Charle's Furniture Store has been In business for several years. The firm's owners have described the store as a "high-price, high- service" operatlon that provides lots of assistance to Its customers. Margin has averaged a relatively high 29% per year for several years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to open in the area served by Charlie's, and management Is considering lowering prices to compete effectively. Required: a. Calculate current sales and ROI for Charlie's Furniture Store. b. Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROl as Charlie's currently earns. c. Suppose you presented the results of your analysis in parts a and b of this problem to Charle, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to Increase my sales volume by 50% to earn the same return?" GIven the results of d. Now suppose Charlie says, "You know, I'm not convinced that lowering prices is my only option in staying competitive. What if I were to Increase my marketing effort? I'm thinking about kicking off a new advertising campaign after conducting more extensive market research to better identify who my target customer groups are." In general, explain to Charlie what the likely impact of a successful strategy of this nature would be on margin, turnover, and ROI. e. What are the other alternative strategy that might help Charle malntaln the competitiveness of his business.

Charle's Furniture Store has been In business for several years. The firm's owners have described the store as a "high-price, high- service" operatlon that provides lots of assistance to Its customers. Margin has averaged a relatively high 29% per year for several years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to open in the area served by Charlie's, and management Is considering lowering prices to compete effectively. Required: a. Calculate current sales and ROI for Charlie's Furniture Store. b. Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROl as Charlie's currently earns. c. Suppose you presented the results of your analysis in parts a and b of this problem to Charle, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to Increase my sales volume by 50% to earn the same return?" GIven the results of d. Now suppose Charlie says, "You know, I'm not convinced that lowering prices is my only option in staying competitive. What if I were to Increase my marketing effort? I'm thinking about kicking off a new advertising campaign after conducting more extensive market research to better identify who my target customer groups are." In general, explain to Charlie what the likely impact of a successful strategy of this nature would be on margin, turnover, and ROI. e. What are the other alternative strategy that might help Charle malntaln the competitiveness of his business.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 4TP: Malone Industries has been in business for five years and has been very successful. In the past...

Related questions

Question

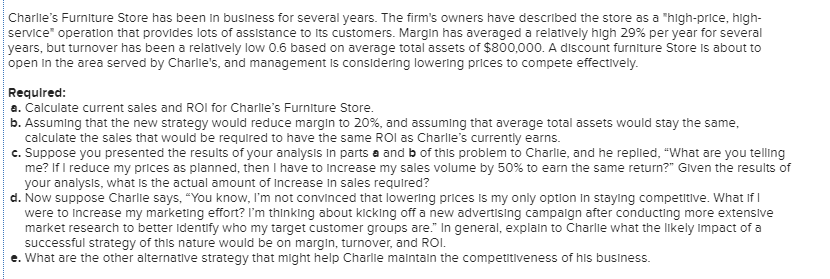

Transcribed Image Text:Charle's Furniture Store has been In business for several years. The firm's owners have described the store as a "high-price, high-

service" operatlon that provides lots of assistance to Its customers. Margin has averaged a relatively high 29% per year for several

years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to

open in the area served by Charlie's, and management Is considering lowering prices to compete effectively.

Required:

a. Calculate current sales and ROI for Charlie's Furniture Store.

b. Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same,

calculate the sales that would be required to have the same ROl as Charlie's currently earns.

c. Suppose you presented the results of your analysis in parts a and b of this problem to Charle, and he replied, "What are you telling

me? If I reduce my prices as planned, then I have to Increase my sales volume by 50% to earn the same return?" GIven the results of

d. Now suppose Charlie says, "You know, I'm not convinced that lowering prices is my only option in staying competitive. What if I

were to Increase my marketing effort? I'm thinking about kicking off a new advertising campaign after conducting more extensive

market research to better identify who my target customer groups are." In general, explain to Charlie what the likely impact of a

successful strategy of this nature would be on margin, turnover, and ROI.

e. What are the other alternative strategy that might help Charle malntaln the competitiveness of his business.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning