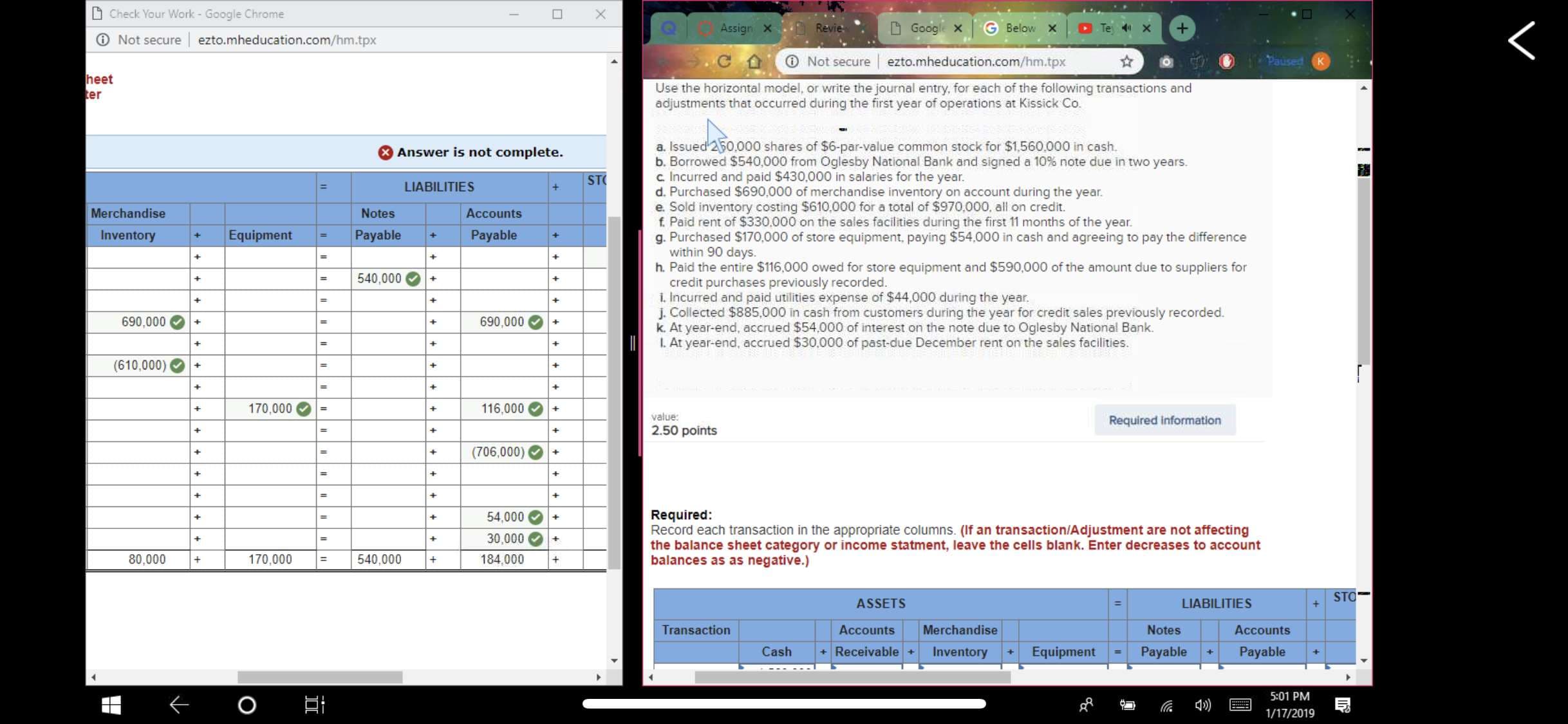

Check Your Work-Google Chrome ⓘ Not secure l ezto.mheducation.com/hm.tpx Assign × С Not secure l ezto.mheducation.com/hm.tpx heet er Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 250,000 shares of $6-par-value common stock for $1,560,000 in cash. b. Borrowed $540,000 from Oglesby National Bank and signed a 10% note due in two years C Incurred and paid $430,000 in salaries for the year. d. Purchased $690,000 of merchandise inventory on account during the year e. Sold inventory costing $610,000 for a total of $970,000, all on credit. f Paid rent of $330,000 on the sales facilities during the first 11 months of the year g. Purchased $170,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference Answer is not complete. 隨 ST LIABILITIES Merchandise Notes Accounts Inventory EquipmentPa Payable within 90 days h. Paid the entire $116,000 owed for store equipment and $590,000 of the amount due to suppliers for -540,000+ credit purchases previously recorded i. Incurred and paid utilities expense of $44,000 during the year j. Collected $885,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $54,000 of interest on the note due to Oglesby National Bank L. At year-end, accrued $30,000 of past-due December rent on the sales facilities 690,000+ 690,000+ 610,000)+ 70,000 116,000 value: 2.50 points Required information (706,000) 54,000+ 30,000+ 184,000 Required: Record each transaction in the appropriate columns. (If an transaction/Adjustment are not affecting the balance sheet category or income statment, leave the cells blank. Enter decreases to account balances as as negative.) 80,000 + 170,000 540,000 + STO ASSETS LIABILITIES Transaction Accounts Merchandise Notes Accounts Cash ReceivableInventoryEquipmentPayablePayable 5:01 PM 1/17/2019

Check Your Work-Google Chrome ⓘ Not secure l ezto.mheducation.com/hm.tpx Assign × С Not secure l ezto.mheducation.com/hm.tpx heet er Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 250,000 shares of $6-par-value common stock for $1,560,000 in cash. b. Borrowed $540,000 from Oglesby National Bank and signed a 10% note due in two years C Incurred and paid $430,000 in salaries for the year. d. Purchased $690,000 of merchandise inventory on account during the year e. Sold inventory costing $610,000 for a total of $970,000, all on credit. f Paid rent of $330,000 on the sales facilities during the first 11 months of the year g. Purchased $170,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference Answer is not complete. 隨 ST LIABILITIES Merchandise Notes Accounts Inventory EquipmentPa Payable within 90 days h. Paid the entire $116,000 owed for store equipment and $590,000 of the amount due to suppliers for -540,000+ credit purchases previously recorded i. Incurred and paid utilities expense of $44,000 during the year j. Collected $885,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $54,000 of interest on the note due to Oglesby National Bank L. At year-end, accrued $30,000 of past-due December rent on the sales facilities 690,000+ 690,000+ 610,000)+ 70,000 116,000 value: 2.50 points Required information (706,000) 54,000+ 30,000+ 184,000 Required: Record each transaction in the appropriate columns. (If an transaction/Adjustment are not affecting the balance sheet category or income statment, leave the cells blank. Enter decreases to account balances as as negative.) 80,000 + 170,000 540,000 + STO ASSETS LIABILITIES Transaction Accounts Merchandise Notes Accounts Cash ReceivableInventoryEquipmentPayablePayable 5:01 PM 1/17/2019

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 1CP: CHALLENGE PROBLEM This problem challenges you to apply your cumulative accounting knowledge to move...

Related questions

Question

Can you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?

Transcribed Image Text:Check Your Work-Google Chrome

ⓘ Not secure l ezto.mheducation.com/hm.tpx

Assign ×

С

Not secure l ezto.mheducation.com/hm.tpx

heet

er

Use the horizontal model, or write the journal entry, for each of the following transactions and

adjustments that occurred during the first year of operations at Kissick Co.

a. Issued 250,000 shares of $6-par-value common stock for $1,560,000 in cash.

b. Borrowed $540,000 from Oglesby National Bank and signed a 10% note due in two years

C Incurred and paid $430,000 in salaries for the year.

d. Purchased $690,000 of merchandise inventory on account during the year

e. Sold inventory costing $610,000 for a total of $970,000, all on credit.

f Paid rent of $330,000 on the sales facilities during the first 11 months of the year

g. Purchased $170,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference

Answer is not complete.

隨

ST

LIABILITIES

Merchandise

Notes

Accounts

Inventory

EquipmentPa

Payable

within 90 days

h. Paid the entire $116,000 owed for store equipment and $590,000 of the amount due to suppliers for

-540,000+

credit purchases previously recorded

i. Incurred and paid utilities expense of $44,000 during the year

j. Collected $885,000 in cash from customers during the year for credit sales previously recorded.

k. At year-end, accrued $54,000 of interest on the note due to Oglesby National Bank

L. At year-end, accrued $30,000 of past-due December rent on the sales facilities

690,000+

690,000+

610,000)+

70,000

116,000

value:

2.50 points

Required information

(706,000)

54,000+

30,000+

184,000

Required:

Record each transaction in the appropriate columns. (If an transaction/Adjustment are not affecting

the balance sheet category or income statment, leave the cells blank. Enter decreases to account

balances as as negative.)

80,000 +

170,000

540,000 +

STO

ASSETS

LIABILITIES

Transaction

Accounts Merchandise

Notes

Accounts

Cash ReceivableInventoryEquipmentPayablePayable

5:01 PM

1/17/2019

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning