current liabilities 2,000,000 1,380,000 Long-term liabilities 3,400,000 3,680,000 Common stock 920,000 920,000 Retained earnings 3,680,000 3,220,000 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. (Round percentages to one decimal place.)

Chapter 14 Financial Statement Analysis Retained earnings, urrent year, 36.8% EX 14-4 Vertical analysis of balance sheet Balance sheet data for Alvarez Company on December 31, the end of two recent follow: Obj. 2 fiscal years, Current Year Previous Year $2,500,000 $1,840,000 Current assets 5,600,000 6,072,000 Property, plant, and equipment Intangible assets EXCEL TEMPLATE 1,900,000 1,288,000 Current liabilities 2,000,000 1,380,000 Long-term liabilities 3,400,000 3,680,000 Common stock 920,000 920,000 Retained earnings 3,680,000 3,220,000 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. (Round percentages to one decimal place.)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.6BE

Related questions

Question

Transcribed Image Text:Chapter 14 Financial Statement Analysis

Retained earnings,

urrent year, 36.8%

EX 14-4 Vertical analysis of balance sheet

Balance sheet data for Alvarez Company on December 31, the end of two recent

follow:

Obj. 2

fiscal

years,

Current Year

Previous Year

$2,500,000

$1,840,000

Current assets

5,600,000

6,072,000

Property, plant, and equipment

Intangible assets

EXCEL TEMPLATE

1,900,000

1,288,000

Current liabilities

2,000,000

1,380,000

Long-term liabilities

3,400,000

3,680,000

Common stock

920,000

920,000

Retained earnings

3,680,000

3,220,000

Prepare a comparative balance sheet for both years, stating each asset as a percent of total

assets and each liability and stockholders' equity item as a percent of the total liabilities and

stockholders' equity. (Round percentages to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Looking at the changes, what conclusions can you draw from them?

Solution

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning