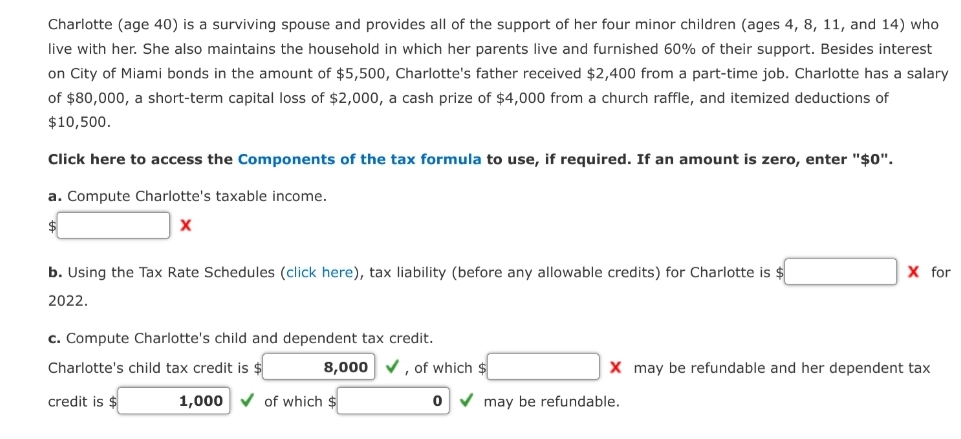

Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children (ages 4, 8, 11, and 14) who live with her. She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salar of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. Click here to access the Components of the tax formula to use, if required. If an amount is zero, enter "$0". a. Compute Charlotte's taxable income. X b. Using the Tax Rate Schedules (click here), tax liability (before any allowable credits) for Charlotte is $ 2022. c. Compute Charlotte's child and dependent tax credit. Charlotte's child tax credit is $ crodit in d 8,000, of which $ 000 ✓ of which t X fo X may be refundable and her dependent tax may be refundablo

Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children (ages 4, 8, 11, and 14) who live with her. She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salar of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. Click here to access the Components of the tax formula to use, if required. If an amount is zero, enter "$0". a. Compute Charlotte's taxable income. X b. Using the Tax Rate Schedules (click here), tax liability (before any allowable credits) for Charlotte is $ 2022. c. Compute Charlotte's child and dependent tax credit. Charlotte's child tax credit is $ crodit in d 8,000, of which $ 000 ✓ of which t X fo X may be refundable and her dependent tax may be refundablo

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 42P

Related questions

Question

H 19

Transcribed Image Text:Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children (ages 4, 8, 11, and 14) who

live with her. She also maintains the household in which her parents live and furnished 60% of their support. Besides interest

on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary

of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of

$10,500.

Click here to access the Components of the tax formula to use, if required. If an amount is zero, enter "$0".

a. Compute Charlotte's taxable income.

X

b. Using the Tax Rate Schedules (click here), tax liability (before any allowable credits) for Charlotte is $

2022.

c. Compute Charlotte's child and dependent tax credit.

Charlotte's child tax credit is $

credit is $

8,000 ✓, of which $

1,000 ✓of which $

0

X for

X may be refundable and her dependent tax

may be refundable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Expert Answers to Latest Homework Questions

Q: Copper(I) ions in aqueous solution react with NH3 (aq) according to

Cu+ (aq) + 2 NH3(aq). ->…

Q: Consider the following equilibrium:

2NO(g) +Cl₂ (g)2NOCI (g) AG° = -41. KJ

Now suppose a reaction…

Q: A local dental practice decides to run a Groupon campaign. The campaign offered

$350 worth of dental…

Q: Alert dont submit AI generated answer.

explain in brief.

Q: None

Q: Required information

[The following information applies to the questions displayed below.]

On…

Q: None

Q: None

Q: None

Q: Submit Answer Tries 0/4

(b)

(a)

-x

B (UT)

By

π/4

8 (rad)

(c)

1/2

(8c29p30) The current-carrying wire…

Q: Don't give answer in image

Q: None

Q: None

Q: Calculating the IRR for Project Long

Project Long is expected to provide five

years of cash inflows…

Q: Alert dont submit AI generated answer.

Q: None

Q: Will and Jane Sparks are establishing a college fund for their 1-year-old daughter, Jennifer. They…

Q: 9. The figure at right depicts the following situation: a thin

uniform rod of length L = 3.0 m and…

Q: None

Q: None

Q: None