Chastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DS0) on its cash conversion cycle. Chastain's 2019 sales (all on credit) were $117,000, its cost of goods sold is 80% of sales, and it earned a net profit of 2%, or $2,340. It turned over its inventory 7 times during the year, and its DSO was 39.5 days. The firm had fixed assets totaling $37,000. Chastain's payables deferral period is 35 days. Assume 365 days in year for your calculations. a. Calculate Chastain's cash conversion cycle. Do not round intermediate calculations. Round your answer to two decimal places. days b. Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Do not round intermediate calculations. Round your answers to two decimal places. Total assets turnover: ROA: c. Suppose Chastain's managers believe that the inventory turnover can be raised to 9.3 times. What would Chastain's cash conversion cycle, total assets turnover, and ROA have been if the inventory turnover had been 9.3 for 2019? Do not round intermediate calculations. Round your answers to two decimal places. Cash conversion cycle: days Total assets turnover: ROA: %

Chastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DS0) on its cash conversion cycle. Chastain's 2019 sales (all on credit) were $117,000, its cost of goods sold is 80% of sales, and it earned a net profit of 2%, or $2,340. It turned over its inventory 7 times during the year, and its DSO was 39.5 days. The firm had fixed assets totaling $37,000. Chastain's payables deferral period is 35 days. Assume 365 days in year for your calculations. a. Calculate Chastain's cash conversion cycle. Do not round intermediate calculations. Round your answer to two decimal places. days b. Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Do not round intermediate calculations. Round your answers to two decimal places. Total assets turnover: ROA: c. Suppose Chastain's managers believe that the inventory turnover can be raised to 9.3 times. What would Chastain's cash conversion cycle, total assets turnover, and ROA have been if the inventory turnover had been 9.3 for 2019? Do not round intermediate calculations. Round your answers to two decimal places. Cash conversion cycle: days Total assets turnover: ROA: %

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

I need help with a finance question

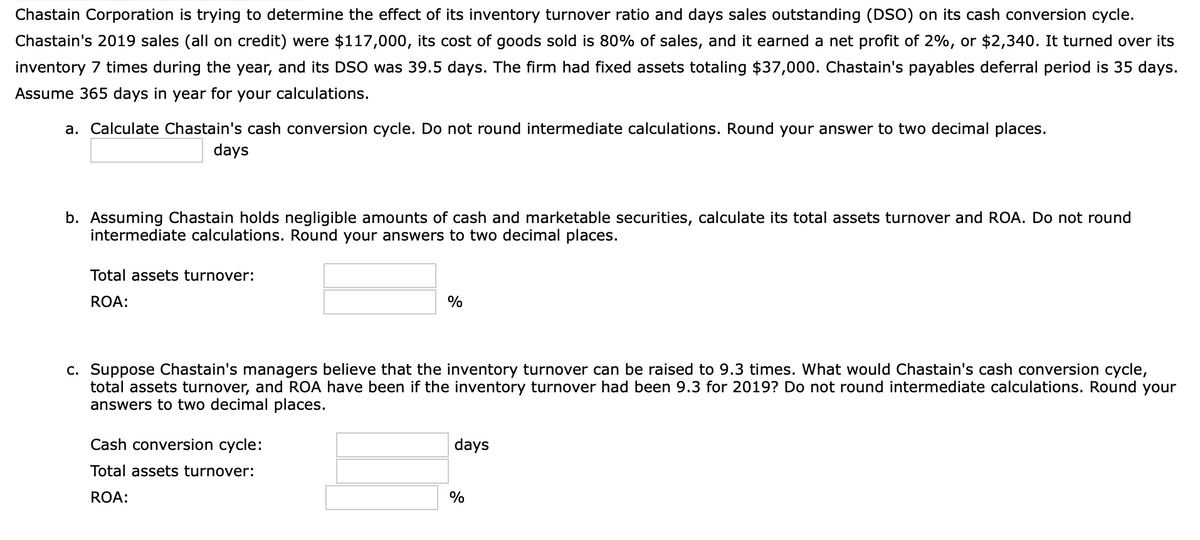

Transcribed Image Text:Chastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DSO) on its cash conversion cycle.

Chastain's 2019 sales (all on credit) were $117,000, its cost of goods sold is 80% of sales, and it earned a net profit of 2%, or $2,340. It turned over its

inventory 7 times during the year, and its DSO was 39.5 days. The firm had fixed assets totaling $37,000. Chastain's payables deferral period is 35 days.

Assume 365 days in year for your calculations.

a. Calculate Chastain's cash conversion cycle. Do not round intermediate calculations. Round your answer to two decimal places.

days

b. Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Do not round

intermediate calculations. Round your answers to two decimal places.

Total assets turnover:

ROA:

%

c. Suppose Chastain's managers believe that the inventory turnover can be raised to 9.3 times. What would Chastain's cash conversion cycle,

total assets turnover, and ROA have been if the inventory turnover had been 9.3 for 2019? Do not round intermediate calculations. Round your

answers to two decimal places.

Cash conversion cycle:

days

Total assets turnover:

ROA:

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning